In the ever-evolving digital world, virtual payment cards have become a necessity for online shopping and advertising. PSTNET is a leading provider of virtual cards in both dollars and euros, catering to the needs of businesses and individuals alike.

First of all, Virtual Credit Cards (VCC) from PSTNET is the best option to pay for media buying and affiliate marketing campaigns, allowing businesses to advertise on popular advertising platforms like Facebook Ads and Google Ads. With PST.NET‘s virtual payment cards, businesses can easily manage their advertising budgets and track their spending in real-time. Plus, PSTNET has more then 25 exclusive BINs (Bank Identification Number) to protect the users from various payment problems, like risk payment bans.

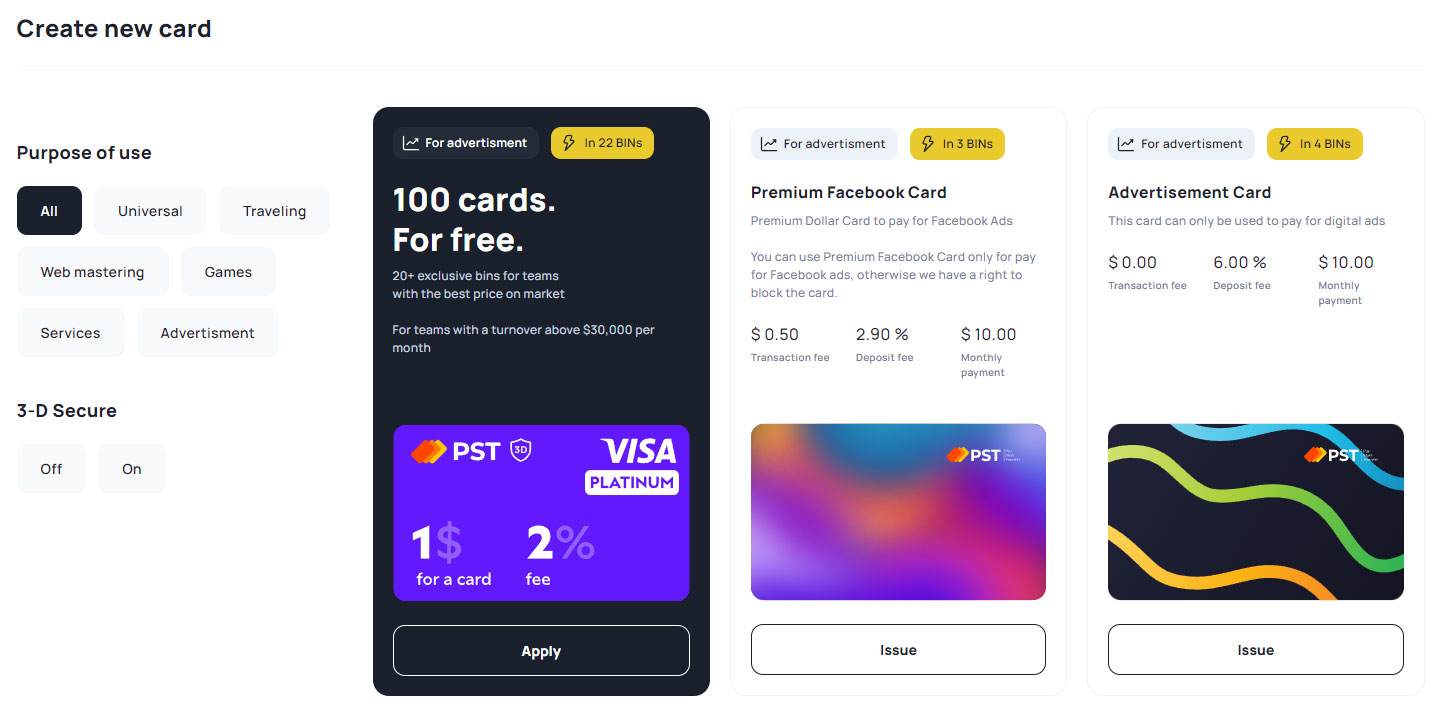

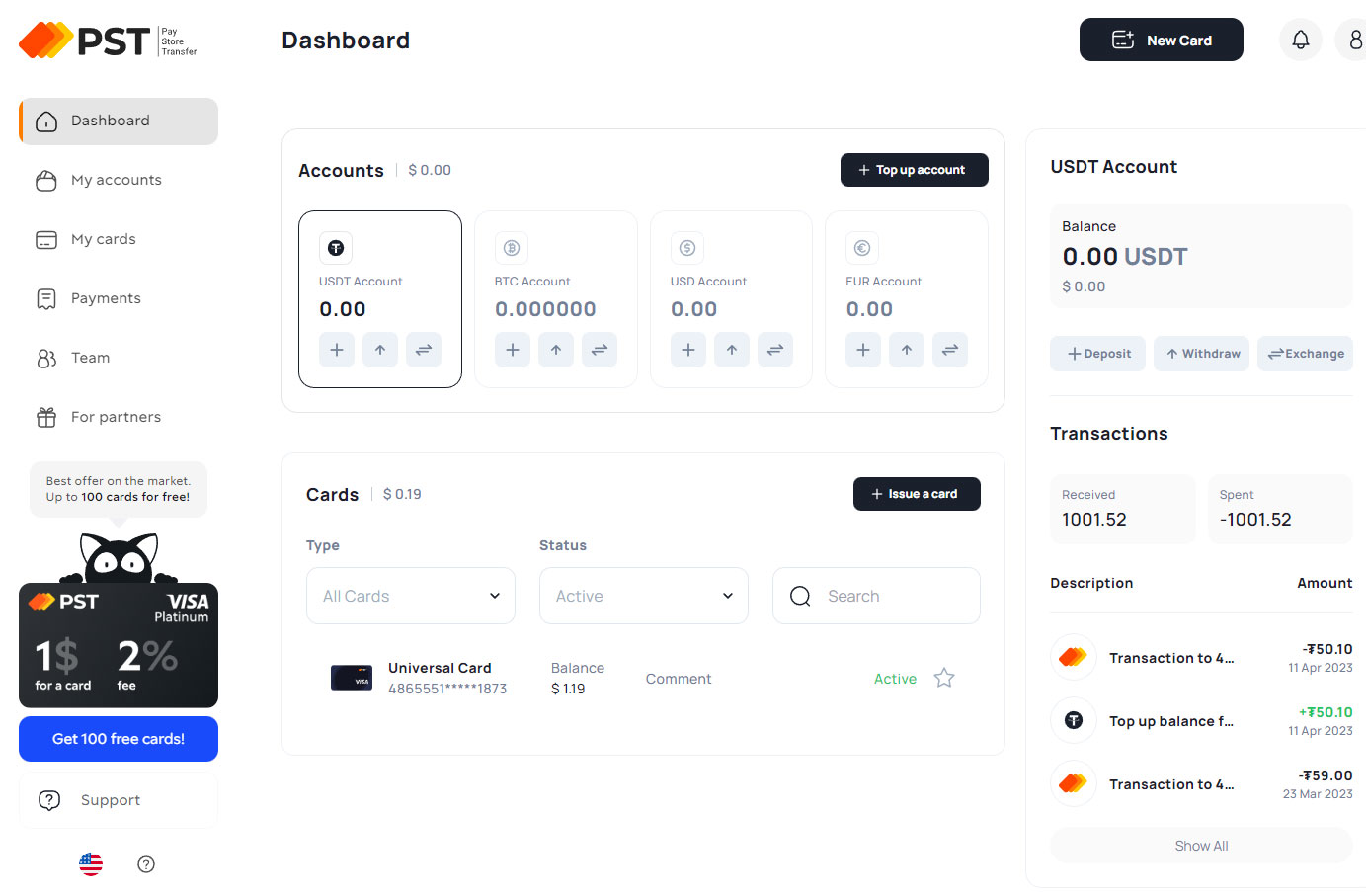

Unlimited Virtual Payment Cards with PST.NET at Affordable Prices

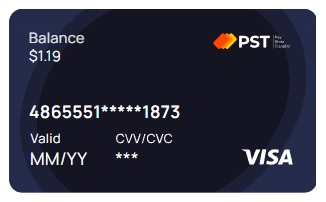

With an unlimited number of virtual payment cards starting from just $1, PST.NET offers various virtual credit cards to choose from, ensuring seamless transactions with no limits on spend or the number of cards. What’s more, the top-up fee starts from just 2%, making it an affordable solution for all.

Zero Transaction Fees and Easy Registration with PST.NET

PST.NET boasts a range of attractive features, including 0% transaction fees, 0% fees for declined payments, 0% fee for operations on blocked cards, and 0% fees for withdrawal from the card. The service also offers an easy 1-minute registration process, allowing users to sign up and sign in with Google, Telegram, or email.

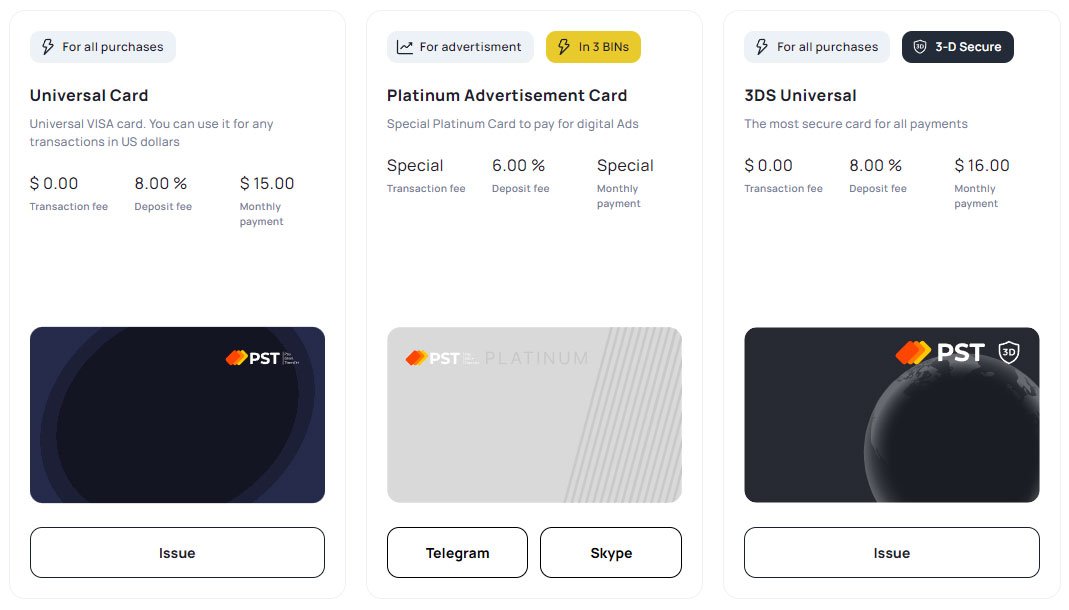

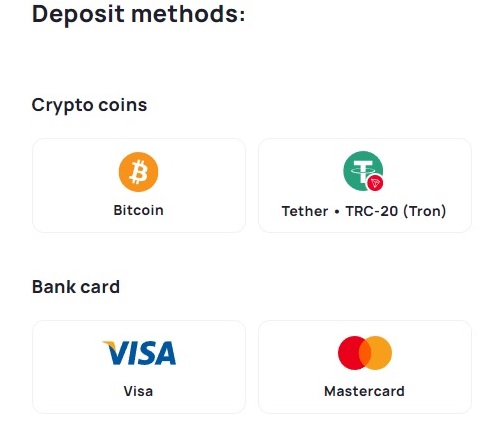

Multiple Deposit and Withdrawal Options with PST.NET

In addition to instant top-up options with cryptocurrencies like USDT and BTC, PST.NET also offers deposit options via debit/credit cards and wire transfers. The withdrawal of funds from the PSTNET account is available from just $500, and the support service is available 7 days a week.

Earn Commission with the PST.NET Affiliate Program

PST.NET also offers an affiliate program, allowing users to earn up to 90% of the service commissions that their referrals pay. Invited users will receive 50% discount for their first virtual crypto Visa or Mastercard card.

Best Virtual Payment Card

If you are able, we kindly ask for your support of Logll Tech News today. We appreciate it.

Sergio Richi

Editor, Logll Tech News

Conclusion

In conclusion, PST.NET is the ultimate solution for online shopping and advertising, offering a range of reliable and convenient features to meet the needs of businesses and individuals alike. With its virtual crypto cards, PST.NET is a one-stop-shop for all your media buying and affiliate marketing needs in 2023.

Here is a special offer for LOGLL readers. You can get your fifth virtual card from PST.NET for free by sending the LOGLL5 promo code to the PSTNET support team (https://t.me/PST_support).