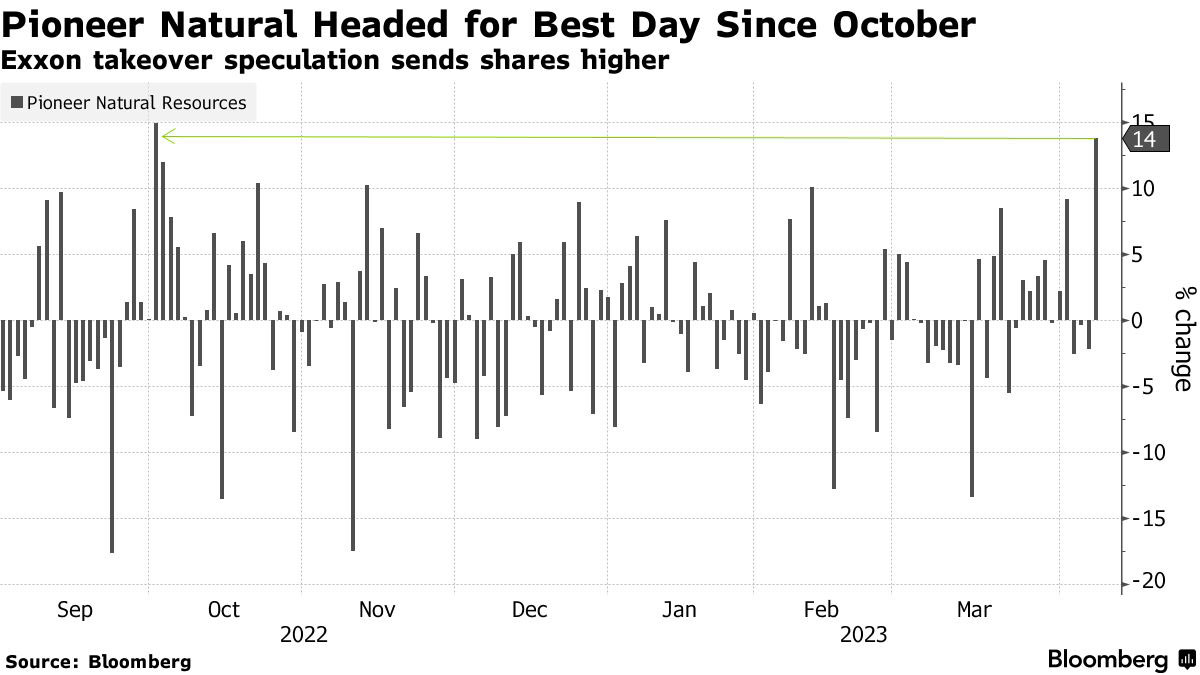

Shale producers witnessed a surge on Monday, following reports of Exxon Mobil Corp.’s preliminary takeover talks with Pioneer Natural Resources Corp. Pioneer shares experienced an 8.5% jump, their largest intraday gain since August 2021, leading other shale oil peers higher as the S&P 500 Energy Index climbed 1.8% on the same day. Diamondback Energy Inc. rose 4%, while Devon Energy Corp. gained 3.1%.

US Shale Patch Primed for Consolidation

After years of growth, the US shale patch is ripe for consolidation. Output is slowing down as the most productive drilling areas become less fruitful, pushing acquisitions as the primary growth engine in regions like the oil-rich Permian Basin of West Texas and New Mexico. If Exxon acquires Pioneer, it would become the largest producer in the Permian, granting access to over a decade-long runway of profitable drilling locations.

Differing Views on Potential Takeovers

Some investors see Exxon’s interest in Pioneer as an isolated play for a substantial number of drilling locations, while others expect the rest of 2023 to be a busy time for oil deals. Truist Securities analyst Neal Dingmann anticipates Exxon and Chevron Corp. to be on the hunt, with Devon, Diamondback, Coterra Energy Inc., APA Corp., and Permian Resources remaining active in the M&A market.

Industry Consolidation Inevitable

Smead Capital Management President and CEO Cole Smead believes that consolidation in the industry is inevitable and expects more large oil companies to participate actively. Pioneer Natural Resources’ stock surged early Monday on reports of Exxon Mobil’s early takeover talks, while Exxon Mobil’s stock edged slightly up.

Exxon Mobil’s Preliminary Talks with Pioneer Natural Resources

According to the Wall Street Journal, Exxon Mobil held informal talks with Pioneer Natural Resources about a possible acquisition. With record profits in 2022, Exxon Mobil is exploring options to spend some of its cash. However, it remains unclear if a deal will be finalized, with the possibility of negotiations extending into 2023.

US, EU: Best Virtual Payment Cards

Pioneer Natural Resources’ Strong Performance

In 2022, Pioneer Natural Resources, the largest oil producer in the Permian Basin, saw profits surge 130% to $30.57 per share, generating $8.4 billion in surplus cash. The company returned around $8 billion to shareholders in dividends and share repurchases and produced 650,000 barrels of oil equivalent per day. By the end of 2022, Pioneer Natural Resources had reduced its debt by over 26% compared to the end of 2021.

Other Shale Stocks Reacting to the News

Besides Pioneer Natural Resources, other shale plays advanced on Monday. Diamondback Energy rose 3.6%, Devon Energy climbed 2.3%, Marathon Oil edged up 2.8%, SM Energy increased 2.3%, APA jumped 3.2%, and Occidental Petroleum advanced 2% in market trade.

If you are able, we kindly ask for your support of Logll Tech News today. We appreciate it.

Sergio Richi

Editor, Logll Tech News

⭐️⭐️⭐️⭐️⭐️ Wall Street Stock

Veronese Design 6 Inch Tall Wall Street Stock Market Bull Bear Fight Financial Broker Gift Abstract Cold Cast Resin Bronze Finish Tabletop Statue

Official Licensed Bronze Wall Street Bull Stock Market NYC Resin Figurine Statue with Base (Large 6.5in)

$31.49

Best Offer Today

Conclusion

The reported interest of Exxon Mobil in Pioneer Natural Resources has sparked a surge in shale oil producers, signaling the possibility of consolidation within the industry. As output slows down in the most productive drilling areas, acquisitions are becoming the main growth engine, particularly in regions like the oil-rich Permian Basin. While some investors see Exxon’s interest as an isolated play, others anticipate a busy year ahead for oil deals, with more large oil companies likely to participate. This ongoing speculation has not only led to Pioneer Natural Resources’ stock surge but has also affected other shale stocks positively. In the coming months, the oil industry will be closely watched for any developments on potential mergers and acquisitions, which could reshape the landscape of shale oil production in the US.