The US stock market continues to rally, with the tech-heavy Nasdaq 100 experiencing its best quarter since June 2020. This optimism in the markets comes as a key measure of inflation cools down, suggesting that the Federal Reserve may be nearing the end of its rate-hiking campaign.

The personal consumption expenditures (PCE) price index, excluding food and energy, rose by 0.3% in February, slightly below the median estimate. This has fueled the belief that peak inflation has been reached, but there is still work to be done to re-establish price stability.

Tech Stocks Lead the Rally

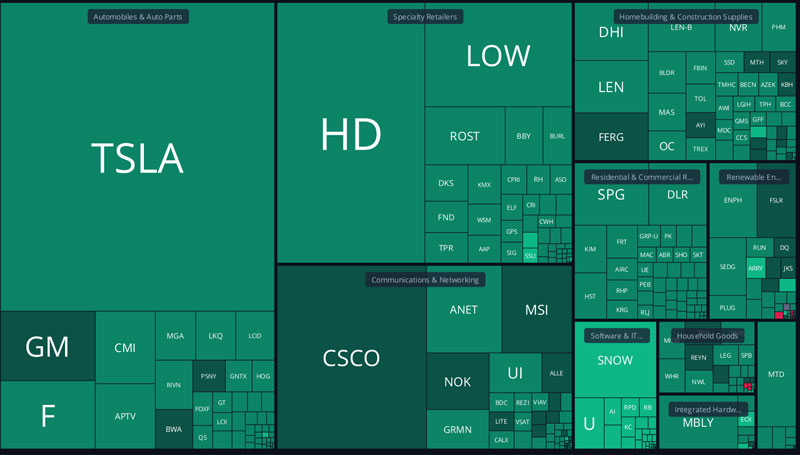

Technology shares have risen to their highest since August 2022, pushing gains in the broader market. However, analysts like Michael Gibbs, director of equity portfolio and technical strategy at Raymond James, have noted the uneven nature of the rally beneath the surface, indicating confusion within the current market backdrop.

Narrow Rallies Raise Concerns

Extremely narrow rallies, like the one currently observed, are not considered healthy, and Matt Maley, chief market strategist at Miller Tabak + Co., warns that more groups need to participate in the rally to prevent a potential market correction.

US Stocks More Attractive Amid Recession Risks

As focus shifts from high interest rates to recession risks, US stocks appear more attractive than their European counterparts. A Citi team led by Beata Manthey upgraded US stocks to overweight from underweight on Friday, as they expect global earnings-per-share to contract by 5% in 2023.

Market Highlights

Notable market highlights include a 9% weekly gain in New York-traded oil due to disruptions in Iraqi exports, and Bitcoin’s best quarter since March 2021 with a 70% gain. Additionally, Digital World Acquisition Corp., the blank-check firm taking Donald Trump’s media company public, saw a rally after he became the first former president to be indicted.

If you are able, we kindly ask for your support of Logll Tech News today. We appreciate it.

Sergio Richi

Editor, Logll Tech News

⭐️⭐️⭐️⭐️⭐️ New Releases

JETEAGO Patio Rattan Bar Set, 3-Piece Outdoor Furniture Wicker Bistro Set with Table, Barstools, Glass Top Table and 2 Thick Cushion for Patios Backyards Porches Gardens Poolside, Blue

JETEAGO 5 Pieces Patio Conversation Set Outdoor Rattan Bistro Set All-Weather Wicker Furniture Set with Washable Cushions, Ottoman, Glass Coffee Table for Garden, Poolside, Backyard,Red

L Shaped Desk with File Cabinet & Power Outlet, 55 Inch Large Corner Computer Desks with LED Strip, L-Shaped Computer Desk with Drawers and Storage Shelves for Home Office, Espresso

$43.00

PETLIBRO Automatic Cat Feeders, Timed Cat Feeder Programmable 1-6 Meals Control, Automatic Pet Feeder for Cat & Dog, Cat Food Dispenser with Long Battery Life, Automatic Dog Feeder for Dry Food Black

$49.99

Recommended reading: Hardware Wallet

Conclusion

In conclusion, the US stock market, particularly the tech-heavy Nasdaq 100, has shown promising signs of growth, experiencing its best quarter since June 2020. While peak inflation seems to have been reached, analysts remain cautious about the uneven nature of the current rally and the potential risks of a recession.

The market has demonstrated resilience in the face of multiple challenges, with various sectors witnessing gains in recent weeks. As the focus shifts from high interest rates to recession risks, US stocks continue to appear more attractive than those in Europe. Nevertheless, it will be crucial for more market groups to participate in the rally to ensure its long-term sustainability and prevent potential corrections.