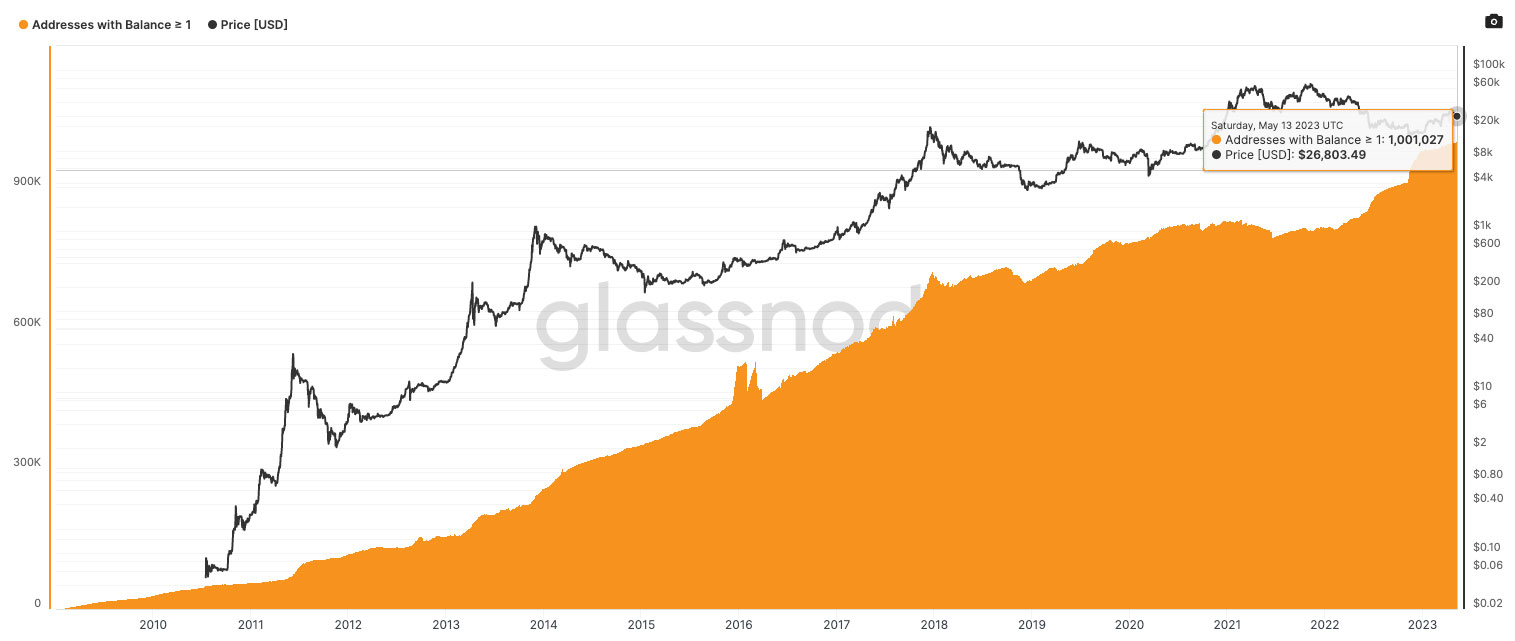

The world of Bitcoin, the flagship cryptocurrency, has witnessed an intriguing phenomenon despite a rather tumultuous market scenario. Despite the Bitcoin price plunging by over 65% in the last year, data shows an upswing in conviction among buyers who have taken the opportunity to acquire it at a discount. In a remarkable turn of events, the count of Bitcoin addresses possessing one Bitcoin or more has exceeded the one million mark.

Bitcoin: More Buyers, More Belief

This “million wholecoiner” landmark was accomplished on May 13, as per the data analytics firm Glassnode. It is worth noting that the most noticeable surges in addresses holding one Bitcoin or more coincided with a drastic market nosedive in June and post-November 11, following the FTX bankruptcy filing.

According to the data, a staggering 190,000 “wholecoiners” joined the Bitcoin bandwagon from February 2022, as Bitcoin prices plummeted from the highs of November 2021. Glassnode’s co-founder, Negentropic, shared with his 54,000 Twitter followers that Bitcoin’s best buy opportunities often appear when there is “blood in the streets.”

"Buy when there is Blood in the streets."

— 𝗡𝗲𝗴𝗲𝗻𝘁𝗿𝗼𝗽𝗶𝗰 (@Negentropic_) May 12, 2023

📉$25.8k still remains a possibility, as indicated by the options market

🔮 Confident in our mid-term outlook of $35k as external pressures subside.

💼 Market pricing Fed pause in June, no rate cut - optimal for the run to $35k for… pic.twitter.com/xBnIyHK5A0

Related Posts

Best Crypto Exchange

The Broader Market Context

Negentropic’s insight came amid a series of major bank collapses in the United States, along with speculation about the Federal Reserve possibly halting interest rate hikes in the coming months. Citing these factors, Glassnode expressed its confidence in Bitcoin, predicting a mid-term price target of $35,000.

However, it’s crucial to note that the milestone of “one million” Bitcoin addresses doesn’t necessarily equate to the same number of individuals. Many Bitcoin investors maintain multiple addresses, while others are owned by large institutions like cryptocurrency exchanges and investment firms, typically holding large Bitcoin amounts.

Best United States Crypto Card

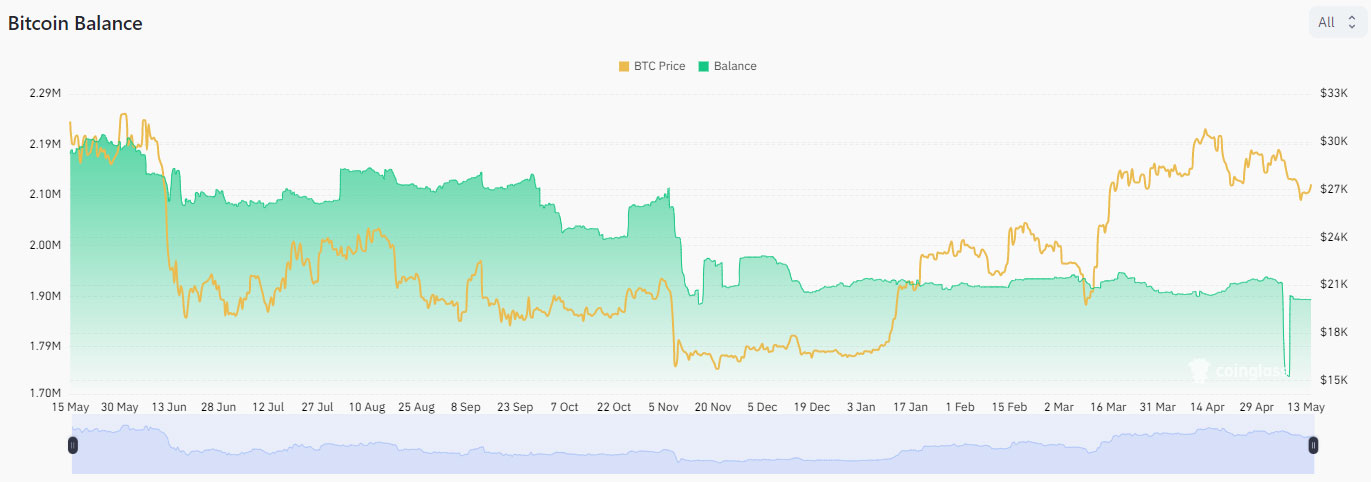

Bitcoin on Exchanges and “Lost” Coins

As per data from crypto analytics provider CoinGlass, out of the approximately 19 million Bitcoin currently circulating, 1.89 million BTC, valued at $50.7 billion, are held by major centralized exchanges such as Binance and Coinbase. In addition, an estimated 3 million BTC, worth about $80.4 billion and representing 17% of the total circulating supply, are considered “lost forever,” as stated by Glassnode. The firm draws these estimates from a range of data sources, including BTC sent to “burn addresses,” wallets with lost keys, and large accounts that haven’t seen any activity for over a decade.

This analysis paints an intriguing picture of the Bitcoin market, highlighting the undeterred faith of the Bitcoin community despite substantial price fluctuations. The growing number of “wholecoiners” serves as a testament to this unwavering belief, setting a new record in the annals of Bitcoin history.

If you are able, we kindly ask for your support of Logll Tech News today. We appreciate it.

Sergio Richi

Editor, Logll Tech News

Conclusion

In conclusion, the rise in Bitcoin addresses holding at least one Bitcoin, despite significant market volatility, illustrates the growing belief in the potential of this pioneering cryptocurrency. While the market has experienced sharp downturns, these times of “blood in the streets” have presented opportunities for conviction-driven buyers, bolstering the ranks of “wholecoiners.”

The “million wholecoiner” milestone is a strong testament to this faith, marking a significant chapter in the evolving narrative of Bitcoin. However, it’s important to interpret this data accurately, given that one address doesn’t always equate to one individual.

Despite the substantial number of Bitcoins held by large exchanges and those considered “lost forever,” the enduring appeal of Bitcoin continues to resonate with its proponents. As the market navigates its challenges, this unwavering belief could potentially lead the way to a more robust and resilient Bitcoin ecosystem.