In this report, we will present our opinion on Bitcoin, which is based on both statistical data and technical analysis. Monarch and Genesis has provided with an aggregate series of onchain metrics and technical analysis that we will be using.

On-chain Metrics

As part of our assessment, we have included hyperlinks to a more comprehensive explanation of each metric, which we highly recommend reading for a deeper understanding. Additionally, we have assigned a value judgment ranging from 0 to 10 to each metric, based on how the current behavior of the metric compares to its behavior at bottom values in the past cycles. This assessment will enable us to evaluate the present market situation.

📌 Ratio:

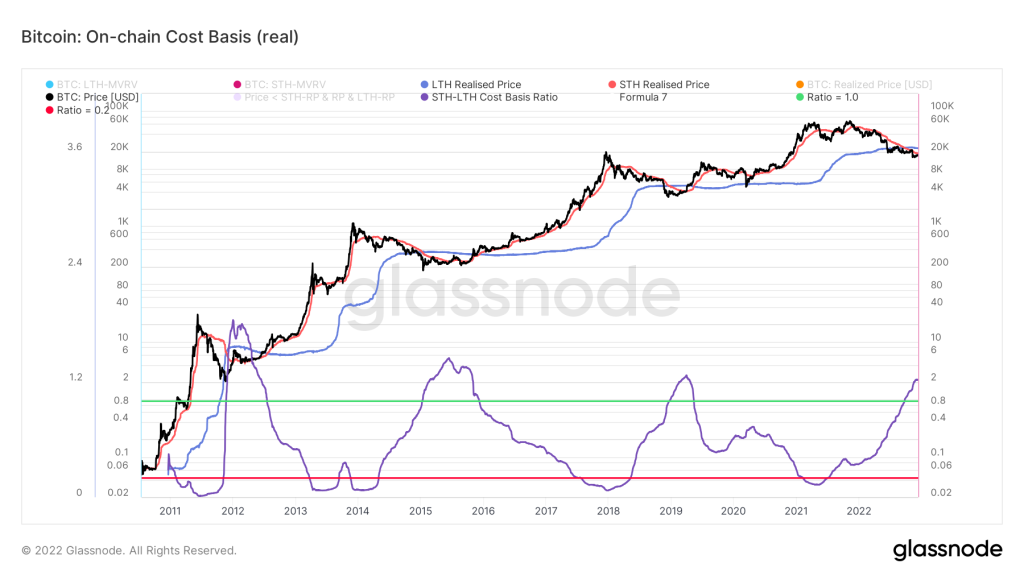

1️⃣ Cost Basis

(Image credit: glassnode)

Cost Basis: It estimates the base values of long- and short-term holders.

- The report has two parts:

- LTH real-time price and STH real-time price;

AKA: Cost Basis Ratio;

What is happening now:

LTH’s Cost Basis Ratio currently dominates the Short-Term Holder Basis Value, as it has historically done during periods of global accumulation on Bitcoin. It is also above the value of “1” and close to the peak of the 2018 market cycle, where global trend change occurred from downtrend to uptrend.

Based on our estimate, this metric is 8/10 in favor of the buyer.

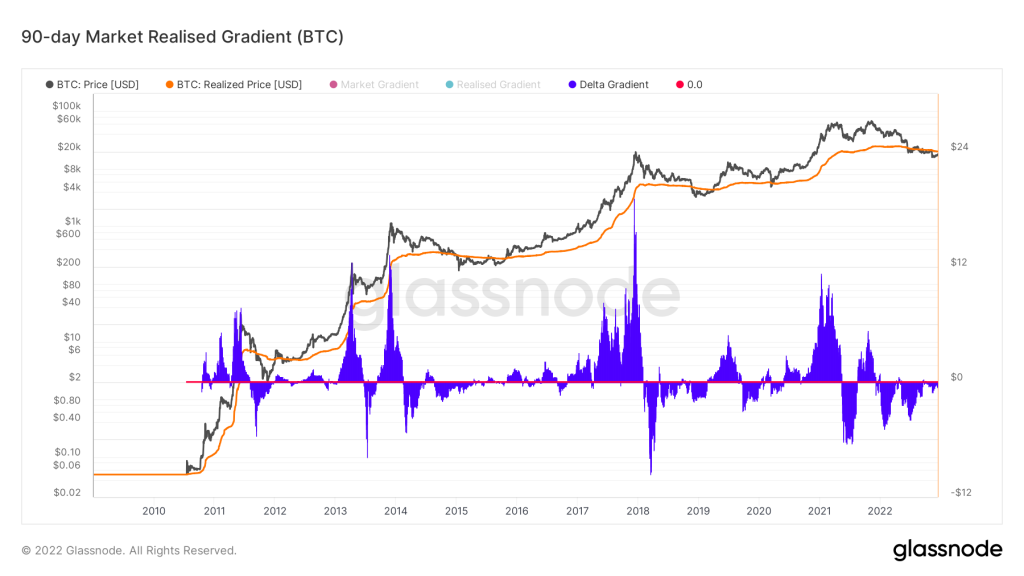

2️⃣ Market Realised Gradient

Market Realised Gradient: metric models market momentum relative to capital inflows.

- Delta Gradient measures the relative movement between speculative value and true organic capital inflows.

- Data: Market Cap, Realized Cap, Gradient, Realized a gradient.

As of now:

Analyzing the whole picture of the bear market we come to a certain pattern, which is that the price updates the lows, and the indicator on the contrary shows gradually increasing minimum values, which is certainly interpreted as a bullish divergence / convergence (whatever you like). This convergence indicates an upward trend in global trends. It’s clear that we are seeing the same recurrence of the pattern according to previous cycles, which signals that the bear market is reaching a point of extreme exhaustion.

For this metric, I’d give it an 8/10.

[azonpress_tables id=”2″]

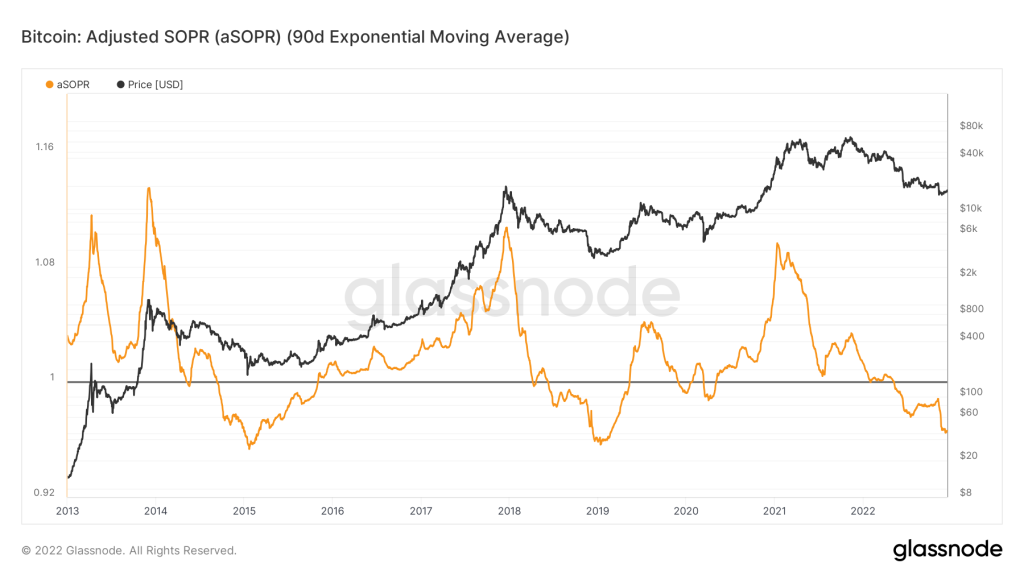

3️⃣ aSOPR

(Image Credit: Glassnode)

aSOPR: the spent output profit ratio, commonly shortened to SOPR, which stands for spent output profit ratio. As we all know from our daily trading.

- the Spend Output Profit Ratio is a measure of the lost profits. Using this measure, we can get a sense of how both market structures of bulls and bears are feeling and where we stand in the market.

- Using Adjusted SOPR (aSOPR) instead of the original SOPR is more relevant because it is a modified version. One of the advantages of aSOPR is that it disregards any output whose lifetime is less than one hour. It can be said that the metric allows to ignore intermediate transactions in terms of performance.

Situation as it stands now:

In the present moment, aSOPR (using a 90d EMA) has a value below “1”, indicating that the metric is at very low levels, coins are being sold at a loss, an increasing one as the index declines. There is no doubt that the index has breached the upper bound of the block and is now inside the range established by the upper bound at 0.97, which, obviously, is a great opportunity to take long-term positions. On a global level, the indicator has some room for decline, but that doesn’t require the price to decrease, so I think the bear market is almost exhausted and a global trend change is imminent. Once the bottom is formed on the indicator aSOPR, I expect the LIFE in the market (a reversal of the index globally).

Towards buyer: 9/10.

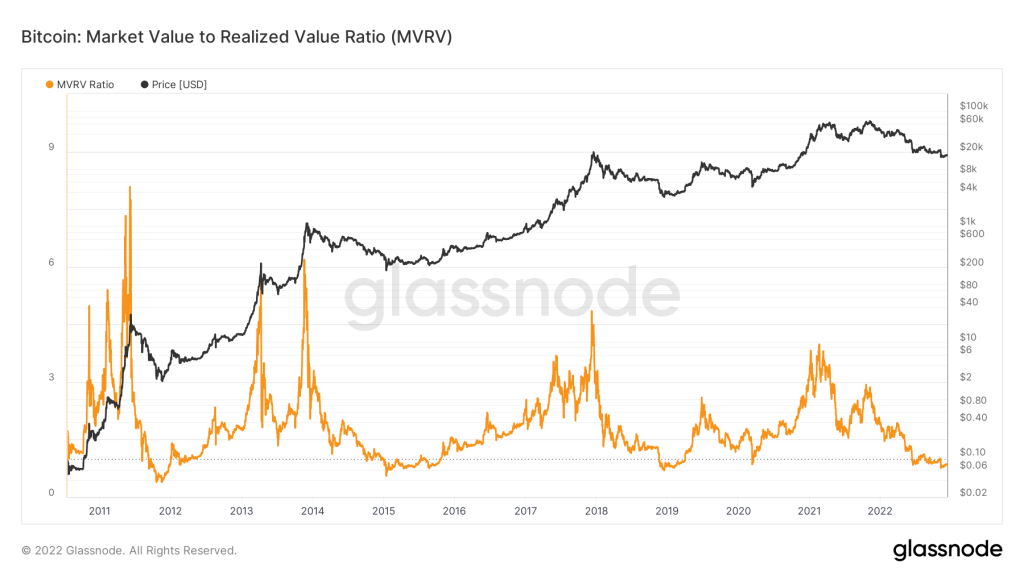

4️⃣ MVRV

(Image Credit: Glassnode)

The MVRV (Market Value to Realized Value Ratio) — measures how much an asset is worth compared with its Realized Value. Using MVRV, you can estimate market profitability, and understand if the price is above or below fair value.

- Inputs include market capitalization and realized capitalization.

Situation at the moment:

A value below “1” indicates a significant undervaluation of an asset, and indicates the market cap is now significantly below the realized cap. In the final stages of a bear market, after which a LIFE returned to the market, Bitcoin started showing signs of growth.

This metric is 9/10 on the buyer’s side.

5️⃣ MVRV Z-Score

(Image credit: Glassnode)

The MVRV-Z score — identifies whether an asset is over- or undervalued relative to its “fair value,” measured by the deviation between the market price and the realized market price.

- A derived indicator of the standard MVRV, MVRV-Z.

Situation today:

It has been observed that the MVRV Z-Scrore indicator is currently at very low values, falling to the green block at this time, which indicates an undervaluation of the asset, in particular Bitcoin. Based on historical records, each of the bottoms of each cycle were exactly in the green block, where the indicator is currently located, which indicates a serious undervaluation of the asset.

Taking this metric into consideration, I have given a 9/10 on the buyer’s side.

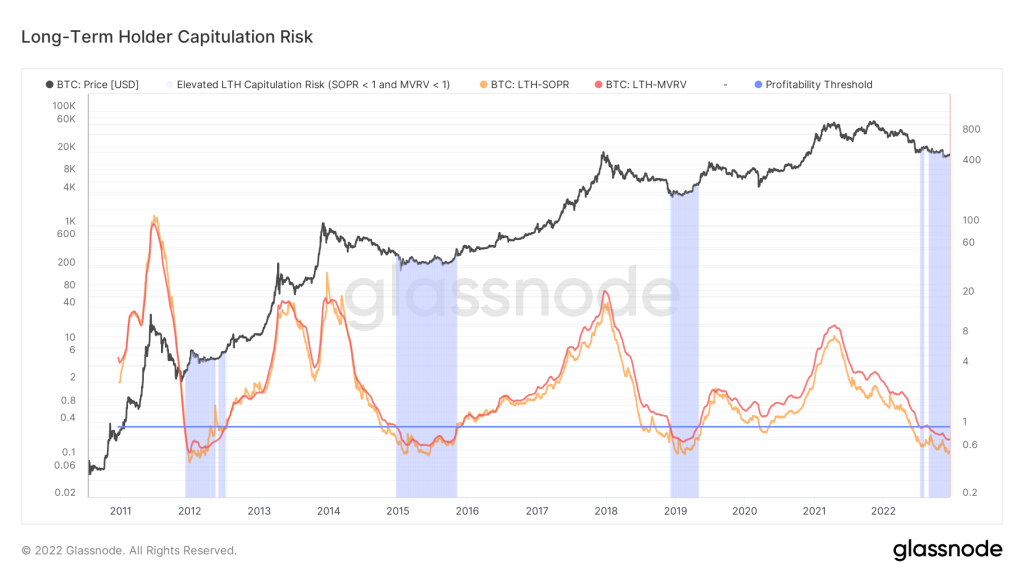

6️⃣ LTH Capitulation Risk

(Image credit: Glassnode)

LTH Capitulation Risk: Long-Term Holder Capitulation Risk is a metric for determining periods of increased stress for long-term BTC holders.

- There are two metrics that are used as inputs for these analyses: LTH-SOPR and LTH-MVRV.

- In blue, LTH surrender risk is indicated, and if MVRV and SOPR are below “1.0”, this indicates that long-term holders are experiencing losses, that is, have unrealized losses on unspent coins (MVRV), and those coins are primarily capturing realized losses (SOPR).

State of play:

Since August 24, 2022, the LTH Capitulation Risk indicator has outlined the area for over 100 consecutive days, which is a positive signal for us, indicating that the bottom of the current market cycle has already formed. This indicator is close to the values where previous cycles have been marked by a reversal, a change of trend from downward to upward. In the current cycle, I expect the metric to remain prominent throughout the accumulation phase.

Based on this metric: 9/10 for the buyer.

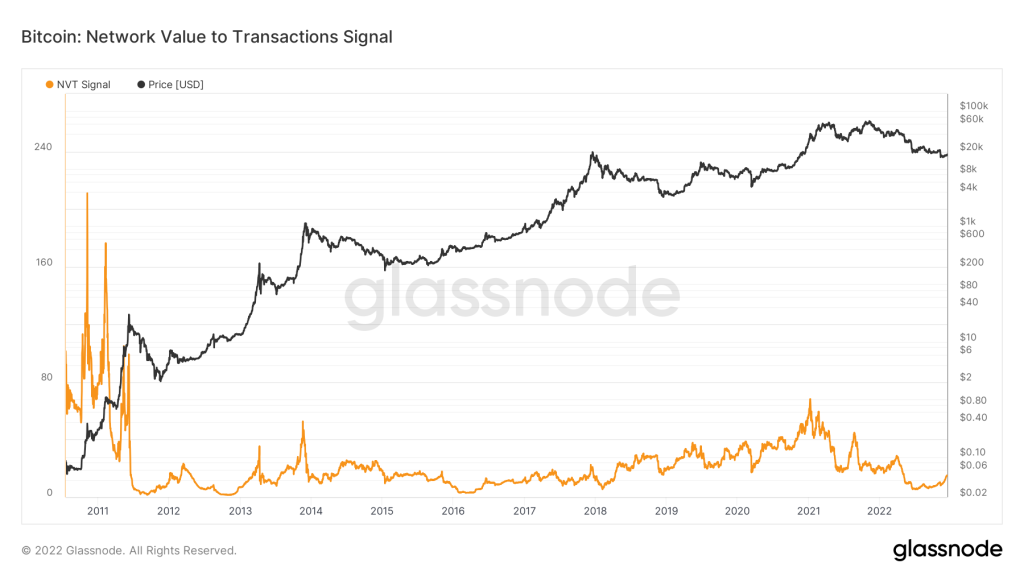

7️⃣ NVT Signal

(Image credit: Glassnode)

NVT Ration: Market value and transfer volume are related by the Network-Value-Transaction Ratio (NVT). There is a modified version of the NVT Ratio known as the NVT Signal (NVTS), which uses the 90-day moving average of daily remittance volume as the denominator for its calculation. It’s pretty similar to its original metric.

Situation at present:

Because the volume of transfers on the chain is exceeding the growth in market capitalization, the Signal NVT values are low. Investors are pricing bitcoin at a discount as a result. Low NVT Signal values are historically times when BTC accumulates and market bottoms tend to coincide. A utility which outpaces value growth indicates more users are joining the network, more value is being deposited, and can be an indication of undervaluation.

As for this metric, it is a 10/10 in favor of the buyer.

📌 Profit / Loss:

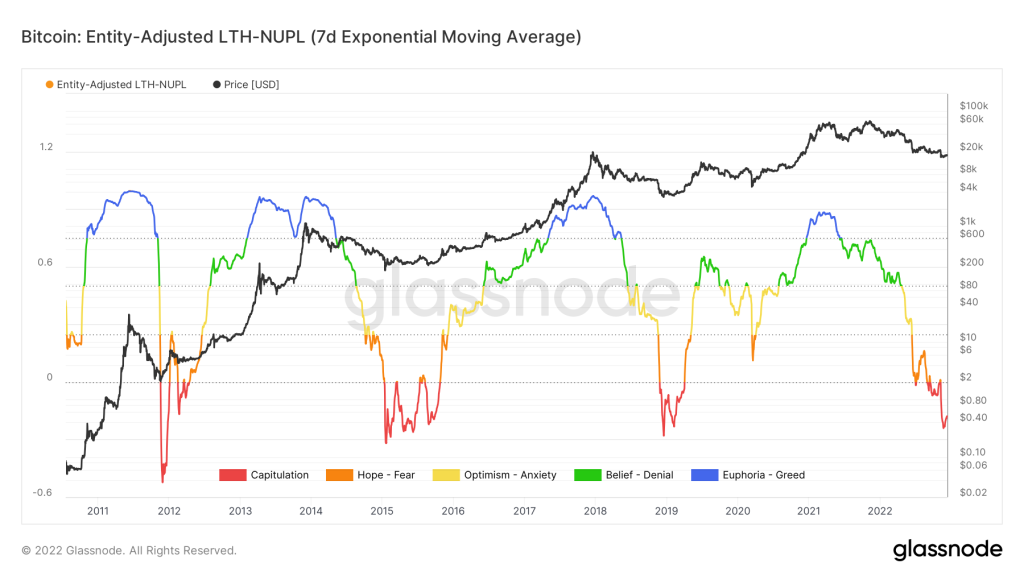

8️⃣ Entity-Adjusted LTH-NUPL

(Image credit: Glassnode)

Entity-Adjusted Net Unrealized Profit/Loss as determined by the type of entity, is a modified version of NUPL (Net Unrealized Profit/Loss).

Its original version has two major differences:

- It only uses coins over 155 days old in its calculations (coins that are under the control of long term holders) in order to come up with the above calculation.

- Transactions that take place “inside” the system are discarded;

It is due to the data provided by this metric that we can estimate the Market Sentiment at different times of the year. How does that work? Is it fear of selling and price collapse or is it faith in growth? In this chart, each sector is shown in its own color.

The current situation in the country is as follows:

According to the chart, the indicator has very low values, i.e. its value is well below “0,” which indicates that there is a preponderance of losses in the group of long-term holders, as you can see from the data. The indicator Entity-Adjusted LTH-NUPL has also been changed to red, which indicates statistically the final stage of the bear market.

🟥 — The capitulation was as follows

When the indicator drops below the “0” value, capitulation occurs, according to the metric. We call anything below zero a capitulation phase. As part of our Entity-Adjusted LTH-NUPL metric, this refers to long-term holders capitulating.

This metric receives an 8/10 towards the buyer.

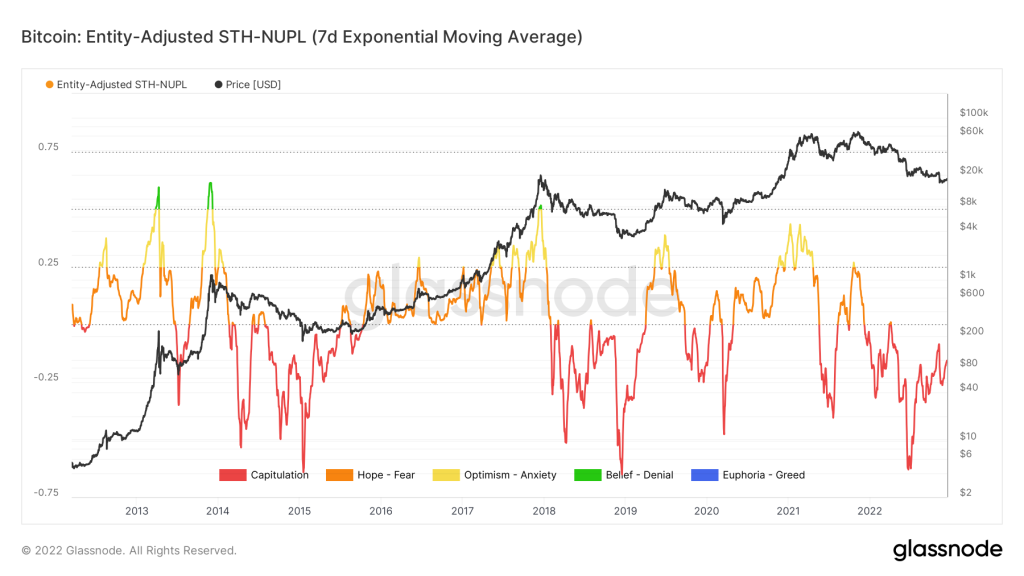

9️⃣ Entity-Adjusted STH-NUPL

(Image credit: Glassnode)

Entity-Adjusted STH-NUPL: It is an improved measure of net unrealized profit/loss from short-term holders, which excludes “inside” trades.

- This metric works based on the same principle as NUPL. It means the network is in a net profit state if the value of the indicator is above “0”, and vice versa, if the value is below “0”, it means it’s in a net loss state.

- There is a regularity characteristic of this metric that, in bull markets, the figure tests the “0” level as support, while in bear markets, on reaching the “0”, it turns downward.

As of now:

There are still unrealized losses in the short-term holding group, despite the index being below zero (“0”). Also, the indicator remains red, which indicates weak hands have capitulated.

As a result of this metric, I would estimate that the buyer will receive an 8/10.

1️⃣0️⃣ Realized Profit

![Realized Profit [USD] (14d Exponential Moving Average)](https://logll.com/wp-content/uploads/2022/12/Realized-Profit-USD-14d-Exponential-Moving-Average-1024x576.png)

(Image credit: Glassnode)

Realized profit — An indicator for realized profit is intended to quantify, in USD, the total amount of realized profit for all coins that were moved that day, meaning coins which were spent during that day. An indication of capital inflows, demand strength, and network profitability can be obtained from the metric.

- When markets are in bear market, the metric has a global downward trend, indicating less selling by large holders.

Here is the current situation:

In November 2021, the index was showing values of $6.5 billion. In December 2022, it shows $19 million, an indication of the market being squeezed. It’s almost the end of the downtrend. There is a clear end to the aggressive phase of bearish trend.

Using this metric, we estimate the buyer to be 9/10.

1️⃣1️⃣ Realized Loss

![Realized Loss [USD] (14d Exponential Moving Average)](https://logll.com/wp-content/uploads/2022/12/Realized-Loss-USD-14d-Exponential-Moving-Average-1024x576.png)

(Image credit: Glassnode)

Realized loss — A realized loss is the amount of all moved coins whose price was higher at the previous move than at the current move, which is expressed in US dollars. Indicators like this typically burst after aggressive price decreases because panicked participants fix their losing positions during such moments.

Presently, the following situation exists:

A long period of time passed in which the price of the oil was kept sideways and did not drop below $18, 600, while the indicator showed relatively low levels that indicated low realized losses during this period of time. The Realized Loss spiked after Bitcoin dropped to $15,863 on November 9, 2022, indicating the huge losses had been fixed. As a result, holders who had unrealized losses turned them into realized losses, which led to their losing faith in the price growth of Bitcoin.

The buyer’s side is estimated to earn 7/10 on this metric.

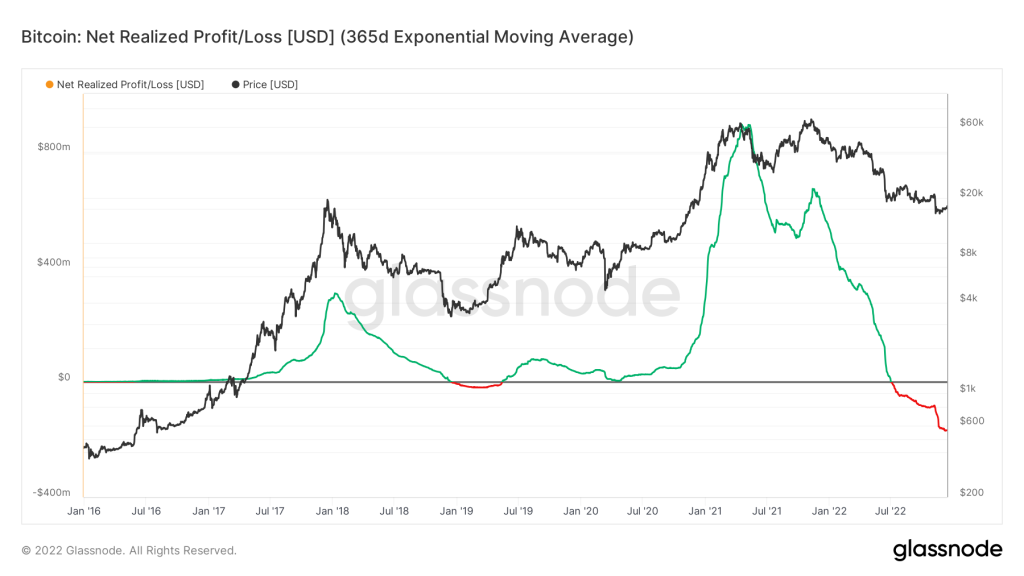

1️⃣2️⃣ Net Realized Profit/Loss

(Image credit: Glassnode)

Net Realized Profit/Loss — In other words, it represents the overall net profit or loss realized by all coin holders. Calculates the net profit or loss (in US dollars) for all coins spent during the specified time period.

- Negative values (the red indicator) indicate chain losses. The price is moving downward and this indicates there is a capital outflow in the market. A deep low can signal investor capitulation, increasing the likelihood of an upside recovery.

Situation at present:

As seen in the chart, using the 365-day exponential moving average, one clear pattern can be seen regarding the accumulation phase at the end of a bear market. This metric illustrates perfectly the beginning and end of the global accumulation phase. In July 2022, the index crossed for the first time, since when it has continued to decline, signaling the market’s increasing losses. As far as Net Realized Profit/Loss metrics are concerned, Bitcoin is in the global accumulation phase. In terms of statistics, the metric has always identified the best pricing ranges within a cycle for accumulation.

Based on the above metric, I would give the buyer a 10/10.

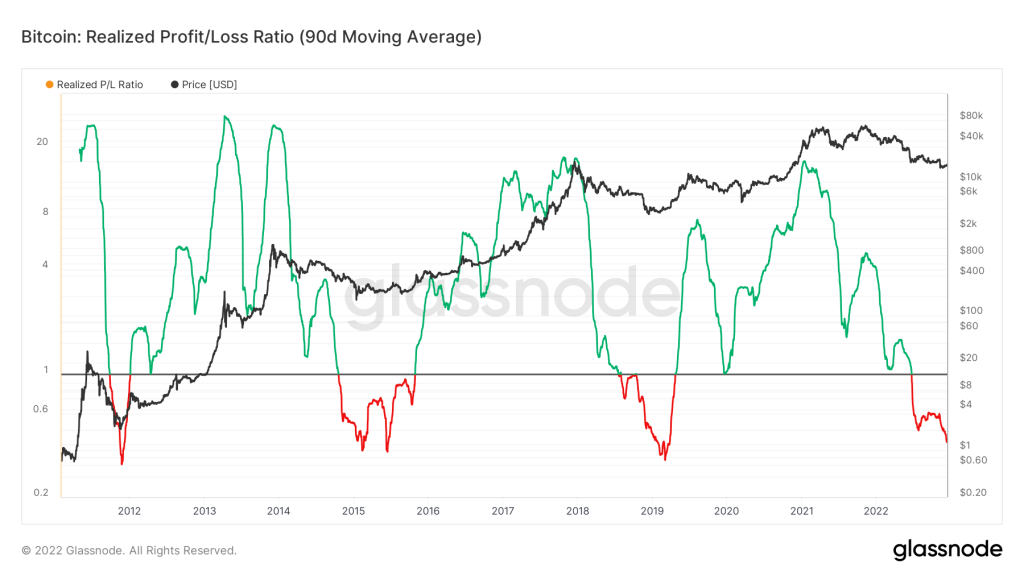

1️⃣3️⃣ Realized P/L Ratio

(Image credit: Glassnode)

Realized P/L Ratio: Realized Profit Ratio. This indicator allows you to track how many times the realized profit was greater or less than the realized loss and vice versa. The input data for the calculation of the realized profit margin are the same as the 2 basic indicators for the calculation of the net realized profit: realized profit and realized loss.

- Realized Profit/Loss Ratio — is the ratio of coins moved with profit to coins moved with loss, so the formula for calculating this ratio is: Realized Profit/Realized Loss.

- Current situation:

Analyzing the data of the realized profit and loss indicator, we draw the following conclusions:

— the sharpest phase of the bear market has passed;

— Realized P&L < 1, which means that losses dominated the market and are now almost 2 times larger;

— The index has entered the main sector and there is still room for a small decline, but not necessarily together with the decline in BTC prices.

Calculation of this metric: 9/10 for the buyer.

📌 Pricing Models:

1️⃣4️⃣ Realized Cap

![Realized Cap [USD]](https://logll.com/wp-content/uploads/2022/12/Realized-Cap-USD-1024x576.png)

(Image credit: Glassnode)

Realized Cap — Essentially, Realized Capitalization refers to a type of market capitalization that values each UTXO on the basis of its last movement rather than its current value.

- It achieves this by reducing the impact of lost coins and long-dormant coins, and valuing coins based on their actual presence in the Bitcoin economy. Essentially, the Realized Cap provides an estimate of the total value of the BTC network.

- Increasing Realized Cap: occurs when coins that were last traded at more advantageous prices are spent (the buy price is higher than the sell price). If a coin is moved higher in a bull market and lower in a bear market, its Realized Cap value will suffer.

As of now:

Clearly, the overall picture is deteriorating. During the bear market, the Realized Cap indicator started digging deep when it realized the tech bounce. The decrease is continuing at the moment, yet I think that 85% of the movement has already been realized, although the main path is certainly passed. Even so, there is still a small margin for error, since during the global accumulation phase, the index gradually halts in its rapid downward motion and smoothes out the reversal of global trend.

This metric yields an estimate of 8/10 in favor of the buyer.

1️⃣5️⃣ Realized Price

![Realized Price [USD]](https://logll.com/wp-content/uploads/2022/12/Realized-Price-USD-1024x576.png)

(Image credit: Glassnode)

The Realized Price — is derived from the Realized Cap divided by the current supply.

This tool will assist in identifying the undervaluation zone on the BTC market. If you take into account that the Realized Price is based on the Realized Cap, it can be said that when the Market Price (black) crosses the Realized Price (orange) from top to bottom in a bear market, that is the primary message that the market will start to accumulate according to the Realized Price metric. The term “undervaluation” refers to the case where the real price becomes higher than the traded price, Market Price, causing undervaluation.

As of right now:

When Realized Price is greater than Market Price on a statistical basis, it has always been a great opportunity for the buying side of the market to participate in the market. Currently, Bitcoin is in an excellent position for partial accumulation and is currently trading at a price well below the Realized Price (average Realized Price now = $20,000), indicating that it is undervalued.

Buyer’s side valuation: 10/10.

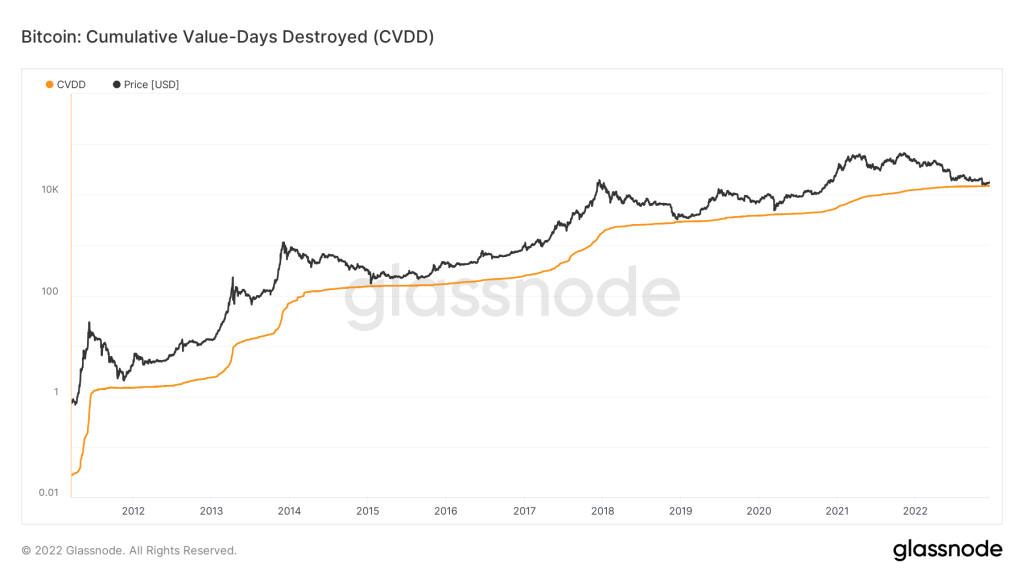

1️⃣6️⃣ CVDD

(Image credit: Glassnode)

CVDD — A cumulative value days destroyed (CVDD) metric represents cumulative (cumulative) value days destroyed over a period of time. As coins move from old to new hands, CVDD tracks the cumulative destruction amount. The CVDD has the advantage of increasing in value, as Coin Days Destroyed (CDD) increases in “coin days destroyed.” With CVDD we can detect bear markets at the bottom.

A common way to use this metric is in conjunction with its counterparts:

- CVDD and top price are included.

- In addition to CVDD, you should also consider the realized price

Combining these two gives you the most comfortable ranges for accumulating long positions.

It is currently the following situation:

It’s averaging 14, 980 days destroyed so far. CVDD’s value is close to Bitcoin’s. By analyzing past cycles, I conclude that a strong convergence of market price and CVDD indicates BTC is nearing the bottom.

In terms of this metric, I’d give it a 9/10.

1️⃣7️⃣ Balanced Price

![Balanced Price [USD]](https://logll.com/wp-content/uploads/2022/12/Balanced-Price-USD-1024x576.png)

(Image credit: Glassnode)

Balanced Price — As you may know, The Balanced Price metric is one of those metrics that is designed to pinpoint the minimum (bottom) of the Bitcoin market cycle by using a number of different indicators.

- Realized Price and Transfer Price are the two metrics used to calculate Balanced Price. The function of this module is to detect the bottom of basic cycles.

- The Transfer Price is calculated by dividing the cumulative total of all coin day destructions (CVDD) by the circulating supply.

Currently:

As a matter of statistical fact, the market price usually reaches a sliding Balanced Price at the end of a bear market, and this cycle is no exception, as the Balanced Price law was implemented on November 9, 2022. A balanced price at the moment is 15, 300 dollars, so the market price is near it, which confirms the hypothesis about the formation of the global bottom.

An overall valuation of 9/10 is given toward the buyer.

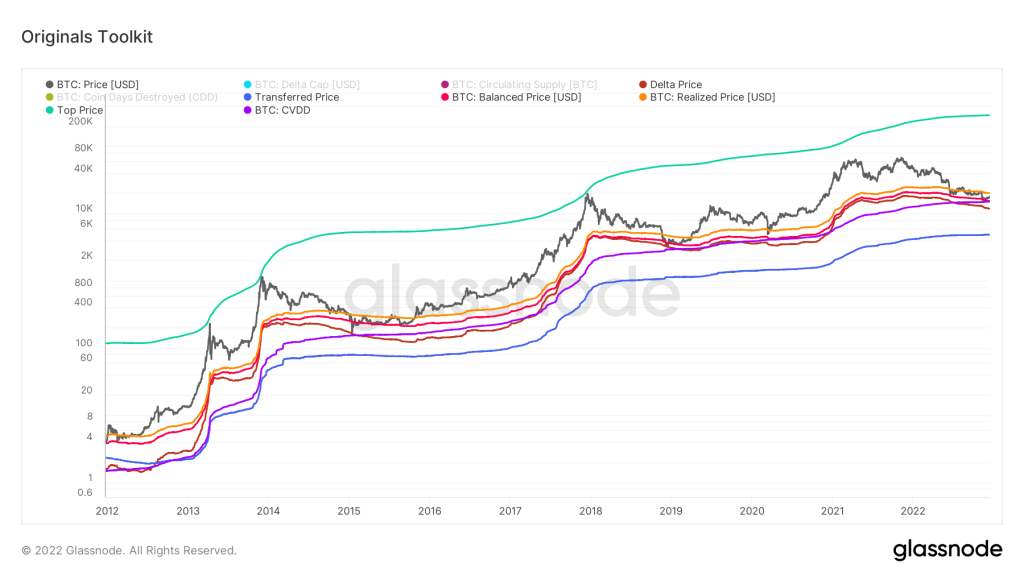

1️⃣8️⃣ Original Toolkit

(Image credit: Glassnode)

Original Toolkit — Object Chain Analysis Toolkit includes original and innovative pricing models created during the early days of Object Chain Analysis. Industry metrics are the foundation for many years to come.

A description of pricing models can be found below:

— Realized Price

— Delta Price

— CVDD

— Transferred Price

— Balanced Price

— Top Price

At the moment:

BTC is close to all indicators, based on this chart, during this time period. Below is an excerpt:

1) Actual Price (average = $20, 000): The market price is below the real price;

2) Delta Price (average value = $11, 700): The market price is higher than the delta price;

(3) CVDD (mean value = $14, 980): Market price is higher, but globally similar to CVDD.

(Average transfer price = 4,850);

5. Balanced Price (mean value = $15,300): It is higher than the market price, which has already been driven in, and it is very close globally.

According to this metric, the seller scores 8/10 in the buyer’s favor.

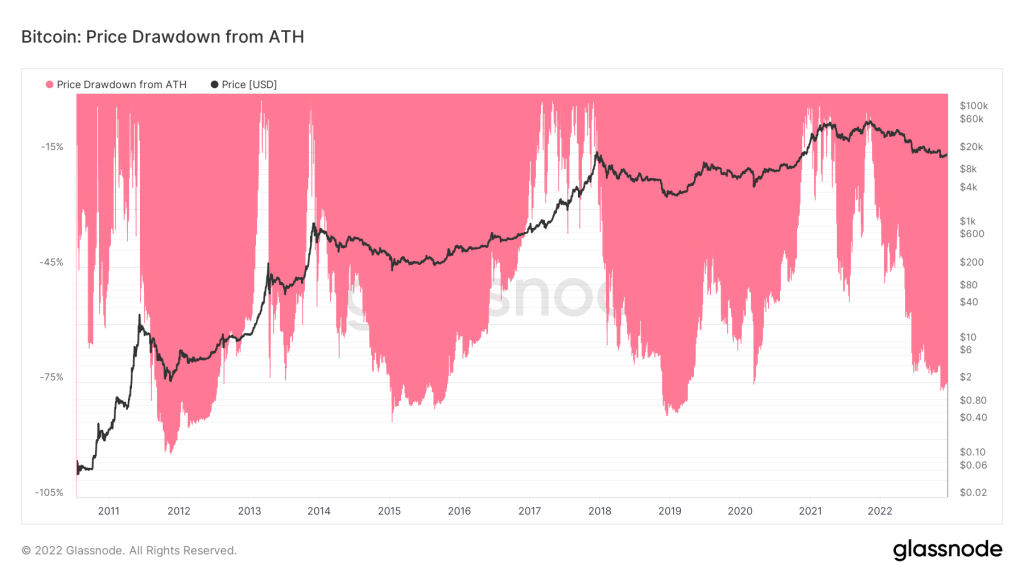

1️⃣9️⃣ Price Drawdown from ATH

(Image credit: Glassnode)

Price Drawdown from ATH — The metric measures the percentage (%) decline from the ATH.

The following data is from the previous cycle:

- 2015 — The ATH for 2015 was $1,134. The index was -85%, or $172 per BTC

- 2018 — 19 587: ATH. Rate was -83.68%, decline to $3, 237 per BTC

It is expected that ATH will reach $67, 589 in 2021. So far, the decline has been as follows: - 2021 — During that moment, the index reached a value of -77 % at 15, 797 $ per BTC

The cycle of 2012 is excluded, since the market was extremely volatile, and the cycle of 2015 is taken into account, since the market had already begun to mature.

At the moment:

The given data shows that the indicator has passed the main decline point as you can see from the data presented. Knowing that at this moment, the price has drawn down from ATH by – 77, which confirms what we’ve assumed about the bottom stage of price formation, I think the current prices are favorable for long-term positions.

This metric provides a 9/10 estimate in the buyer’s favor.

Conclusion

No matter what the cryptocurrency market appears to be indicating through its positive metrics with regards to a potential recovery, our team believes that 2023 will be a difficult period for world markets, which includes cryptocurrencies, as we anticipate the SP500 to drop to the range of $2200 to $2400.

(Image credit: TradingView)

Official Website (TradingView)

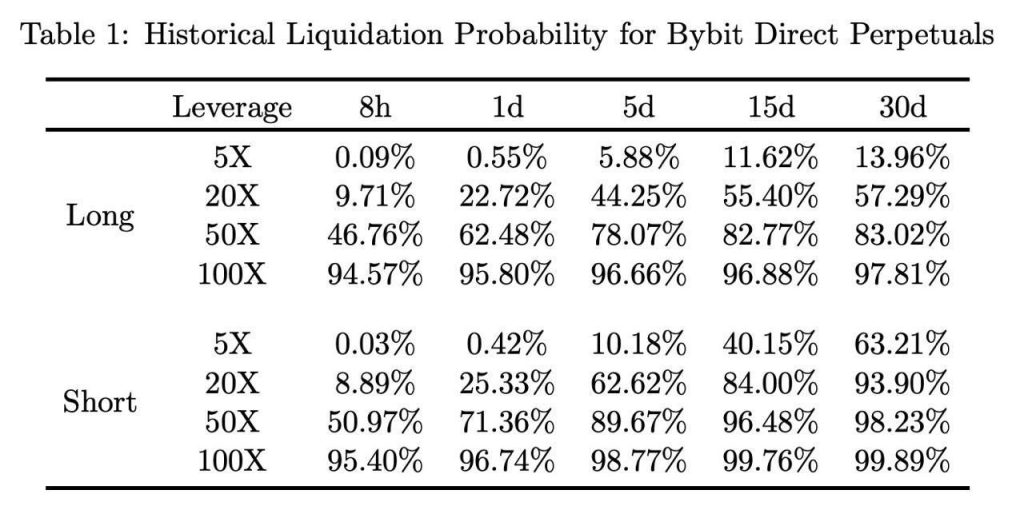

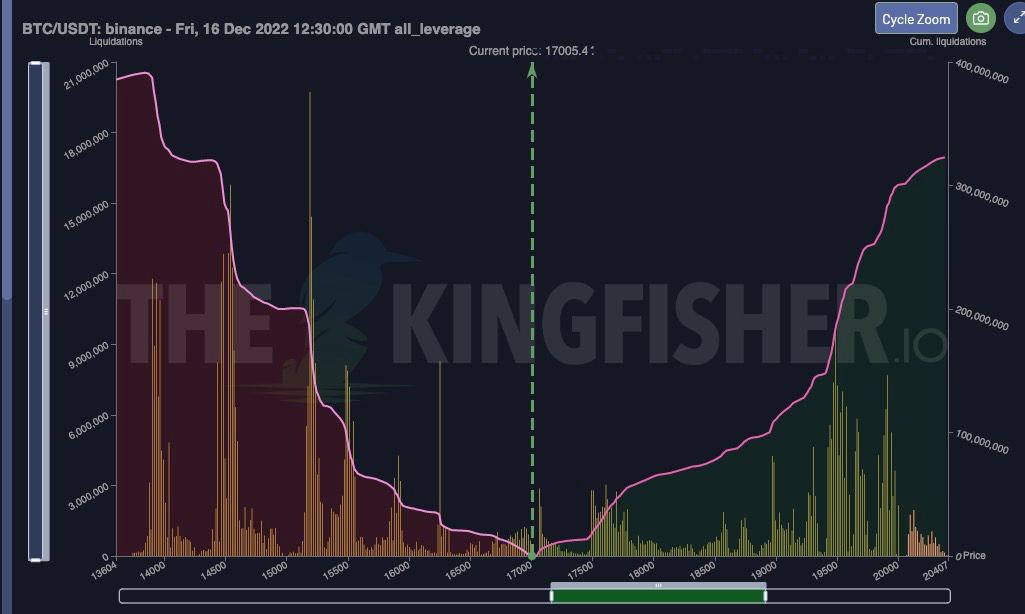

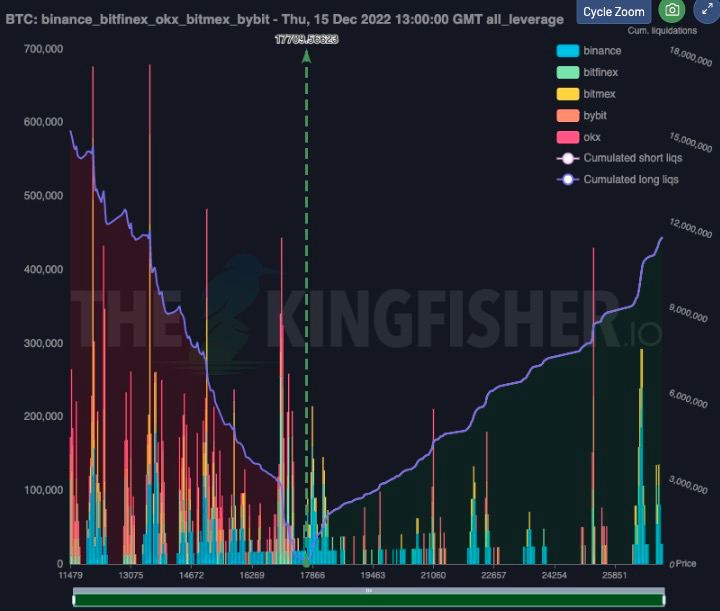

Furthermore, if we take into account the Kingfisher service, there have been liquidations on Bitcoin below the $14,000 mark, with the service providing a table of liquidations based on the margin of the crypto exchange.

(Image credit: Kingfisher)

(Image credit: Kingfisher)

(Image credit: Kingfisher)

We publish our latest Logll Tech News via Telegram and Twitter (Sergio Richi from logll.com)

FAQ:

❓ What is Bitcoin’s on-chain data?

Bitcoin’s on-chain data refers to all the transactions that have ever taken place on the Bitcoin network.

✔️ What does on-chain data allow us to do?

On-chain data allows us to see how much activity is taking place on the Bitcoin network and how many people are using it.