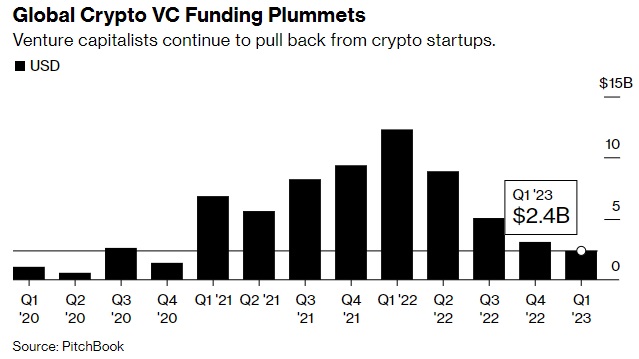

Recent data from research firm PitchBook indicates that private funding for crypto startups in the first quarter of this year has plunged to its lowest level since 2020. Global VC funding for the industry fell to $2.4 billion in the quarter, marking an 80% decline from its all-time high of $12.3 billion during the same period last year.

Macro Environment and Crypto-Specific Challenges Impact Investment

According to PitchBook crypto analyst Robert Le, the drop in venture investing is not a surprise, as it has dwindled across the board this year. Rising interest rates and the unraveling of Silicon Valley Bank have contributed to this decline. Additionally, the crypto industry has faced its own unique challenges, such as scandals, market downturns, and regulatory uncertainty.

FTX’s Collapse Reinforces Need for Due Diligence

Le noted that the collapse and bankruptcy of crypto exchange FTX have slowed down the pace of funding rounds and emphasized the importance of due diligence. VCs now spend more time conducting research and questioning founders before deciding whether to back a startup.

Signs of Recovery for Crypto Venture Investing

Despite the significant downturn, PitchBook data reveals that month-over-month crypto venture investing increased in February and March. This indicates that the worst of the funding drought may be over, and venture investors are still interested in backing crypto infrastructure startups, data analytics firms, and developer platforms.

US, EU: Best Virtual Payment Cards

M^Zero Labs Raises $22.5 Million Amidst Market Turmoil

Berlin-based decentralized finance infrastructure startup M^Zero Labs managed to raise $22.5 million in a funding round announced this month. CEO Luca Prosperi said the market turmoil made the fundraising process more stressful, but the company is fortunate to have venture backers who remain committed to crypto’s potential. The fresh capital will be used to expand the team and support the company’s growth.

If you are able, we kindly ask for your support of Logll Tech News today. We appreciate it.

Sergio Richi

Editor, Logll Tech News

⭐️⭐️⭐️⭐️⭐️ Crypto Hardware Wallet

Ledger Nano X Crypto Hardware Wallet (Blazing-Orange) - Bluetooth - The Best Way to securely Buy, Manage and Grow All Your Digital Assets

$104.00

Trezor Model T - Advanced Crypto Hardware Wallet with LCD Touchscreen, Secure Bitcoin & Over 1450 Coins for Maximum Security

$179.00

Best Offer Today

Conclusion

In conclusion, the recent decline in crypto VC funding highlights the challenges faced by the crypto industry due to macroeconomic factors and industry-specific issues. However, despite these obstacles, there are signs of recovery as evidenced by the increase in month-over-month crypto venture investing and the successful funding round of M^Zero Labs. The industry’s resilience suggests that investors remain interested in the long-term potential of crypto-based startups and technologies. As the market stabilizes and due diligence becomes a priority, we can expect to see a more measured and sustainable approach to investing in the crypto space moving forward.