Cryptocurrency has become an increasingly popular investment in recent years, with many people seeking to diversify their portfolios and take advantage of potential high returns. However, with so many different cryptocurrencies available, it can be challenging to determine which ones are worth investing in.

Analyzing Patterns and Trends for Potential Investment Points

By analyzing patterns and trends in the data, we can make predictions about where a particular coin may be headed in the future. This can be especially useful for identifying potential entry and exit points for investment.

For each of the potential coins we will be analyzing, including Cosmos, Chia Network, Alchemy Pay, Celo, Conflux, BitDAO, and Chainlink, we will be using both fundamental and technical analysis to gain a complete understanding of their potential for growth.

Providing Charts with Potential Targets and Market Volatility Warning

We will also be providing charts with potential targets for each coin based on our analysis. However, it is important to remember that cryptocurrency markets can be highly volatile, and there is no guarantee that any particular coin will grow as we predict.

As always, it’s essential to do your own research and make informed decisions when it comes to investing in cryptocurrencies. Our analysis should serve as a starting point for your own research and not as financial advice.

Cosmos (ATOM) Blockchain infrastructure

Interchain Foundation: Developing the Cosmos Ecosystem

The Interchain Foundation, a non-profit organization based in Switzerland, is committed to developing, supporting, and managing the Cosmos ecosystem. With a focus on creating an ecosystem of independent but interoperable blockchains that can effectively interact with each other, the foundation has already made significant progress.

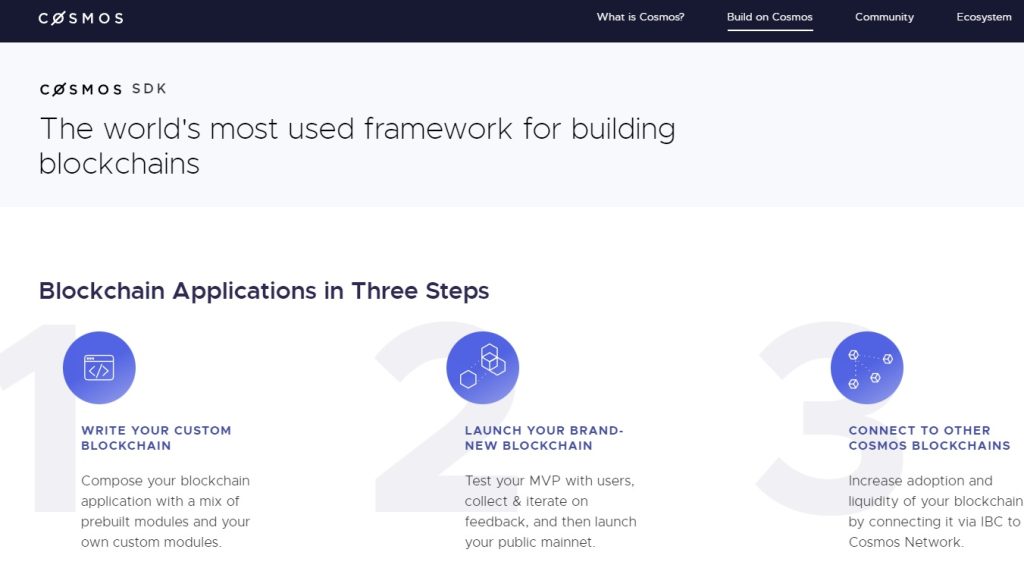

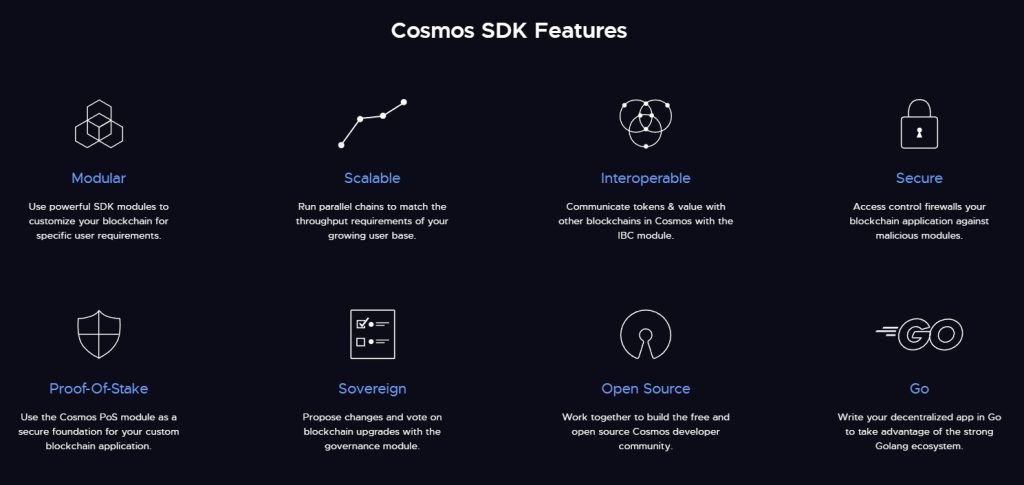

Cosmos SDK: Simplifying Blockchain Creation

The team at Interchain Foundation has developed a unique product called Cosmos SDK, which significantly simplifies the creation and launch of their own blockchains for developers. This set of modules includes everything necessary for staking, voting and management systems, issuing their own cryptocurrency, and more. The best part is that there is no charge for using Cosmos SDK, making it easier for more projects to launch and develop the entire ecosystem.

Inter-Blockchain Communication (IBC) Protocol

Inter-Blockchain Communication (IBC) is a protocol developed by the project team that allows assets and information to move freely and securely between blockchains within the Cosmos ecosystem. This is a significant competitive advantage for Cosmos, as other projects are still trying to replicate it. The native coin of the Cosmos Hub blockchain is ATOM.

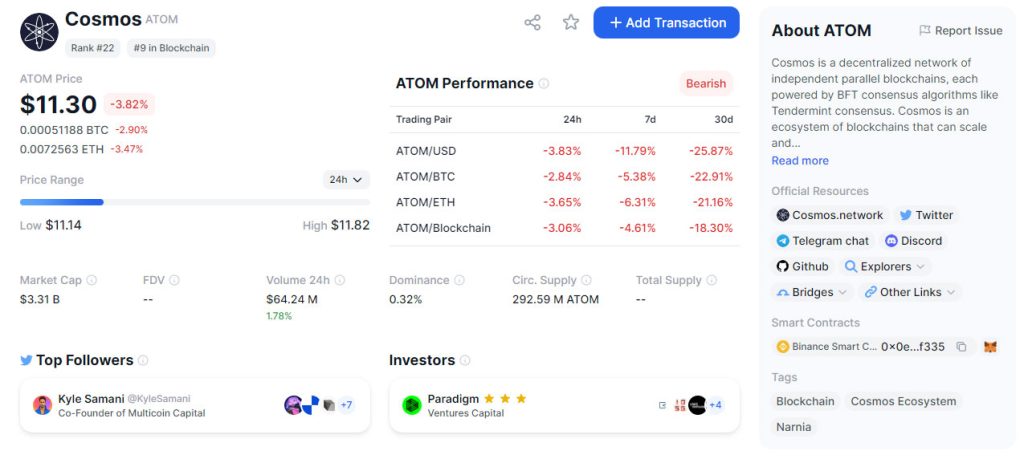

Inflationary Cryptocurrency: ATOM

ATOM is an inflationary cryptocurrency with 292.59 million coins in circulation. The team at Cosmos is preparing an important update – Interchain Security ATOM, which will soon increase the value of the ATOM token by using it for staking not only to protect the native Cosmos Hub blockchain but also other blockchains built on Cosmos.

Investing in the Future of Cosmos

The Interchain Foundation has committed to spending around $40 million in 2023 to develop its basic infrastructure and applications. While this funding is modest compared to other leading blockchains, Cosmos has already built a network of more than 50 networks, including Binance Chain, Oasis Network, Kava, Cronos, and others. With a focus on development, support, and management, the Interchain Foundation is investing in the future of Cosmos.

Launch of Cosmos 2.0

At the Cosmoverse conference held on September 26-28, 2022, the developers announced a document that represents a long-term vision for the further development of the entire Cosmos ecosystem. The plan is to expand the usefulness of the central Cosmos Hub network and improve the project’s tokenomics.

Cosmos is a very ambiguous project. On the one hand, it has a very strong technical component (the IBC protocol, a set of free Cosmos SDK modules), which has made Cosmos one of the leading ecosystems. On the other hand, there is a lack of strong marketing, low involvement of the ATOM coin in the development of the entire ecosystem, and an ill-conceived inflation mechanism.

The development of the Cosmos 2.0 document shows that the team understands the existing problems and is taking the right steps to address them. However, for the changes to be implemented, a vote among ATOM token holders on the launch of Cosmos 2.0 is still required. The first vote took place in November 2022, and the ATOM holder community was divided – the proposal sparked controversy over the updated tokenomics and the desire to implement several complex new tools at once. As a result, the vote failed. However, it is possible that it will be repeated in the near future, after certain adjustments are made to the Cosmos 2.0 evolution program. It is important to keep an eye on how the situation develops.

Potential Positive Scenario

Given the above, we can hope for a positive scenario:

⭐️⭐️⭐️⭐️⭐️ Hardware Wallet

Trezor Model One - Crypto Hardware Wallet - The Most Trusted Cold Storage for Bitcoin, Ethereum, ERC20 and Many More (Black)

$59.00

Ledger Nano S Plus Crypto Hardware Wallet (Matte-Black) - Safeguard Your Crypto, NFTs and Tokens

Chia Network (XCH): Developing Blockchain Infrastructure and Smart Contracts

Chia Network (XCH) is a privately held company led by Bram Cohen, an experienced developer who is also the co-founder and inventor of BitTorrent. The company is focused on developing Layer-1 blockchain infrastructure and smart contracts.

Operating in Two Jurisdictions

Chia Network Inc operates in two jurisdictions, with its parent company in the US and a subsidiary in Switzerland. The company’s goal is to become a publicly reporting company subject to the Securities Exchange Act of 1934, providing full transparency of activity affecting the Chia blockchain. To achieve this, the company collaborates with the US Securities and Exchange Commission (SEC) and the US Commodity Futures Trading Commission (CFTC) in developing its blockchain.

A Unique Approach to Funding

Chia Network did not conduct an initial coin offering (ICO) for XCH coins. Instead, the company raised funding through the sale of preferred shares in the company, a proven Silicon Valley method used by venture capital-backed startups. This collaboration with regulatory bodies gives Chia Network a unique advantage over other projects as more crypto projects come under scrutiny.

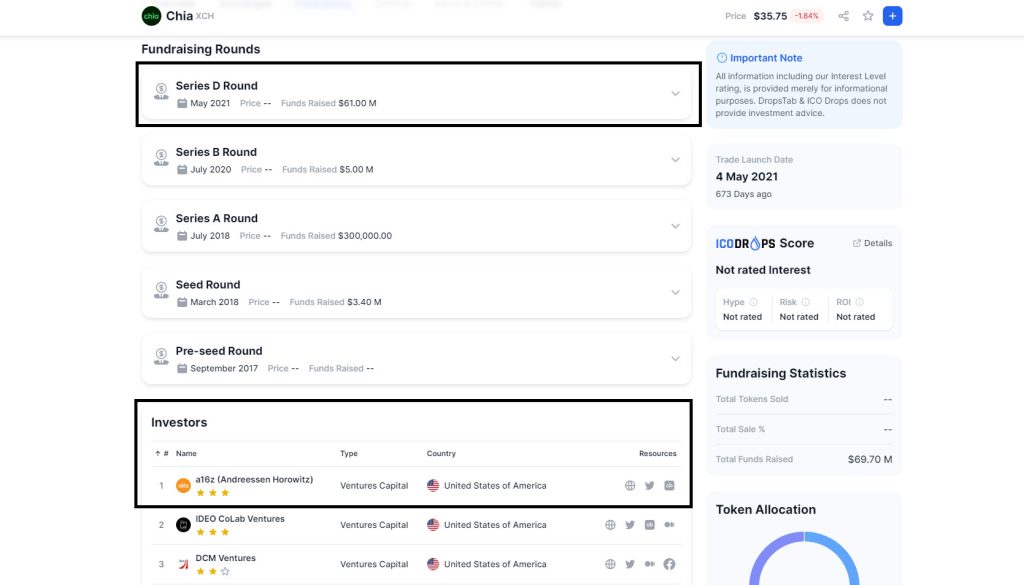

Successful Funding Rounds

Since its inception, Chia Network has raised over $61 million in funding. The most recent round, held in May 2021, was led by Richmond Global Ventures and Andreessen Horowitz.

Low Carbon Footprint Consensus Mechanism

Chia Network’s blockchain uses a unique Proof of Space Time (PoST) consensus mechanism that not only provides the necessary security for the network but also has a low carbon footprint, making it eco-friendly.

Chia: A Decentralized Blockchain with Promising Future

Chia is a highly decentralized public blockchain with over 100,000 nodes spread across more than 200 countries. Its native token, XCH, is utilized for payments, gas fees, and network security. In the spring of 2021, the Chia network was launched, and since then, 6.6 million XCH coins have been mined through farming on hard drives, similar to mining.

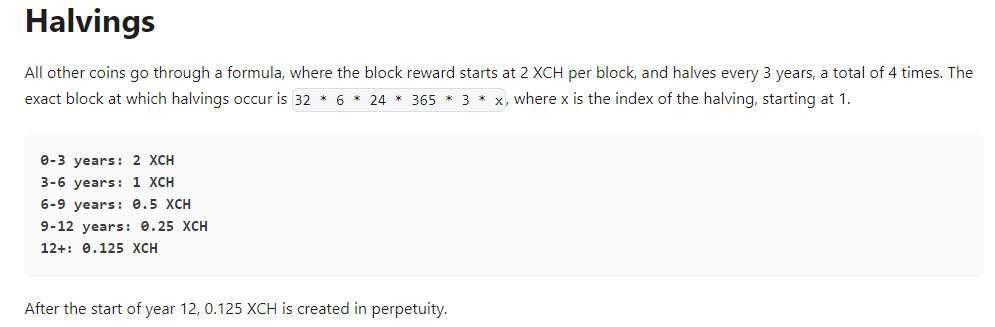

XCH Token and Halving

21 million XCH coins were created by developers and are held in the Strategic Reserve, not used in market circulation. The community will be notified 90 days before the sale of coins from the Strategic Reserve. Employees and contractors of the company cannot receive payments in XCH tokens. The Chia network has halving, which systematically reduces rewards for miners per block.

For the first three years, the network will generate around 3.4 million XCH coins annually, and the following three years will generate half, and so on until it reaches a constant level of 0.125 XCH per block. Unlike BTC, XCH does not have a fixed supply. It will take 21 years of farming for the number of coins on the market to equal the number of tokens in the company’s Strategic Reserve.

The block reward formula for all other coins except XCH follows a specific pattern. It starts at 2 XCH per block and halves every 3 years, a total of 4 times. The exact block at which the halving occurs is determined by the formula 32 * 6 * 24 * 365 * 3 * x, where x represents the halving index starting at 1.

The block reward for different time periods is as follows:

- First 3 years: 2 XCH

- Next 3 years: 1 XCH

- Next 3 years: 0.5 XCH

- Next 3 years: 0.25 XCH

- After 12 years: 0.125 XCH in perpetuity.

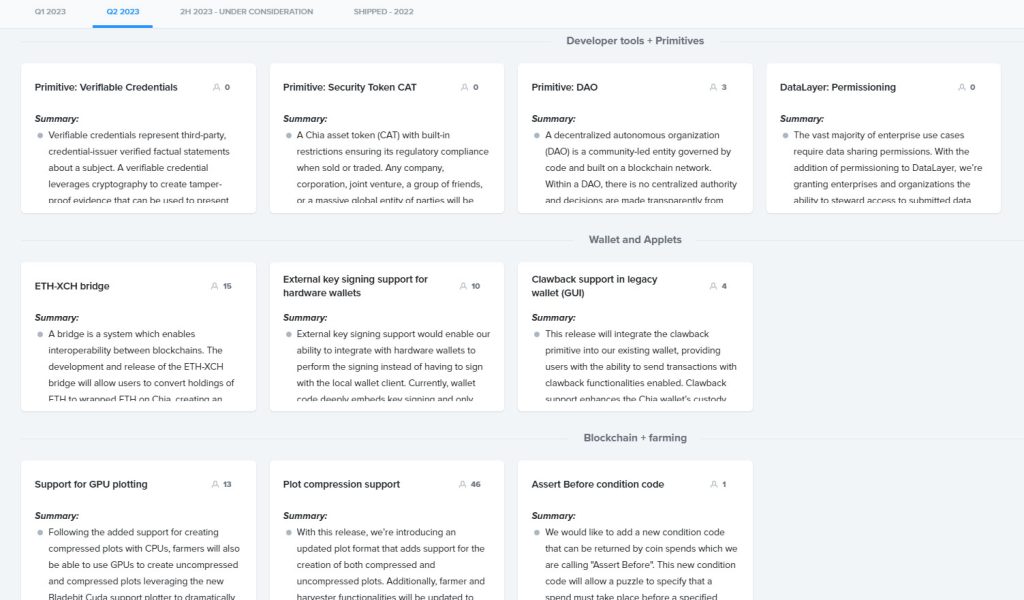

Chia’s Roadmap and IPO Plans

Recently, the team presented a roadmap for 2023, prioritizing the development of the first ETH-XCH bridge, Ledger support, DAO launch, and various technical updates. Regarding the company’s plans to go public through an IPO, there is no exact information on when this will happen. The project, however, looks very promising, with a leader who has experience in creating one of the most widely used protocols on the Internet (BitTorrent). The company initially collaborates with regulatory agencies to comply with all regulatory requirements and has plans to go public through an IPO.

XCH Coin Price and Future Prospects

When the Chia network was launched in the spring of 2021, anyone could farm XCH, and coins were initially very scarce, with their price exceeding $1,600 per coin. However, their infrastructure was still under development, and coins were dumped on exchanges, resulting in bearish pressure throughout 2022.

Despite the challenges, the Chia Network ecosystem is still forming, and the project is in the early stages of development. Nonetheless, it has good chances of success in the future, and the project’s initial high price suggests that it has very good chances of returning to that level.

Alchemy Pay (ACH) Payments

Revolutionizing Payment Solutions: Alchemy Pay

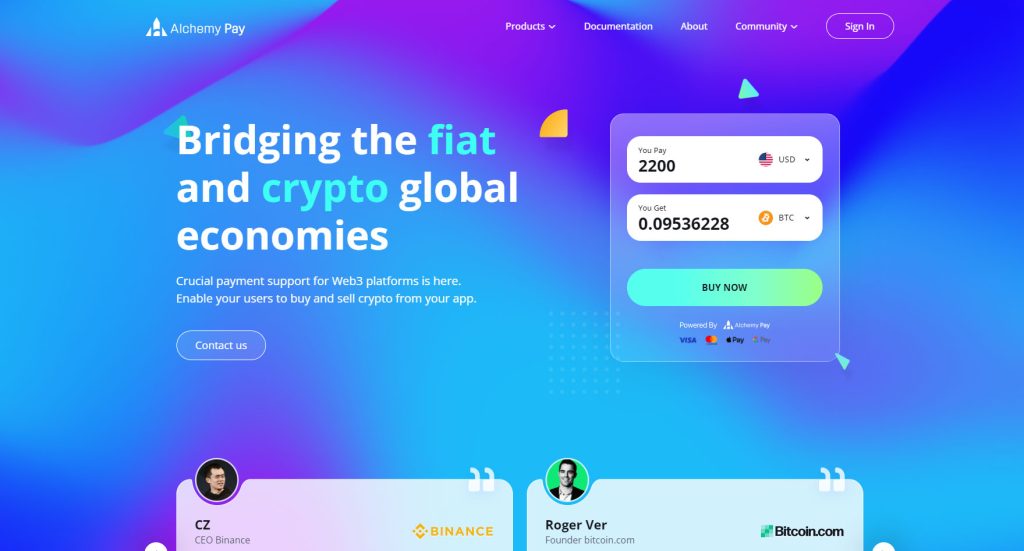

Are you tired of limited payment options for your cryptocurrency transactions? Alchemy Pay, a Singaporean payment solutions provider, has the solution you need. Founded in 2018, Alchemy Pay connects cryptocurrency and global fiat currencies through its payment gateway, enabling merchants to accept cryptocurrency payments.

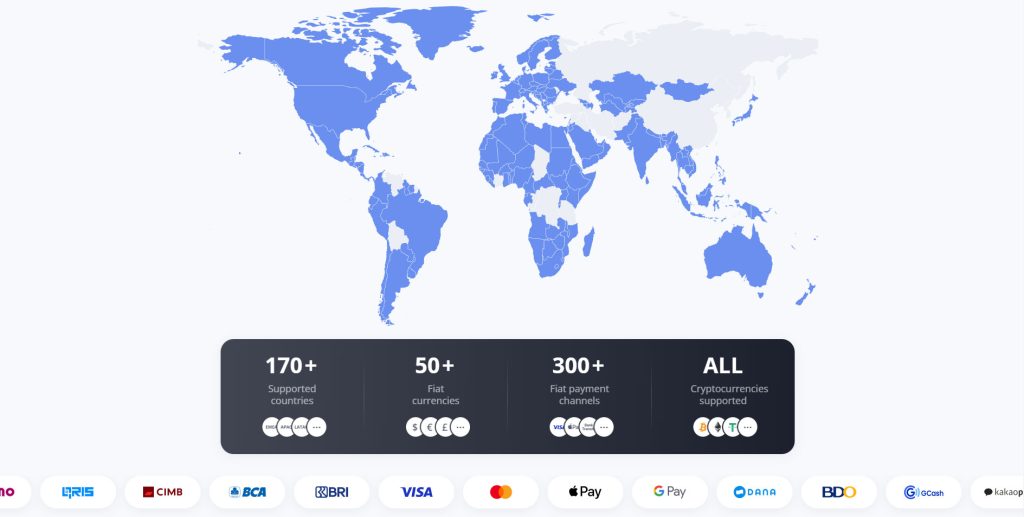

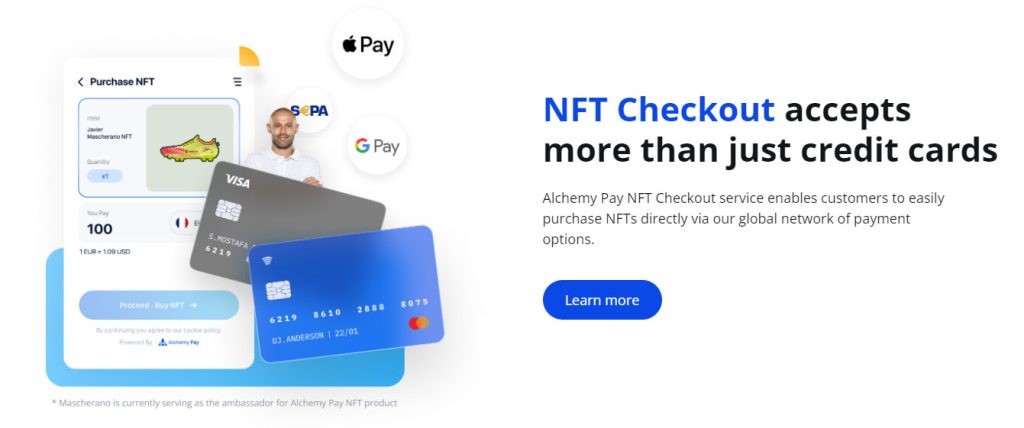

Alchemy Pay collaborates with various enterprises such as trading enterprises, e-commerce platforms, blockchain teams, acquirers, cryptocurrency exchanges, and global money transfer companies to ensure seamless payment solutions for its users. With its extensive network, Alchemy Pay supports payments in 173 countries using various payment methods, including Visa, Mastercard, Apple Pay, Google Pay, regional mobile wallets, and domestic bank transfers, with a focus on developing markets.

Merchants using Binance Pay, Solana Pay, and Crypto.com Pay can also benefit from Alchemy Pay’s payment solutions, along with e-commerce merchants in over 70 countries. At the Leaders in Fintech Awards 2022 ceremony, Alchemy Pay was recognized as the best cryptocurrency payment gateway for entrepreneurs, a testament to the company’s commitment to delivering exceptional payment solutions.

In 2022, Alchemy Pay had 30 new token listings for ACH on exchanges, expanding its reach to more users. The number of ACH holder addresses increased by 150% in 2022, with 19,000 holders on the Ethereum network and 18,000 holders on the BNB Smart Chain.

With Alchemy Pay’s innovative payment solutions, the future of cryptocurrency payments is bright. Experience the convenience and efficiency of Alchemy Pay today!

Alchemy Pay: Strong Start in 2023

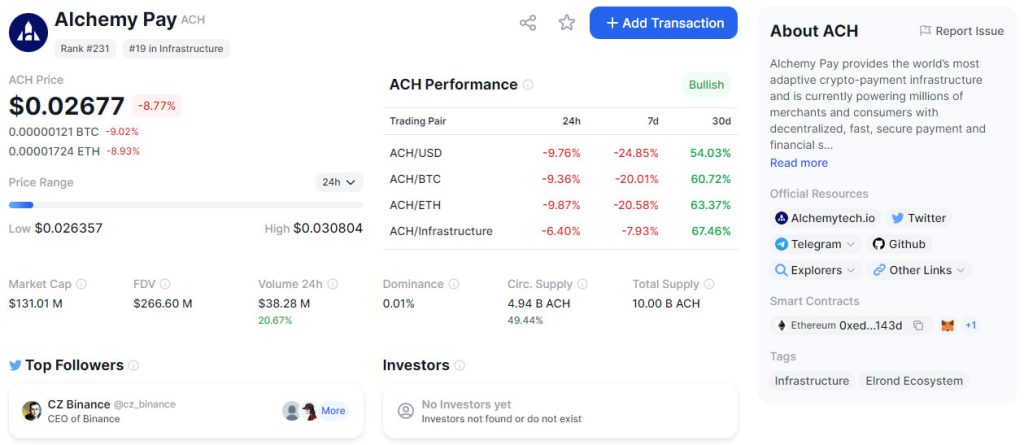

The year 2023 has been a strong start for Alchemy Pay, a payment gateway that bridges the gap between cryptocurrencies and fiat currencies. In February, the platform added support for Google Pay, making it easier for users to transact using cryptocurrencies. Moreover, Alchemy Pay, in collaboration with PT Berkah Digital Pembayaran, has secured a license from the Central Bank of Indonesia to conduct transfers in both fiat and cryptocurrencies. This move is significant as Indonesia is one of Asia’s leading economies and has a high adoption rate of cryptocurrencies. ACH is the ERC-20 and BEP-20 token issued on Ethereum and Binance Chain.

The ACH token has a fixed supply of 10 billion, with 4.94 billion ACH currently in circulation. Alchemy Pay uses ACH tokens as rewards for clients who use their solutions in their businesses, pay transaction fees, and as collateral deposited by business partners when connecting to Alchemy Pay’s products.

Token Distribution

The distribution of ACH tokens is as follows:

- 51% of ACH tokens go towards incentivizing participants who conduct their business using Alchemy Pay’s ecosystem

- 18% of ACH tokens belong to the project team

- 18% of tokens were received by investors

- 6% is allocated for mobile transactions

- 5% is allocated for corporate partners

- 2% is allocated for consultants

Alchemy Pay’s 2023 Development Strategy

Alchemy Pay’s strategy for 2023 is to optimize and update its products, expand payment channels, and add new partners. The project will continue to actively pursue new licenses to expand its operations geographically.

The project’s leadership is also exploring funding options to scale the business. As a leading gateway between crypto and fiat currencies with a strong foothold in the Asian region, Alchemy Pay has embedded the ACH token into its business processes for paying commissions, rewarding partners, and more. As Alchemy Pay expands its payment network, there should be an increase in demand for ACH. However, the value of the ACH token will ultimately depend on the project team’s actions in actively supporting it and embedding it into their products and services.

In conclusion, Alchemy Pay is an exciting project with inherent risks. Its technical infrastructure looks promising, but the token’s value will rely heavily on the team’s continued support and incorporation of ACH into its ecosystem.

Celo (CELO) Blockchain infrastructure

Smart Contracts

The Celo Foundation and cLabs are revolutionizing the decentralized finance (DeFi) space with their platform. With its unique niches, including Regenerative Finance and mobile focus, Celo is attracting a wide range of investors, supporting growth and development on its platform. By introducing tokenized carbon credits and stablecoins optimized for mobile phones, Celo is leading the way in sustainable and accessible financial solutions.

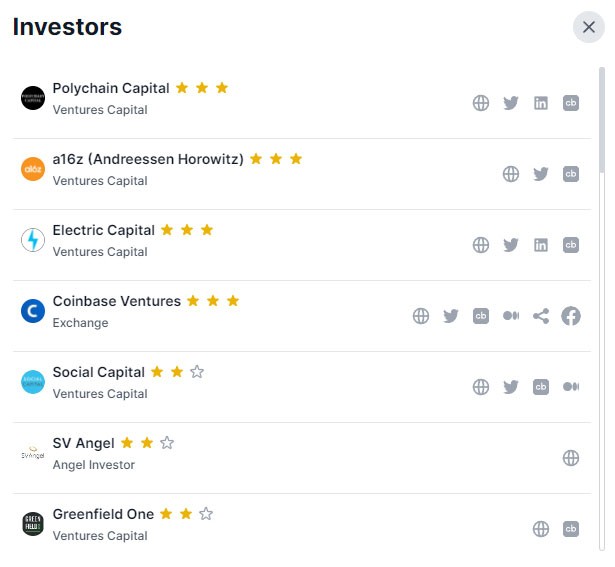

Celo’s development has been supported by a total of seven funding rounds, resulting in a raised amount of $66.5 million. Among the investors that have contributed to this funding are renowned names such as Andreessen Horowitz (a16z), Coinbase Ventures, Polychain Capital, Electric Capital, SV Angel, and other prominent players in the industry.

Mobile

Celo’s focus on mobile devices is a game-changer in the world of blockchain technology, introducing millions of smartphone owners to DeFi through their phone numbers. As the platform continues to grow, it’s no surprise that Celo’s key growth metrics for 2022 are impressive, with over 1000 projects, 339 active developers per month, 1.3 million Celo asset holders, and 13.5 million transactions per month. With over $77 million in funding raised by ecosystem projects in Q3 2022, Celo is poised to connect the dots between financial accessibility and sustainability.

Celo Forms Partnerships and Offers Educational Program

Celo has formed partnerships with several companies, including Ethereum Climate Platform by ConsenSys, IDEO, Brave, Flow Carbon, and Toucan Protocol in 2022. The partnership with Deutsche Telekom began in April 2021, with the company joining the Celo ecosystem through a strategic purchase of the native CELO token. Deutsche Telekom’s subsidiary T-Systems MMS also became a validator group manager in the Celo network.

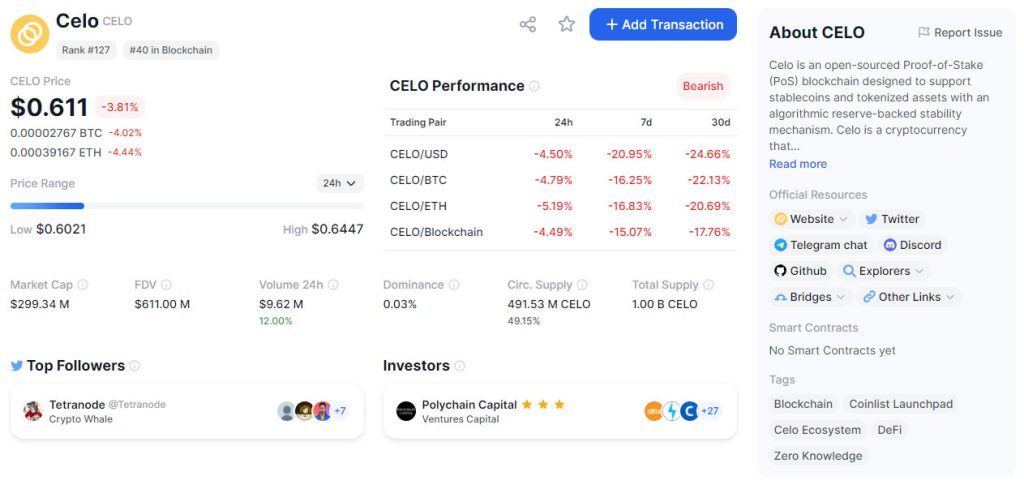

Celo Camp and Native Coin

Celo offers an 8-week educational program, and registration for the 7th stage of Celo Camp is ongoing. Startups can receive a grant to create their product on the Celo platform through this program. The native coin of the Celo blockchain is CELO, with a fixed supply of 1 billion coins. Currently, 491.5 million CELO is in circulation.

Future Plans for Celo

The project’s leadership presented “The Next Chapter: Introducing Celo 2.0” on January 26, 2023. Celo aims to become the best platform for launching and scaling any Web3 project that contributes to a regenerative economy. The focus will be on deep alignment with the Ethereum roadmap, horizontal scalability, and improving CELO tokenomics.

Celo’s Strengths and Weaknesses

Celo’s team, emphasis on convenient mobile payments, focus on a regenerative economy, and partnership with Deutsche Telekom deserve attention. However, the trust in Celo was slightly affected by the incident in July 2022 when the network stopped working due to a failure, and validators restarted the blockchain after client update. Overall, the Celo project is worth attention, and its development should be monitored. A 10-fold increase in the coin seems technically feasible, potentially reaching $11.

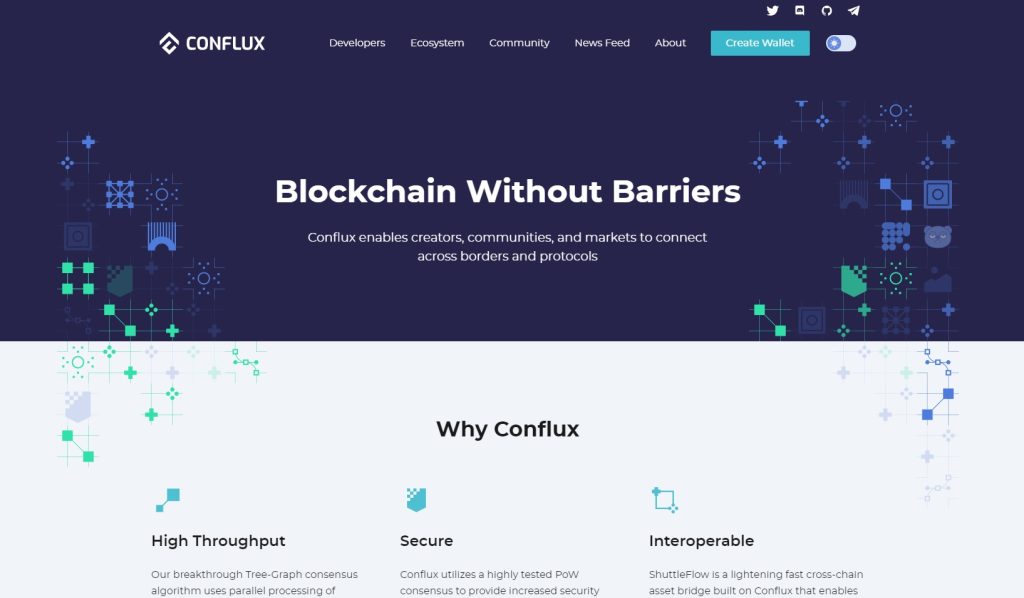

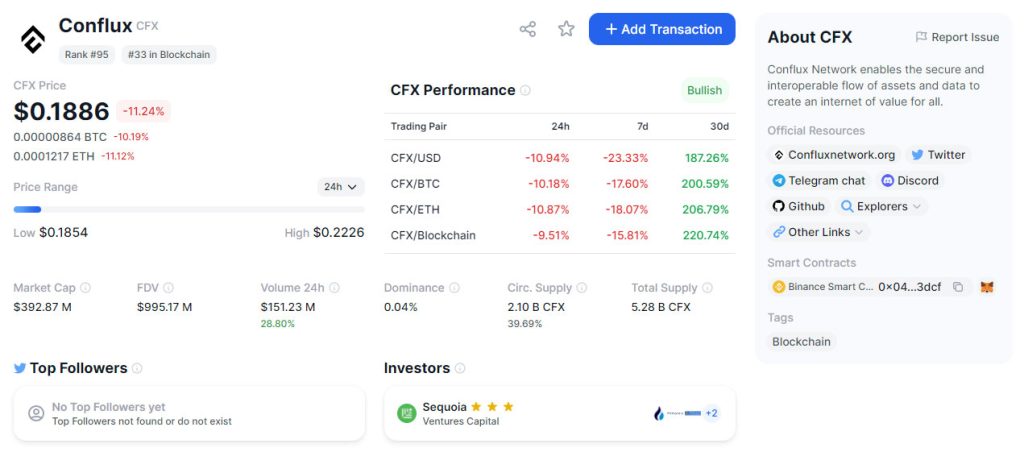

Conflux (CFX) Blockchain infrastructure

The Conflux Network: A High-Performance Blockchain

The Conflux Network is a high-performance Layer-1 blockchain that was founded in the research lab of Turing Award laureate Dr. Andrew Yao at Tsinghua University. Although headquartered in Beijing, China, the project has representations in Toronto, Canada, and Lagos, Nigeria.

Promoting Blockchain Education and Research

The Conflux Foundation aims to promote blockchain education and research through the Tree-Graph Research Institute, which collaborates with the Shanghai government, and the Key Laboratory of Blockchain Infrastructure and Applications, which collaborates with the Hunan province government.

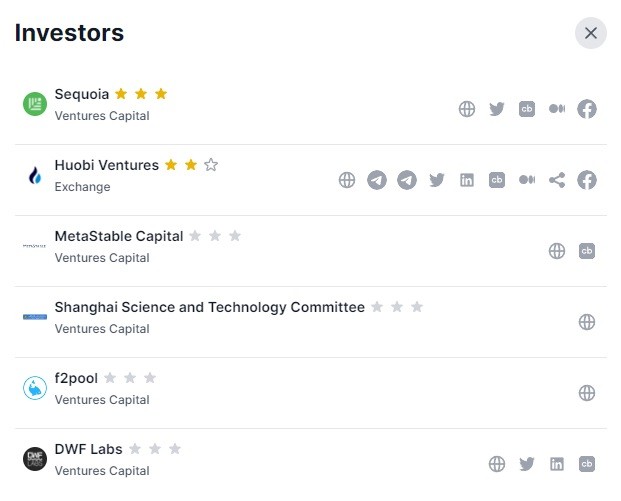

Funding and Recognition

The first funding round raised $35 million in venture investments from companies such as Sequoia Capital, Baidu Ventures, Huobi, Shunwei Capital, among others. An additional private investor token sale brought in $5 million. Conflux is the only public blockchain in China that complies with regulatory requirements. It was named one of the “100 Leading Emerging Giants in the Asia-Pacific Region” in a report published by KPMG and HSBC. Conflux was also one of five crypto projects to make the list of the top 100 startups.

Important Partnerships

The rapid rise in CFX price in early 2023 is due to several important partnerships:

- Little Red Book (XiaohongShu), the Chinese version of Instagram with over 200 million monthly active users, integrated Conflux Network support for working with NFTs into its application.

- Conflux Network has entered into a partnership with China Telecom (390 million users) to develop and pilot the blockchain-enabled SIM card (BSIM) service in Hong Kong. BSIM will provide a secure place to store digital private keys and support NFT transmission and exchange. The first BSIM pilot program is scheduled to launch in Hong Kong by the end of 2023.

- Conflux Network has begun working with Alchemy Pay, a payment gateway that helps users purchase cryptocurrency with fiat money (accepts Visa and MasterCard payments in 173 countries).

These partnerships have helped the Conflux Network gain traction in the industry and pave the way for further adoption of blockchain technology.

Conflux Network Secures $10 Million Investment from DWF Labs

Exciting news for Conflux Network, as they have just received a massive investment of $10 million from DWF Labs, a renowned digital asset market maker and investment company. With this funding, Conflux aims to expand its technology and grow its user base. But how will this investment help them achieve these goals?

A Closer Look at CFX Token

At the heart of the Conflux Network lies its native coin, CFX. During the mainnet launch, 5 billion CFX were created, with a distribution of 40% for the Ecosystem Fund, 36% for the Genesis Team, 12% for Private Equity Investors, 8% for the Community Fund, and 4% for Foundation Holdings.

Mining is the primary way to earn CFX, with new coins issued daily through the PoW algorithm. However, the reward per block has been decreasing since the network launch, currently standing at 1 CFX as of February 23, 2023. With a block formation time of 0.5 seconds, the daily emission is approximately 172.8k CFX, with the base of inflation being the unlocked coins issued during the mainnet launch. While there is no maximum limit on the issuance, regular public discussions take place every two months to consider the reduction, increase, or maintenance of the reward for miners.

What’s Next for Conflux Network?

While Conflux Network’s progress has been impressive so far, their 2023 roadmap remains a mystery. The team used to publish monthly reports on their blog, which allowed users to track their development closely, but the last report was released in September 2022. What could they be planning behind closed doors? Only time will tell.

Final Verdict

Will Conflux Network soar or stumble with this significant investment? Only time will tell if this project will prove to be a brilliant success or a commercial failure. But with the backing of a reputable investor like DWF Labs, it’s safe to say that the future looks bright for Conflux Network.

Conflux Development: Lack of Transparency and Uncertainty

The Conflux network’s launch resulted in the creation of coins that are currently being distributed to an unknown group of individuals, as the project team stopped publishing monthly development reports on Conflux. There are no results for the year 2022, making it difficult to assess the previous year’s roadmap. The 2023 roadmap is also yet to be announced, which has led to uncertainty regarding the project’s future.

Despite these issues, Conflux is the only blockchain in China that meets regulatory requirements, providing unique opportunities for both local and international companies operating in the Chinese market. Min Wu, the Technical Director of Conflux, states that the Chinese internet industry is making an effort to transition to Web3, with Conflux playing a vital role in spreading the technology.

Conflux’s high technological level is further emphasized by the involvement of leading Chinese universities in its development, as well as a joint project with China Telecom to develop BSIM.

The project’s positive outlook is reinforced by its inclusion in KPMG and HSBC’s “100 Leading Emerging Giants in the Asia-Pacific Region” list.

How to Withdraw CFX to Your Personal Wallet

If you are storing your coins on an exchange (which is highly discouraged), there are no issues. However, if you want to withdraw CFX to your personal wallet, you need to know the following:

- Binance supports the input/output of bCFX (a token on the BNB Smart Chain network).

- KuCoin supports the additional Conflux network – eSpace (a compatible EVM network). In this option, you can use the MetaMask wallet.

- OKX supports the native Conflux network. In this option, you can use the Fluent wallet from the developers.

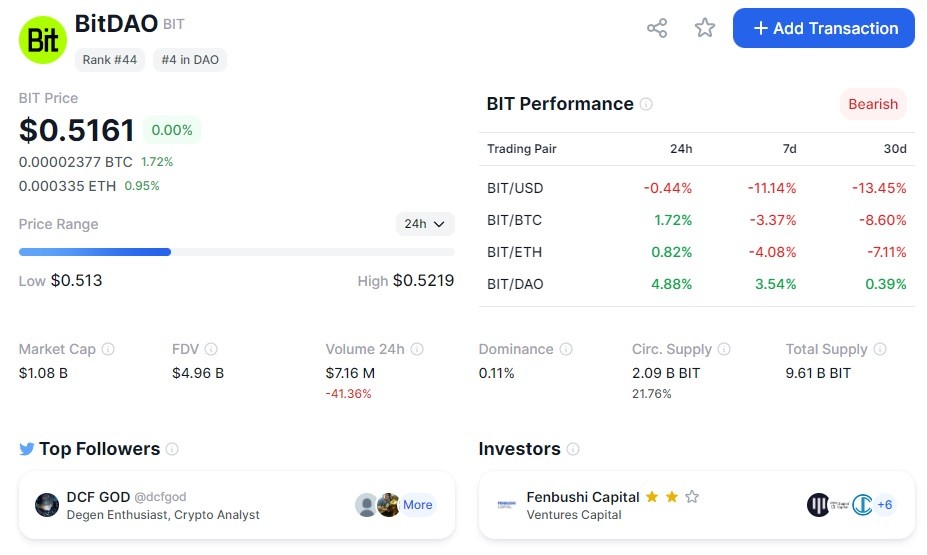

BitDAO: World’s Largest Decentralized Autonomous Organization

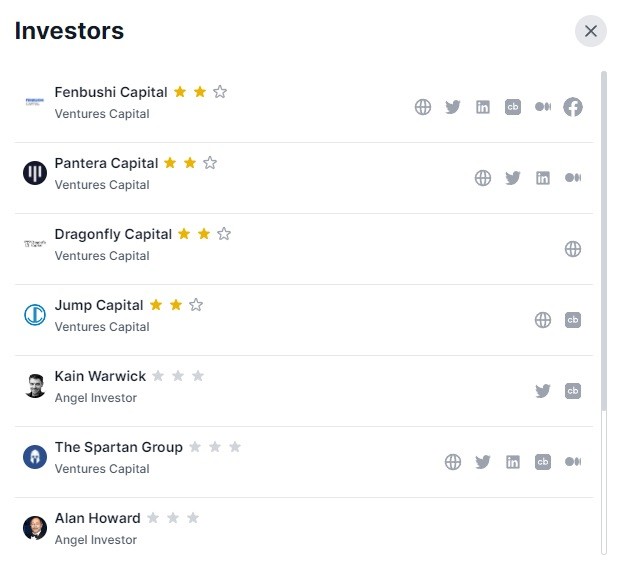

BitDAO is the world’s largest decentralized autonomous organization (DAO) focused on a wide range of projects, including DeFi, DAO, NFT, and gaming. The project began in June 2021 with initial investments of $230 million from investors such as Founders Fund, Pantera Capital, Dragonfly Capital, and Peter Thiel.

BitDAO launched its governance token in August 2022, raising 112,000 ETH (~$356 million at the time) in an auction. In total, 180 million BIT were sold for Ethereum, with an additional 20 million tokens sold for the native SushiSwap token (SUSHI).

The project is supported by a group of members who hold BIT tokens. BitDAO aims to collaborate with crypto projects through token exchange and joint development. Token exchange is expected to allow the BitDAO fund to accumulate a collection of tokens from the best crypto projects.

Bybit Exchange is one of the first BitDAO partners. The exchange has pledged to contribute 2.5% of its net profit from futures on its platform to the BitDAO Protocol Treasury.

As of March 2023, the BitDAO Treasury has the following structure:

- 69.5% is 3.33 billion BIT (~$1.7685 billion);

- 16.6% is 270,000 ETH (~$422.8 million);

- 9.3% is 235.7 million USDC;

- 2.9% is 73.9 million USDT;

- 1.7% other assets (~$42 million).

BitDAO Community Votes to Buy Back Tokens BIT

The BitDAO community members have voted to allocate $100 million USDT from the treasury to buy back tokens BIT from the market. The buyback program ran from January 1 to February 19, 2023, with purchases made through TWAP (buying BIT at about $695 every 30 seconds) bot on the Bybit exchange. BIT is a token issued on the Ethereum network with a fixed supply of 10 billion tokens. Tokens are released into circulation monthly according to a schedule, and the last BIT tokens are expected to be unlocked in May 2024. Some of the BIT tokens are burned, with 659.28 million tokens burned as of today.

BitDAO Launches Mantle Network and Considers Creating a $200M Fund for Web3 Startups

BitDAO has decided to launch Mantle, a high-performance Ethereum layer 2 network (similar to Optimism and Arbitrum) that provides low fees and high security in 2023. Mantle will operate on the BIT token, meaning that all transactions on the network will require BIT tokens to pay for fees. The test network has already been launched, and BitDAO is currently considering creating a $200 million fund for Web3 startups that will be built on the Mantle network ($100 million from the BitDAO treasury and $100 million from external investors).

Essentially, BitDAO aims to become an investment tool for other decentralized products and services, with their success contributing to the further development of the BitDAO machine for growth. Recently, the project completed a buyback program of its own tokens on the market for $100 million USDT, which was allocated from the BitDAO treasury.

Expectations for BIT Value Increase with Launch of Mantle Network

With the launch of the Mantle network, the value of BIT should increase as this token will be required to pay for transaction fees. Overall, the project looks promising, and it is necessary to monitor its further development.

BitDao (BIT) Governance Token

Introducing BitDAO: The World’s Largest Decentralized Autonomous Organization

BitDAO is a decentralized autonomous organization (DAO) with a mission to support various crypto projects, including DeFi, DAO, NFTs, and gaming. It started in June 2021 with an initial investment of $230 million from renowned investors such as Founders Fund, Pantera Capital, Dragonfly Capital, and Peter Thiel.

The Launch of BitDAO’s Governance Token

In August 2022, BitDAO launched its governance token, which raised 112,000 ETH, equivalent to around $356 million at that time, through an auction. A total of 180 million BIT tokens were sold for Ethereum, and an additional 20 million tokens were sold for the native token of SushiSwap (SUSHI). The project is supported by a group of participants who own BIT tokens.

Collaboration with Other Crypto Projects

BitDAO aims to partner with other crypto projects through token exchange and joint development, with the exchange of tokens allowing BitDAO to accumulate a collection of the best crypto projects’ tokens. Bybit exchange is one of BitDAO’s first partners, pledging to donate 2.5% of the net profit from futures on its platform to the BitDAO protocol treasury.

Structure of the BitDAO Treasury

As of March 2023, the BitDAO treasury has the following structure: 69.5% is 3.33 billion BIT ($1.7685 billion), 16.6% is 270,000 ETH ($422.8 million), 9.3% is 235.7 million USDC, 2.9% is 73.9 million USDT, and 1.7% is other assets (~$42 million).

BIT Token Buyback Program

BitDAO community members voted to allocate 100 million USDT from the treasury to buy back BIT tokens from the market. The buyback program ran from January 1 to February 19, 2023, with the purchase made through TWAP deals (buying BIT tokens worth around $695 every 30 seconds) using a bot on the Bybit exchange.

BIT Token Burn and Mantle Network Launch

BIT is an Ethereum network token with a fixed supply of 10 billion tokens, with tokens released monthly according to a schedule. Some BIT tokens are burned, with 659.28 million tokens burned to date. BitDAO has decided to launch Mantle in 2023, a high-performance Ethereum layer 2 network (similar to Optimism and Arbitrum) that provides low fees and high security. Mantle will operate on the BIT token, meaning all network transactions will require BIT tokens for fee payment. The test network is already launched, and BitDAO is considering creating a $200 million fund for Web3 startups to be built on the Mantle network ($100 million from the BitDAO treasury and $100 million from third-party investors).

BitDAO’s Vision

In essence, BitDAO aims to become an investment tool for other decentralized products and services, with their success contributing to BitDAO’s growth and development.

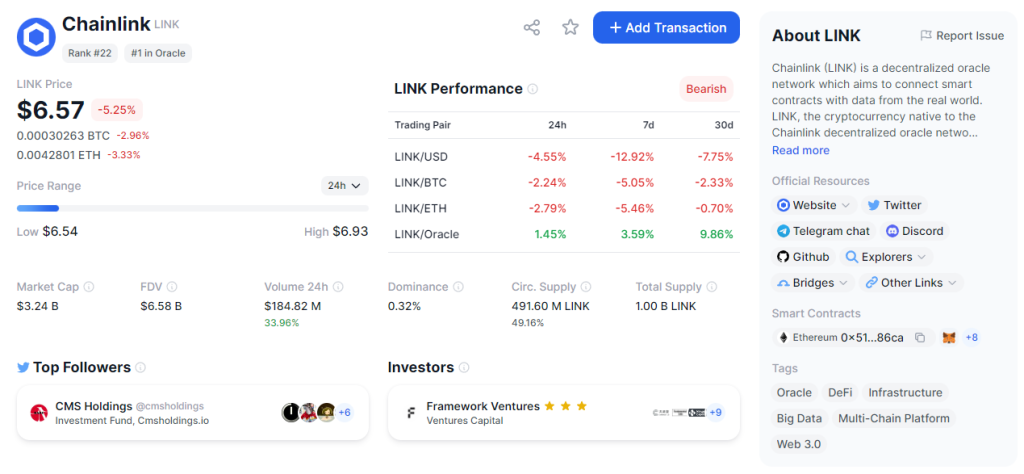

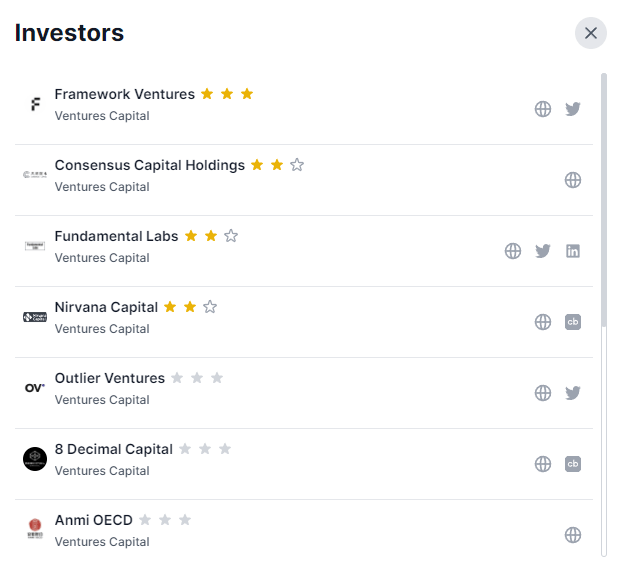

Chainlink (LINK)

The Critical Problem Chainlink Solves in Blockchain

Blockchain systems are designed to be isolated, which poses a critical problem for smart contracts. To work safely and unlock their full potential, smart contracts require real-world data such as currency exchange rates, asset values, and statistics. However, they need a reliable intermediary to transmit this information from the “regular internet” to the blockchain. This is where oracles come in, and Chainlink is a leader in this field.

As the first decentralized oracle developed in 2017, the Chainlink network (LINK) now secures tens of billions of dollars in decentralized finance (DeFi), insurance, gaming, and other major sectors of the crypto sphere. Operating in 12 blockchains, including Ethereum, Arbitrum, Optimism, Polygon, Avalanche, and BNB Chain, Chainlink’s influence is vast and growing.

Chainlink’s Collaboration with Major Organizations and Its Role in Web3 Infrastructure

Today, major organizations such as AccuWeather, FedEx, FlightStats, and Associated Press collaborate with Chainlink to verify data. Impressively, around 7 trillion US dollars (not a typo – that’s trillion) in transaction value equivalence (TVE) are allowed. TVE is the total dollar value of all transactions permitted by the protocol. This metric gives a good idea of Chainlink’s role as a key Web3 infrastructure.

In conclusion, Chainlink solves the critical problem of securely transmitting real-world data to smart contracts, enabling them to operate effectively and unlock the full potential of blockchain technology. As a leader in this field, Chainlink plays a key role in the advancement of the blockchain ecosystem.

Unveiling the Minds Behind Chainlink Labs

Chainlink Labs is a research organization with a mission to accelerate innovation and adoption of smart contracts. They provide developers with the ability to create multifunctional decentralized applications and offer global enterprises a universal gateway for all blockchains. But who are the researchers behind this innovative project?

The Research Team

The research team at Chainlink Labs is composed of a group of experts in computer science and blockchain technology. They include:

- Lorenz Breidenbach, Head of Research and Development at Chainlink Labs. He is a security researcher and former scientific staff member of BRIDGE at ETH Zurich and IC3.

- Ari Juels, Chief Scientist at Chainlink Labs. He is a professor and computer science teacher at Cornell University.

- Dalia Malki, Chief Scientist at Chainlink Labs. She was the Technical Director of the Diem Association, a leading researcher at Novi, a co-founder of VMware Research, a principal researcher at Microsoft Research, and a professor at the Hebrew University in Jerusalem.

- Doctor Bone, a computer science professor at Stanford University.

- Christian Cachin, a computer science professor at the University of Bern who worked at IBM Research for over 20 years.

- Farinaz Koushanfar, a Henry Booker Fellow and professor of electrical and computer engineering at the University of California, San Diego.

- Michael Reiter, James B. Duke Professor of Computer Science, Electrical and Computer Engineering at Duke University.

These experts in computer science and blockchain technology make up the research team that is driving innovation and development at Chainlink Labs. Their collective knowledge and experience are crucial in advancing the capabilities of smart contracts and pushing the boundaries of what is possible with blockchain technology. With this team leading the way, the future of blockchain technology looks brighter than ever before.

Chainlink Labs: Revolutionizing Smart Contract Development

Chainlink Labs is a pioneering research organization that focuses on the development and adoption of smart contracts. With a team of experts in computer science and blockchain technology, Chainlink Labs is committed to advancing the capabilities of smart contracts and pushing the boundaries of what is possible with blockchain technology.

Recent Developments

Chainlink Labs has made significant strides in advancing the capabilities of their oracle network. Recently, Eric Schmidt, former CEO of Google, joined Chainlink Labs as an advisor. Schmidt’s strategic insights will be invaluable in shaping the future growth of Chainlink Labs.

In addition, Kemal El Moujahid, a leader in artificial intelligence, has joined Chainlink Labs to oversee product management for their oracle network. This move will help make their oracle network faster and more reliable.

Upcoming Events and Forecasts

Chainlink Labs has announced that their oracles will be integrated into Coinbase’s Base network, a Layer-2 network built on top of Ethereum. The Base Ecosystem Fund will invest in and support early-stage projects based on Base, providing significant opportunities for growth.

Chainlink Labs is also driving the development of the DeFi derivatives market with their innovative solution – low-latency query-based price oracles. With the global derivatives market exceeding $1 quadrillion, the potential for growth in the DeFi space is enormous. Chainlink Labs’ solution is set to revolutionize the industry and add value to Web3.

In conclusion, by breaking down the fundamental and technical aspects of potential cryptocurrencies, we can gain a better understanding of their potential for growth and make more informed investment decisions. Our analysis of Cosmos, Chia Network, Alchemy Pay, Celo, Conflux, BitDAO, and Chainlink will provide a starting point for your own research, but it is essential to always do your own due diligence and make informed investment decisions.

Support Logll Tech News

Logll Tech News is dedicated to providing reliable and up-to-date information on the latest technology trends and developments. Our team of journalists works hard to ensure that our readers have access to quality content that helps them make informed decisions.

If you found our articles helpful and would like to support our efforts, please consider making a donation. Your contribution will go a long way in helping us continue to produce high-quality journalism that informs and educates our readers.

Thank you for your support!