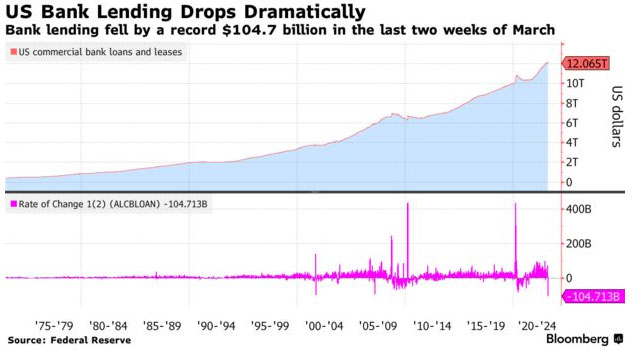

In the final weeks of March, US bank lending experienced a record contraction of nearly $105 billion, according to Federal Reserve data dating back to 1973. This significant tightening of credit conditions is a consequence of several high-profile bank collapses and may pose a threat to the economy. The decline in lending was broad, encompassing real estate, commercial, and industrial loans.

Deposits Also on the Decline, Marking Tenth Consecutive Decrease

Commercial bank deposits decreased by $64.7 billion in the last week of March, marking the tenth consecutive decline, primarily reflecting a drop in large firms. This comes as the recent bank failures have hindered the central bank’s efforts to curb inflation without pushing the economy into a recession.

Bank Failures Raise Market Jitters, Prompting Cautious Lending

The collapse of Silicon Valley Bank and Signature Bank, among others, has led to increased market uncertainty. As a result, banks are expected to adopt a more conservative approach to extending credit. JPMorgan Chase & Co.’s CEO, Jamie Dimon, acknowledged that the banking crisis has increased the likelihood of a recession.

Decrease in Lending Across Bank Sizes and Types

Lending contracted by $23.5 billion at the 25 largest domestically chartered banks and by $73.6 billion at smaller commercial banks over the two-week period. Additionally, lending by foreign institutions in the US fell by $7.5 billion. Although the largest 25 domestic banks account for almost 60% of lending, smaller banks play a critical role in providing credit for commercial real estate.

Key Figures from the Two-Week Contraction

- Commercial and industrial lending fell by $68 billion

- Commercial real estate loans dropped by $35.3 billion

- Total assets, including vault cash, balances due from depository institutions, and the Fed, decreased nearly $220 billion

- Total liabilities declined more than $188 billion

Fed’s H.8 Report: A Crucial Tool for Monitoring Credit Conditions

Economists are paying close attention to the Fed’s H.8 report, which offers an estimated weekly aggregate balance sheet for all commercial banks in the US. This report is crucial for understanding credit conditions, particularly in light of the recent banking crisis. The H.8 release is primarily based on data reported weekly by a sample of domestically chartered banks and foreign-related institutions.

If you are able, we kindly ask for your support of Logll Tech News today. We appreciate it.

Sergio Richi

Editor, Logll Tech News

⭐️⭐️⭐️⭐️⭐️ Piggy Bank and Bill Counter

DETECK Money Counter Machine Mixed Denomination with Reject Pocket, DT800 Bank Grade Multi Currency Bill Counter, Serial Nb, 2CIS/UV/MG Counterfeit Detection, Value Counter, Sort & Print

$1,299.00

Large Piggy Bank for Adults Kids, Vcertcpl Digital Coin Counting Bank with 1.8L Capacity, Great Coin Bank Money Jar for Adults Kids with Saving Goals, Bank for All US Coins (Purple B)

Best Offer Today

Conclusion

In conclusion, the unprecedented contraction in US bank lending in the final weeks of March highlights the growing economic uncertainty following high-profile bank collapses. As credit conditions tighten, banks are expected to adopt a more cautious approach to lending, increasing the risk of an economic downturn. Monitoring the Fed’s H.8 report will be crucial for understanding the evolving credit landscape and the potential impact on the US economy. Policymakers, financial institutions, and businesses must remain vigilant and adapt to these challenging conditions to mitigate the negative effects on economic growth and stability.