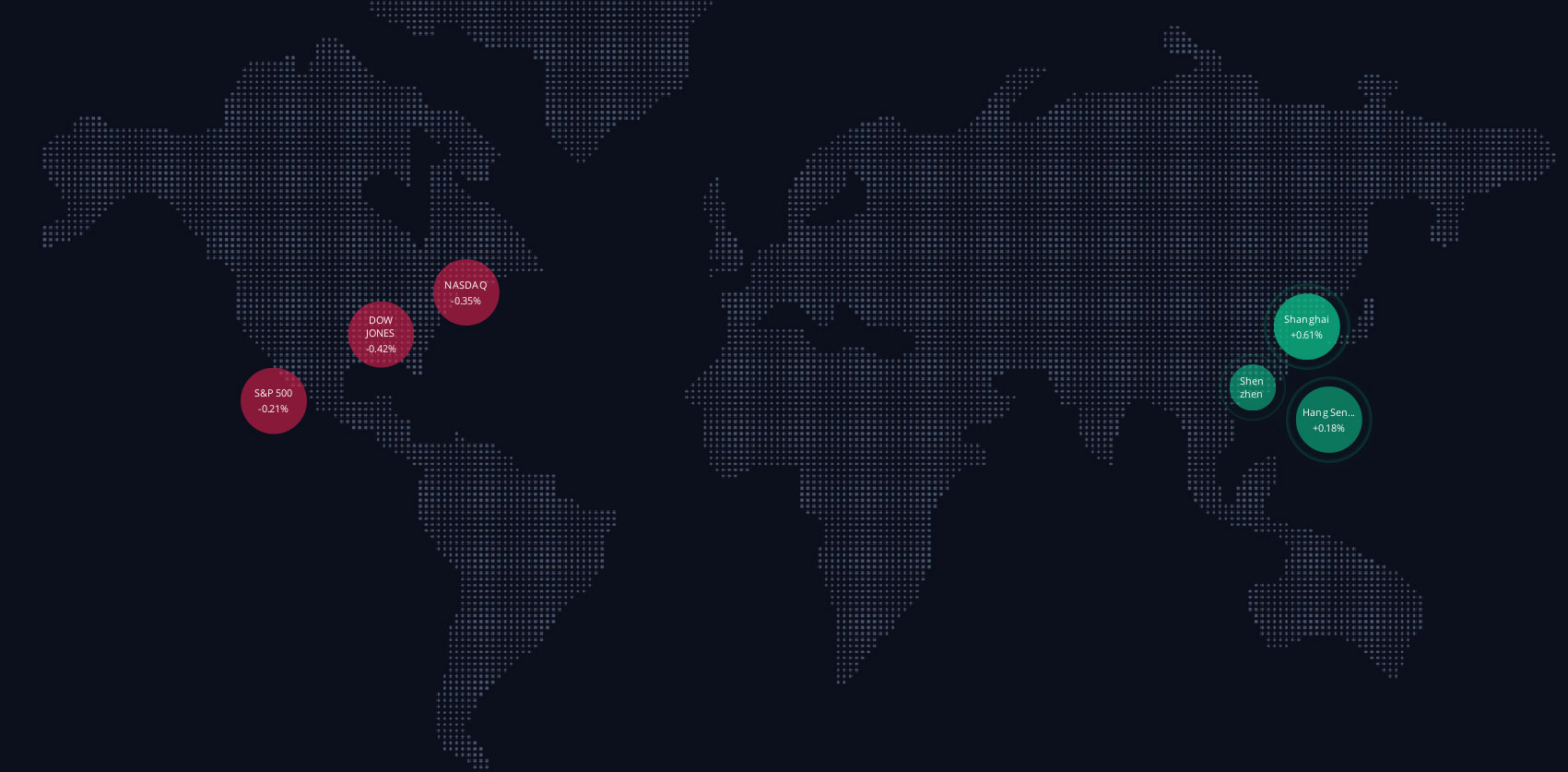

China’s central bank, the People’s Bank of China (PBOC), is injecting more liquidity into the financial system while maintaining the key interest rate in an effort to prevent funding squeezes as the demand for credit rebounds.

Rates Unchanged as the Economy Shows Signs of Recovery

The PBOC offered 170 billion yuan ($25 billion) of funds to banks through the medium-term lending facility (MLF), resulting in a 20 billion yuan net injection in April. The one-year MLF interest rate remains unchanged at 2.75% for the eighth consecutive month, aligning with the expectations of most economists and analysts in a Bloomberg survey.

As anticipation grows that the Federal Reserve may soon end its rate-hike cycle, the market is closely monitoring whether China’s central bank will further ease monetary policy to support economic growth. Muted inflation, which suggests that domestic demand remains subdued, provides the PBOC with the flexibility to take policy action. However, the central bank will also consider other data, such as the recent unexpected surge in exports and new loans, indicating strength in some areas of the economy.

Economic Stabilization and Growth Targets

Achieving a 5% Growth Target Amid Improving Property Market

PBOC Governor Yi Gang stated during a Group of 20 meeting last week that China’s economy is stabilizing and rebounding. The growth target of around 5% this year could be achievable as the property market improves.

The net injection via MLF in April marked the fifth consecutive month of such action by the central bank. In addition, the PBOC cut the required reserve ratio for lenders in March, potentially releasing around 500 billion yuan of long-term funds into the financial system. China’s efforts to ensure adequate liquidity in markets may help stabilize borrowing costs, which are under pressure to rise as the recovering economy increases demand for funds.

Best Crypto Exchange

Smaller Lenders Cutting Deposit Rates

Improving Profitability and Encouraging Borrowing

While the PBOC maintains the policy rate, some smaller Chinese lenders have reduced deposit rates in April. These moves could enhance profitability and stimulate more borrowing. China’s interest rate self-disciplinary mechanism, a regulatory body overseen by the PBOC, has adjusted the assessment method for banks this year. This change encourages lenders to lower deposit rates, according to the 21st Century Business Herald.

Best Virtual Payment Card

If you are able, we kindly ask for your support of Logll Tech News today. We appreciate it.

Sergio Richi

Editor, Logll Tech News

⭐️⭐️⭐️⭐️⭐️ 3D puzzles

ROBOTIME 3D Assembly Wooden Puzzle Laser-Cut Locomotive Kit Mechanical Gears Toy Brain Teaser Games Best Birthday Gifts for Engineer Husband & Boyfriend & Teen Boys & Adults

ROBOTIME Model Car Kits - Wooden 3D Puzzles - Model Cars to Build for Adults 1:16 Scale Model Grand Prix Car

5 in 1 STEM Kit, Wooden Model Car Kits, STEM Projects for Kids Ages 8-12, Gifts for 8 Year Old Boys, 3D Puzzles, Science Educational Crafts Building Kit, Toys for 8 9 10 11 12 Year Old Boys and Girls

$21.99

Best Offer Today

Conclusion: China’s Proactive Approach to Economic Recovery

In conclusion, the People’s Bank of China is taking proactive measures to support the nation’s economic recovery by injecting liquidity into the financial system while maintaining key interest rates. These actions aim to prevent funding squeezes and bolster credit demand as China’s economy shows signs of stabilization and rebound. The central bank’s efforts to ensure adequate liquidity, along with smaller lenders cutting deposit rates, contribute to a more stable environment for borrowing costs and promote economic growth. As the global market keeps a close eye on China’s monetary policy, the nation’s actions demonstrate a commitment to achieving a healthy and sustainable economic rebound.