Before diving into the eBook “The Bank Panic of 1907, 1929, 2008, 2023 and Beyond: A Historical Analysis and Future Projections,” let’s first take a look at 10 vivid images from the Great Depression era.

10 vivid images of the Great Depression era that remind us how awful it is to be jobless:

No one knows for sure what the future holds. You can make the most accurate forecast and still be wrong. But the past is an excellent source of knowledge. The news lately hasn’t been uplifting, and it’s now quite apparent that the global economy is facing a significant challenge. A challenge that will affect everyone. That’s probably why I was so interested in studying pictures from the Great Depression era. They seriously make you think.

A line of people in need of assistance against the backdrop of bright American lifestyle advertisements. Photo by Margaret Bourke-White/Public Domain.

The number of unemployed people is growing rapidly everywhere. Just over 90 years ago, at the end of 1929, the markets crashed, and a prolonged economic crisis began. It affected the whole world, but it particularly hit America and Europe hard. The stock market financial bubble burst, shares instantly became worthless, half the banks went bankrupt, and agricultural prices fell so low that some farmers poured out milk because they didn’t want to give it away for almost nothing. And then there was unemployment… In the 1930s, it exceeded 20% in the United States. But they managed to overcome it!

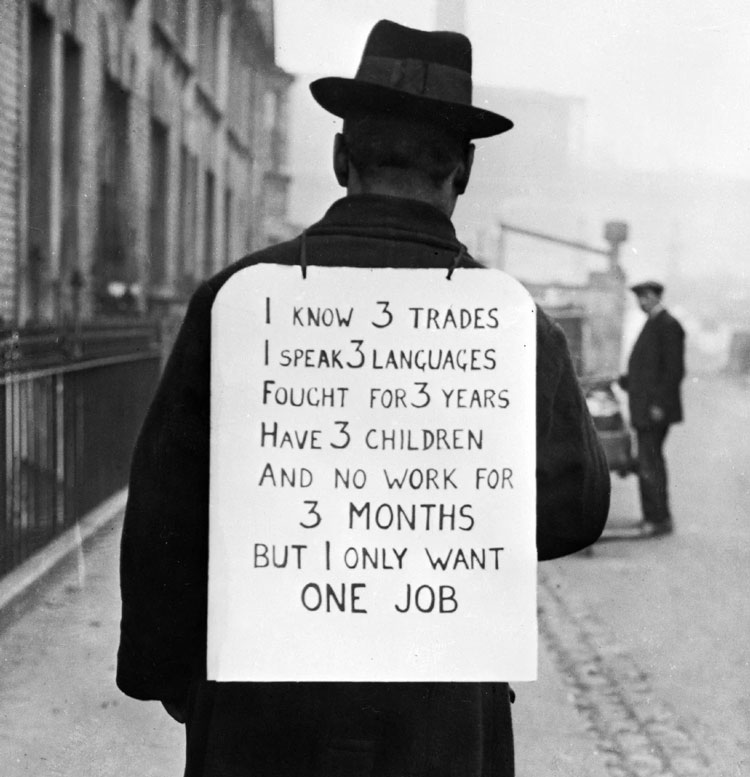

The famous resume: “I have three skills. I speak three languages. I spent three years on the front lines. I have three children. I have been out of work for three months, but I only need one job.” 1935. Photo by Public Domain.

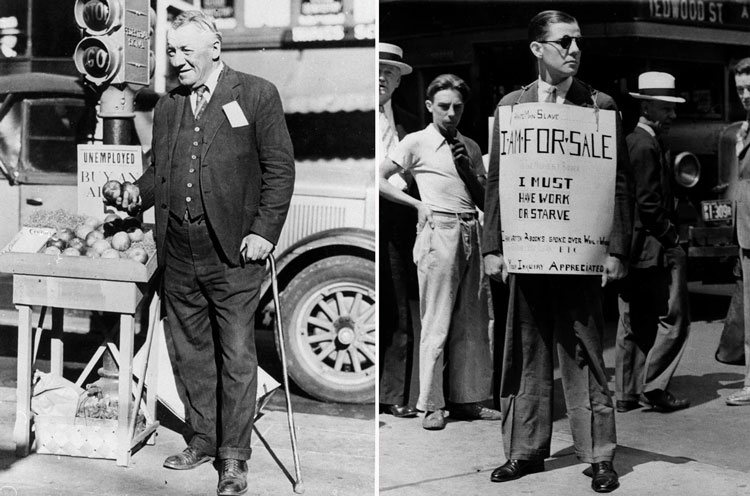

“I am selling myself. My choice is simple: work or starve,” read the poster of an unemployed man in a famous photo. And there are many memorable pictures like that. “Visual” has prepared for you a collection of vivid images from the Great Depression era. I don’t want to upset anyone; these days, we already feel a lack of good news. On the contrary, it’s essential to understand that nothing is new under the sun, humanity has already learned many lessons and will learn just as many more. We’ll get through this! And these photographs… they’re an excellent reminder to everyone that when you have a job, everything, in general, isn’t so bad.

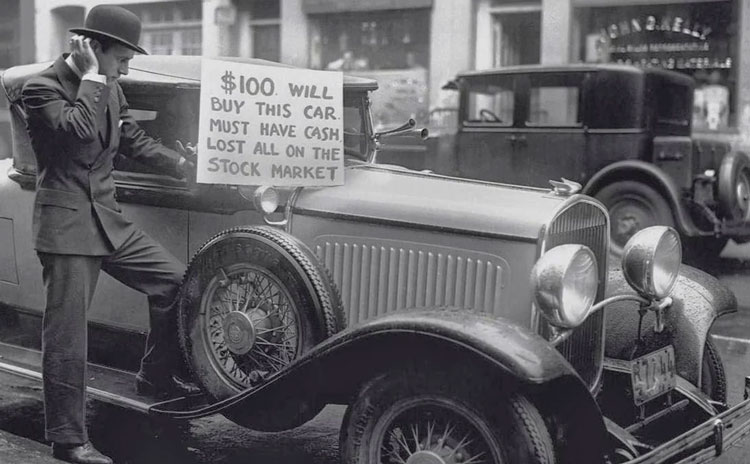

It all began on “Black Tuesday” in October 1929. Adjusted for inflation, people lost about $320 billion.

Bankrupt individuals burn worthless stocks. Photo by National Archives and Records Administration/Public Domain.

Here’s a banker who lost everything in the market and is now selling his car for $100. Photo by Wall Street Journal/Public Domain.

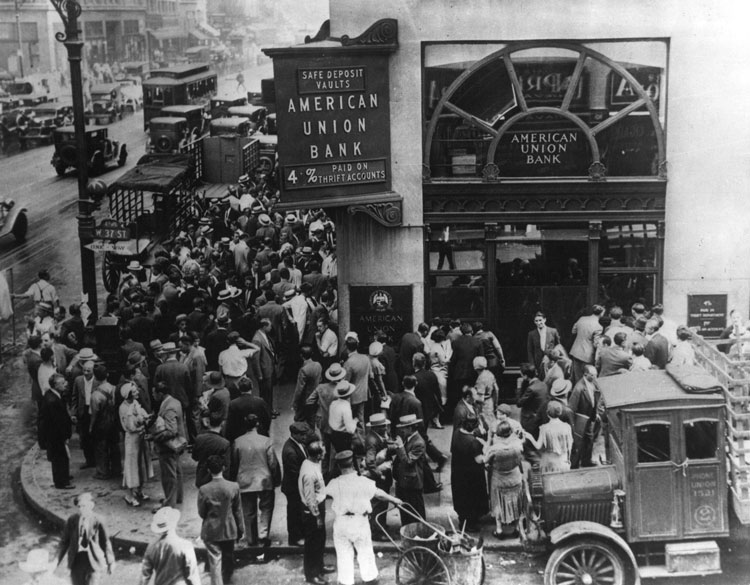

Depositors rushed to withdraw their money from the banks, but it was already too late. 1931, New York. Photo by Public Domain.

At a certain point, the number of unemployed people in the US reached 25%. 1930. Photo by National Archives and Records Administration/Public Domain.

Former millionaire Fred Bell, who went bankrupt overnight, asks people to buy an apple from him. Photo by Associated Press/Public Domain.

Unemployed people line up for soup at Al Capone’s soup kitchen in Chicago. 1931. Photo by National Archives and Records Administration/Public Domain.

Homeless people often lived in flimsy shacks or ended up in homeless shelters, like this one in New York. 1930. Photo by Robert Sennecke/Ullstein Bild/Public Domain.

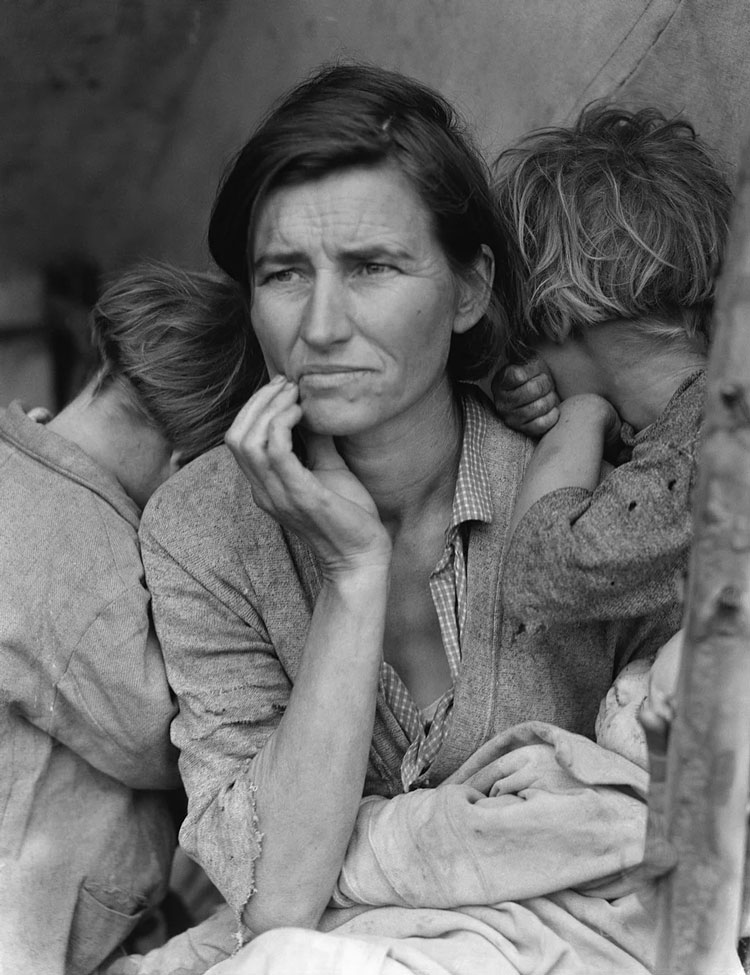

“The Migrant Mother,” a famous photo from the Great Depression era. Pictured is 32-year-old Florence Thompson with her children. In her eyes, there’s a sense of hopelessness. 1936. Photo by Library of Congress/Public Domain.

As difficult as it was for people, it passed. Never lose hope; everything will be fine!

Chapter I

A. Explanation of the Purpose and Scope of the Ebook

The US has a long history of financial crises, with bank panics being among the most severe and impactful. In particular, the bank panics of 1907, 1929, and 2008 had significant consequences for the US economy and financial system, causing widespread job losses, business failures, and a decline in living standards for many Americans.

While these crises are now distant memories, there are warning signs and risk factors that suggest a future bank panic may be on the horizon. In this ebook, we provide a historical analysis of the three major bank panics in US history, while also exploring the potential for a future bank panic in the present day.

We examine the warning signs and risk factors that may contribute to such an event, as well as the policy responses that could help prevent or mitigate a crisis. By analyzing the lessons of history and projecting into the future, this ebook aims to provide readers with a deeper understanding of the challenges facing the US financial system and the potential solutions for addressing them.

B. Brief Overview of the Three Major Bank Panics in US History: 1907, 1929, and 2008

The bank panic of 1907 was a financial crisis that occurred due to a series of events, including the bankruptcy of a major brokerage firm and the failure of several prominent banks. The panic led to a shortage of money and credit, causing a severe contraction in economic activity and widespread bank failures. To mitigate the crisis, prominent bankers such as J.P. Morgan intervened to stabilize the banking system and restore confidence in the economy.

The bank panic of 1929, also known as the Great Depression, was a severe economic downturn that lasted from 1929 to 1939. The crisis was triggered by the stock market crash of October 1929, which led to a wave of bank failures and a sharp decline in economic activity. The Great Depression had a profound impact on the US economy, with widespread unemployment, poverty, and social unrest. The crisis ultimately led to significant policy responses, including the establishment of the Federal Deposit Insurance Corporation (FDIC) and the implementation of the New Deal programs.

The bank panic of 2008, also known as the global financial crisis, was a severe financial crisis that began in the US housing market and quickly spread throughout the global financial system. The crisis was characterized by a collapse in housing prices, a surge in mortgage defaults, and the failure of several major financial institutions. The crisis led to a severe contraction in economic activity and widespread job losses, as well as significant policy responses such as the Troubled Asset Relief Program (TARP) and the Dodd-Frank Wall Street Reform and Consumer Protection Act.

C. Preview of the Book’s Contents and Organization

This ebook is organized into several chapters that provide a comprehensive analysis of the three major bank panics in US history and explore the potential for a future bank panic in the present day. The chapters are as follows:

Chapter I – Introduction: This chapter introduces the purpose and scope of the ebook and provides a brief overview of the three major bank panics in US history.

Chapter II-IV – Historical Analysis: These chapters provide a detailed examination of the bank panics of 1907, 1929, and 2008, respectively. Each chapter explores the background and causes of the crisis, the key events and timeline, the impact on the US economy and financial system, and the policy responses and reforms implemented after the panic.

Chapter V – Warning Signs and Risk Factors for a Future Bank Panic: This chapter offers an overview of the current state of the US economy and financial system, identifying the warning signs and risk factors that could contribute to a future bank panic.

Chapter VI – Policy Responses and Reforms to Prevent or Mitigate a Future Bank Panic: This chapter evaluates potential policy responses and reforms that could help prevent or mitigate a future bank panic, examining the effectiveness of various approaches and the political and economic challenges to implementing them.

Chapter VII – Future Projections: The Potential for a Bank Panic in 2023 and Beyond: This chapter provides a projection into the future, analyzing the likelihood and severity of a future bank panic in 2023 and beyond, and discussing potential policy responses and reforms to prepare for and mitigate a future crisis.

Chapter VIII – Conclusion: This chapter summarizes the key findings and arguments of the ebook, discusses the implications of the analysis for the US economy and financial system, and reflects on the lessons learned from historical bank panics and their relevance for the present and future.

Chapter II. Historical Analysis: The Bank Panic of 1907

A. Background and Causes of the Panic

The bank panic of 1907 was a financial crisis that occurred due to a combination of factors. One of the main causes was the speculation in the stock market, which led to an unsustainable boom and subsequent bust. Additionally, the failure of several prominent banks, including the Knickerbocker Trust Company, contributed to the crisis. Finally, a series of rumors and mistrust among banks led to a shortage of money and credit, causing a severe contraction in economic activity and widespread bank failures.

B. Key Events and Timeline of the Panic

The bank panic of 1907 began in October of that year, when the stock market crashed and several prominent banks failed. The panic spread quickly, and many banks began to experience runs, with depositors withdrawing their funds in fear of bank failures. In response, prominent bankers such as J.P. Morgan intervened to stabilize the banking system and restore confidence in the economy. Morgan coordinated a consortium of banks to lend money to struggling institutions, and also convinced the US government to issue emergency currency to help ease the shortage of money and credit.

C. Impact on the US Economy and Financial System

The bank panic of 1907 had a significant impact on the US economy and financial system. The panic caused a contraction in economic activity, with many businesses failing and unemployment rising. The panic also led to a significant number of bank failures, with over 200 banks closing their doors in the aftermath of the crisis. The impact of the panic was felt for several years, as the US economy struggled to recover from the shock.

D. Policy Responses and Reforms Implemented after the Panic

The bank panic of 1907 led to several policy responses and reforms aimed at preventing future financial crises. One of the most significant reforms was the creation of the Federal Reserve System in 1913, which aimed to stabilize the banking system and prevent future bank panics. Additionally, several laws were passed, including the Aldrich-Vreeland Act of 1908, which established a temporary currency board to issue emergency currency during times of financial stress. These reforms and policy responses played a significant role in preventing future financial crises and stabilizing the US financial system.

Chapter III. Historical Analysis: The Great Depression and the Bank Panic of 1929

A. Background and Causes of the Great Depression

The Great Depression was a severe economic downturn that lasted from 1929 to 1939. The crisis was triggered by the stock market crash of October 1929, which led to a wave of bank failures and a sharp decline in economic activity. The Great Depression had several underlying causes, including speculation in the stock market, overproduction in the agricultural sector, and a decline in international trade due to protectionist policies.

B. Key Events and Timeline of the Bank Panic

The bank panic of 1929 was a significant component of the Great Depression. The panic began in October of that year, when the stock market crashed and several banks failed. The panic quickly spread, with depositors withdrawing their funds in fear of bank failures. The Federal Reserve exacerbated the crisis by contracting the money supply and raising interest rates, which led to a further contraction in economic activity and bank failures.

C. Impact on the US Economy and Financial System

The bank panic of 1929 had a severe impact on the US economy and financial system. The panic led to a contraction in economic activity, with many businesses failing and unemployment rising. The panic also led to a significant number of bank failures, with over 9,000 banks closing their doors in the aftermath of the crisis. The impact of the Great Depression was felt for several years, with the US economy struggling to recover from the shock.

D. Policy Responses and Reforms Implemented after the Panic

The bank panic of 1929 and the Great Depression led to significant policy responses and reforms aimed at preventing future financial crises. One of the most significant reforms was the establishment of the Federal Deposit Insurance Corporation (FDIC), which insured deposits and prevented bank runs. Additionally, several laws were passed, including the Glass-Steagall Act of 1933, which separated commercial and investment banking activities. These reforms and policy responses played a significant role in preventing future financial crises and stabilizing the US financial system.

Chapter IV. Historical Analysis: The Global Financial Crisis and the Bank Panic of 2008

A. Background and Causes of the Global Financial Crisis

The global financial crisis was a severe financial crisis that began in the US housing market and quickly spread throughout the global financial system. The crisis was characterized by a collapse in housing prices, a surge in mortgage defaults, and the failure of several major financial institutions. The global financial crisis had several underlying causes, including lax lending standards, inadequate regulation, and the use of complex financial instruments that were poorly understood.

B. Key Events and Timeline of the Bank Panic

The bank panic of 2008 was a significant component of the global financial crisis. The panic began in September of that year, when the failure of Lehman Brothers, a major investment bank, led to a freeze in credit markets and widespread fear of bank failures. The panic quickly spread, with depositors withdrawing their funds in fear of bank failures. The panic led to a contraction in economic activity, with many businesses failing and unemployment rising.

C. Impact on the US Economy and Financial System

The bank panic of 2008 had a severe impact on the US economy and financial system. The panic led to a contraction in economic activity, with many businesses failing and unemployment rising. The panic also led to a significant number of bank failures, with several major financial institutions, including Bear Stearns and Washington Mutual, failing. The impact of the global financial crisis was felt for several years, with the US economy struggling to recover from the shock.

D. Policy Responses and Reforms Implemented after the Panic

The bank panic of 2008 and the global financial crisis led to significant policy responses and reforms aimed at preventing future financial crises. One of the most significant reforms was the passage of the Dodd-Frank Wall Street Reform and Consumer Protection Act, which aimed to increase regulation of the financial sector and reduce the risk of future crises. Additionally, several policies were implemented to stabilize the financial system, including the Troubled Asset Relief Program (TARP), which provided financial assistance to struggling institutions.

Chapter V.

A. Overview of the Current State of the US Economy and Financial System

As of 03/15/2023, the US economy and financial system are facing challenges, with the collapse of Silicon Valley Bank and two other lenders posing a threat to an already fragile economy. When the Federal Reserve is raising interest rates, as it is now, recession is always a risk, and sudden external shocks can trigger downturns.

According to economists, the US macro economy is fragile and not well understood, with the potential for growth to slow to a walking speed, leading to a rise in unemployment. The collapse of SVB, Signature Bank, and Silvergate Bank has raised questions about whether this event will tip the US into a recession. Economists believe that the US is likely to slow further in 2023, entering a mild recession in late 2023.

The US economy is expected to expand at a muted 0.5-1% pace in 2023, a deceleration from the previous year’s growth rate of 1.5-2%. This is due to weaker activity in residential investment, with housing expected to contract by 10-12% in 2023. Net foreign trade is also expected to be a 1% drag on 2023 GDP due to the stronger dollar hurting export demand.

The Federal Reserve is tightening monetary policy, with cumulative tightening expected to reach 475bp, putting the terminal fed funds target range at 4.75-5.00%. It’s likely that the funds rate will be maintained at this restrictive level until there is conclusive evidence that inflation is retreating to its targeted 2% level. The Fed’s balance sheet reduction, or quantitative tightening, is also ongoing, with the current runoff pace of $95 billion per month expected to continue through 2023.

The rising interest rate environment has so far affected the slowing housing sector and USD strength, but the cumulative effects of higher borrowing costs and tighter financial conditions are expected to dampen demand more broadly across the economy in 2023. Despite the challenges, there are opportunities for growth, with real consumer spending expected to rise approximately 2% in 2023, assuming wage growth of 4-5%, inflation moderating to 3-4%, and further drawdown of excess accumulated pandemic savings.

While the current state of the US economy and financial system presents challenges, policymakers and financial institutions can take steps to mitigate risks and support continued growth.

B. Identification of Warning Signs and Risk Factors that Could Contribute to a Future Bank Panic

The recent bank panic caused by the failure of Silicon Valley Bank (SVB) and Signature Bank has highlighted the need to identify warning signs and risk factors that could contribute to future bank panics. Some of these factors include:

- Risky investments: Banks that make risky bets with their deposits are more likely to experience financial difficulties that can trigger a panic. Regulators need to ensure that banks are investing their deposits in safe and secure assets.

- Insufficient financial cushion: Banks that do not maintain enough of a financial cushion to withstand a crisis are at a higher risk of collapse during a panic. Regulators need to require banks to maintain an adequate financial cushion that can help mitigate risks.

- Excessive debt: Banks that have excessive debt levels are more likely to experience financial difficulties that can lead to a panic. Regulators need to monitor banks’ debt levels and take appropriate action if necessary.

- Weak regulatory oversight: Banks that are subject to weak regulatory oversight are more likely to engage in risky practices that can lead to a panic. Regulators need to strengthen their oversight and enforcement of banking regulations to prevent such practices.

- Interconnectedness: The interconnectedness of banks can amplify the effects of a crisis and increase the likelihood of a panic. Regulators need to monitor and manage the risks associated with the interconnectedness of banks.

In addition to these factors, economic conditions can also contribute to a future bank panic. For example, a strong dollar can negatively impact U.S. exports, hurting revenues and profits for U.S.-based companies. This can lead to financial difficulties for banks that have lent money to these companies. Moreover, a more challenging economic environment can translate into increased spread dispersion among sectors, ratings decompression, and wider high yield bond and loan spreads, which can increase the vulnerability of leveraged credit markets to defaults.

Overall, it is crucial for regulators to identify and monitor these warning signs and risk factors to prevent future bank panics and ensure the stability of the financial system.

C. Analysis of the Likelihood and Severity of a Future Bank Panic

The recent events surrounding Credit Suisse and other banks suggest that there is a significant risk of a future bank panic. While it is difficult to predict the exact timing or nature of such an event, it is important for policymakers and financial institutions to be aware of the warning signs and risk factors.

Credit Suisse, in particular, has been facing major losses and multiple scandals over the past decade, including alleged misconduct, sanctions busting, money laundering, and tax evasion. The bank’s problems have been compounded by the recent collapse of California’s Silicon Valley Bank (SVB) and concerns over potential weaknesses across the global banking sector.

Despite post-financial crisis rules and annual stress testing, there are still risks that some banks may not be able to withstand severe economic shocks and market turmoil. In the worst-case scenario, a bank panic could lead to a run on deposits, creating a potentially risky situation for smaller banks that rely heavily on client cash.

Regional banks in the United States have also been experiencing stress, with smaller banks pulling back on loans to preserve liquidity in the face of a potential banking crisis. The rapid unraveling of startup lender SVB has fueled worries of potential bank runs at peers that could leave them scrambling for funds to meet deposit withdrawal requests.

In conclusion, while there is no certainty of a future bank panic, recent events suggest that the risk is significant. Policymakers and financial institutions should be aware of the warning signs and take steps to mitigate the potential impact, including ensuring adequate capital and risk management measures.

Chapter VI. Policy Responses and Reforms to Prevent or Mitigate a Future Bank Panic

A. Overview of potential policy responses and reforms that could prevent or mitigate a future bank panic

There are several potential policy responses and reforms that could prevent or mitigate a future bank panic. One approach is to increase capital requirements for banks, which would require them to hold more funds in reserve to withstand potential losses. Another option is to require banks to hold more liquid assets, which would allow them to quickly meet withdrawal requests from customers. Additionally, regulators could require banks to develop better risk management strategies and contingency plans in the event of a crisis.

Another potential policy response is to improve the transparency and disclosure of information by banks. This would provide investors and customers with more information about a bank’s financial health and make it easier for them to make informed decisions about whether to invest or keep their funds with a particular institution. Finally, policymakers could consider establishing a system of deposit insurance or other forms of government guarantees to protect consumers in the event of a bank failure.

B. Evaluation of the effectiveness of various policy responses and reforms

The effectiveness of different policy responses and reforms will depend on a variety of factors, including the nature and severity of the crisis, the specific vulnerabilities of the banking system, and the political and economic environment. Capital requirements and liquidity ratios have proven effective in increasing the resilience of the banking system in the wake of the 2008 financial crisis. However, they may also lead to reduced lending and increased costs for banks, which could have negative effects on the broader economy.

Transparency and disclosure requirements may help to improve market discipline and reduce the risk of bank failures, but may also be difficult to implement in practice. Deposit insurance can help to protect consumers and prevent bank runs, but may also create moral hazard by encouraging banks to take on more risk.

C. Discussion of the political and economic challenges to implementing effective policy responses and reforms

There are several political and economic challenges to implementing effective policy responses and reforms to prevent or mitigate a future bank panic. One challenge is balancing the need for increased regulation with concerns about reducing lending and stifling economic growth. Additionally, there may be resistance from the banking industry to increased regulation, as well as concerns about the costs and feasibility of implementing certain reforms.

There may also be challenges related to coordination and cooperation among different countries and regulators, particularly in the context of a global financial crisis. Finally, policymakers must be mindful of the potential unintended consequences of policy responses and reforms, including the risk of creating new vulnerabilities or distortions in the financial system.

Chapter VII. Future Projections: The Potential for a Bank Panic in 2023 and Beyond

A. Overview of the current state of the US economy and financial system

The US economy has recovered from the pandemic-induced recession, with GDP growth and job creation showing strong gains in recent quarters. However, inflation has also risen, which has led to concerns about the Federal Reserve’s monetary policy and the potential for a recession in the near future.

The financial system has remained stable overall, with most banks well-capitalized and able to withstand economic shocks. However, there are still concerns about the health of smaller banks and non-bank financial institutions, as well as potential risks from shadow banking activities.

B. Analysis of the likelihood and severity of a future bank panic in 2023 and beyond

While it is impossible to predict the timing or exact nature of a future bank panic, there are several risk factors that could contribute to such an event. These include a sudden economic downturn, a sharp increase in interest rates, or a major disruption in the financial system caused by cyber attacks or other external shocks.

Additionally, there are concerns about the potential for a “run on the banks” if customers lose confidence in the financial system due to economic or political instability. Such a run could lead to a chain reaction of bank failures and widespread panic, as we saw during the 2008 financial crisis.

C. Discussion of potential policy responses and reforms to prepare for and mitigate a future bank panic

To prepare for and mitigate the potential impact of a future bank panic, policymakers and financial institutions should consider a range of policy responses and reforms. These could include:

- Strengthening capital and liquidity requirements for banks and other financial institutions to ensure they have the resources to weather economic shocks.

- Implementing more rigorous stress tests and risk management practices to identify and address potential vulnerabilities in the financial system.

- Enhancing consumer protections and increasing transparency to help build confidence in the financial system and prevent runs on banks.

- Strengthening regulation and oversight of non-bank financial institutions, such as hedge funds and private equity firms, to reduce systemic risks.

- Improving coordination among regulators and policymakers at the national and international levels to address cross-border risks and prevent contagion.

However, implementing these policy responses and reforms will face political and economic challenges, including resistance from industry groups and concerns about the potential impact on economic growth. As such, policymakers will need to balance the need for stronger regulation and oversight with the need to support a dynamic and innovative financial system that can drive economic growth and job creation.

⭐️⭐️⭐️⭐️⭐️ Meals Ready-to-Eat

MREs (Meals Ready-to-Eat) Genuine U.S. Military Surplus Assorted Flavor (4-Pack)

MRE (Meals Ready-to-Eat Box A, Genuine U.S. Military Surplus, Menus 1-12 by Rothco

ReadyWise Emergency Food Supply, Freeze-Dried Survival-Food Disaster Kit, Camping Food, Prepper Supplies, Emergency Supplies, Breakfast, Lunch, Dinner and Drinks Variety Pack, 25-Year Shelf Life, 52 Servings

$69.99

Recommended reading: Hardware Wallet

VIII. Conclusion

A. Summary of the key findings and arguments of the ebook

In summary, this ebook has analyzed the history and causes of bank panics, as well as the potential risks and challenges to the US economy and financial system. We have discussed various policy responses and reforms that can prevent or mitigate the impact of a future bank panic, including strengthening bank regulation, improving crisis management and resolution frameworks, and enhancing transparency and accountability in the financial sector.

B. Discussion of the implications of the ebook’s analysis for the US economy and financial system

The analysis presented in this ebook highlights the importance of ensuring the stability and resilience of the US financial system. While the likelihood and severity of a future bank panic are difficult to predict, the risks and warning signs must be closely monitored and addressed by policymakers and financial institutions. The potential consequences of a bank panic, including a widespread collapse of banks, disruption of financial markets, and damage to the broader economy, underscore the importance of taking proactive measures to prevent or mitigate such an event.

C. Reflection on the lessons learned from historical bank panics and their relevance for the present and future.

The lessons learned from historical bank panics, such as the importance of strong regulation, effective crisis management, and public trust in the financial system, remain relevant for the present and future. However, the specific challenges and risks facing the US financial system today, such as the rise of non-bank financial institutions, the increasing interconnectedness of global financial markets, and the emergence of new financial technologies, require ongoing vigilance and adaptation by policymakers and financial institutions. By remaining alert to potential risks and challenges, and by implementing effective policy responses and reforms, we can work towards ensuring the stability and resilience of the US financial system for years to come.