The Ethereum Foundation recently sold $30 million worth of Ether, leading to concerns about the possible impact on the cryptocurrency’s price. However, it seems that the general market trend remains unaffected by such sales. On May 6, the Ethereum Foundation transferred a substantial sum of Ether, nearly $30 million, to the Kraken cryptocurrency exchange, causing apprehension among market participants about a potential selloff.

Although the price of Ether (ETH) did experience a decline of 4.8% to $1,900 on the day, the downturn has been minimal so far as the cryptocurrency appears to be maintaining its broader recovery trend. As of May 7, the price of Ether bounced back modestly to $1,920 after testing its 50-day exponential moving average (EMA) near $1,850 as support the day before.

Market Calm Despite Ethereum Foundation Transfer

Despite the substantial transfer from the Ethereum Foundation, traders seem to remain calm as price volatility on Kraken diminished during the same period. This is evidenced by the contracting Bollinger Bands Width, which indicates a sense of stability among market participants.

It is worth noting that the 50-day EMA has successfully limited Ether’s downward movement in 2023, apart from a brief selloff in early March. When the cryptocurrency tests the 50-day EMA as support, it often prompts the ETH price to pursue a breakout above the $2,000 mark.

Related Posts

Best Crypto Exchange

ETH Bulls Eye $2,000 Price Level

Due to the strong support provided by the 50-day EMA, ETH bulls are likely to attempt to push the price above $2,000 once again. On the other hand, if the price drops below the 50-day EMA, traders could turn their attention to the next downside target, which is a support confluence comprising a multi-month ascending trendline and the 200-day EMA near $1,700. This target is approximately 13% below current price levels.

Despite a larger decline, ETH would still be maintaining its overall recovery trend when measured from its June 2022 bottom of $880.

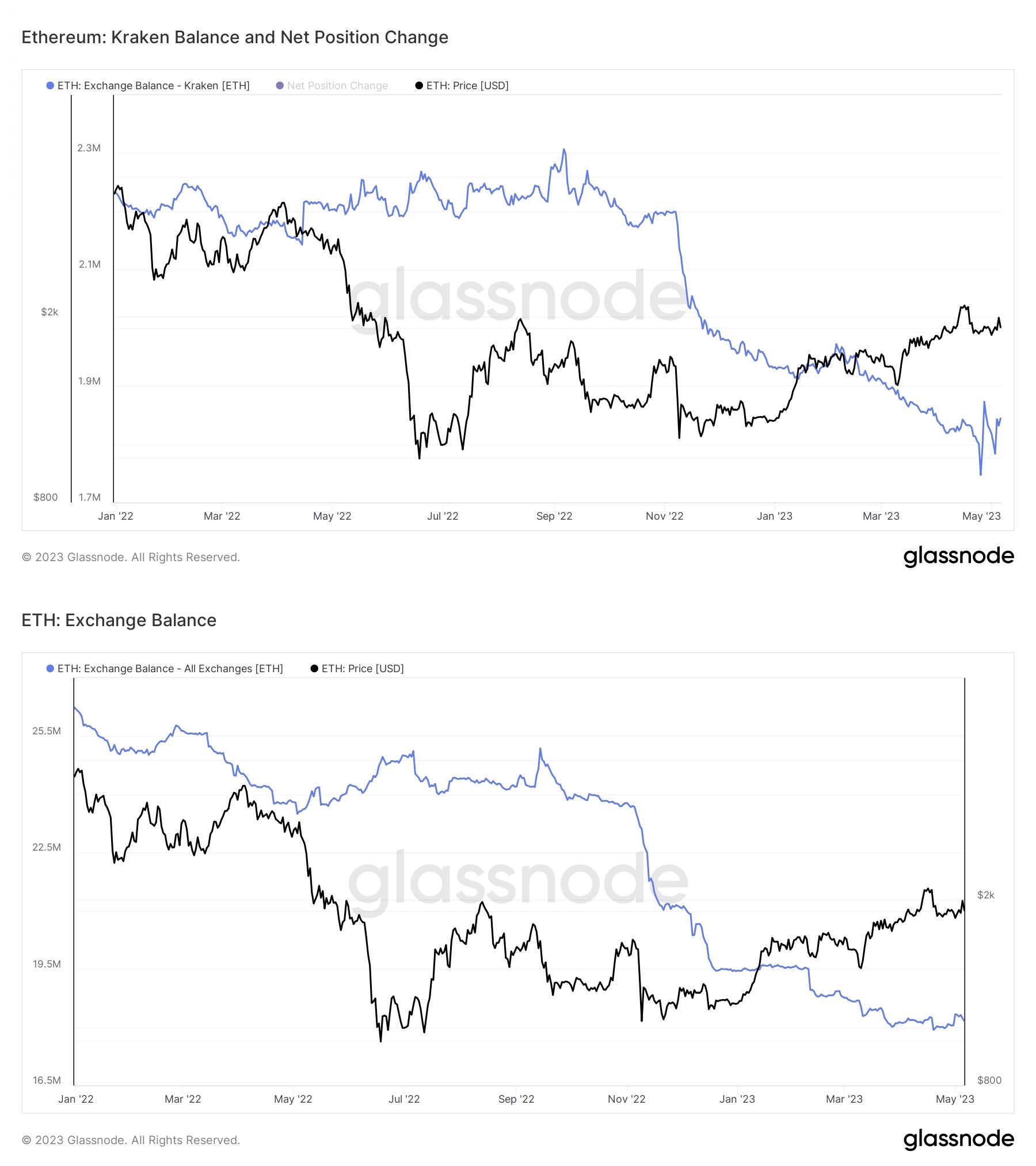

Ethereum Exchange Reserves vs. Kraken Reserves

An increasing exchange balance usually suggests rising selling pressure and vice versa. In the case of Ethereum, the balance remained lower across all exchanges, even after the Ethereum Foundation transferred $30 million to Kraken.

For instance, Kraken’s Ether balance increased to 1.84 million ETH on May 6 from 1.83 million a day earlier. However, the balance across all exchanges actually dropped to 18.15 million ETH from 18.22 million ETH on the same day. This indicates that any potential selling pressure from the Ethereum Foundation can be easily absorbed by the market.

Best Virtual Payment Card

ETH Market Top Not Guaranteed

The Ethereum Foundation’s last significant transfer was 20,000 ETH in November 2021, which coincided with the price reaching approximately $4,850 before experiencing an 80% decline. Similarly, the foundation sold 35,053 ETH at the local market top of around $3,500 in May 2021.

Some analysts have interpreted these patterns as a sign of another potential market top formation near $2,000, suggesting that the price may fall in the upcoming sessions. However, broader data points to a different conclusion. For example, the Ethereum Foundation also made large ETH sales during the 2020-2021 bull cycle, which was fueled by increasing demand for risk-on assets in a low-interest-rate environment. This implies that the foundation’s sales have little influence on Ethereum’s price trend.

Ethereum Foundation sold another 20,000 Ethereum at the recent local top.

— Brad Mills 🔑⚡️ (@bradmillscan) January 28, 2022

Every time the eth foundation / Vitalik / Consensys dumps a massive presale bag it marks the top.

What’s the difference between ripple dumping hundreds of millions on retail vs ETH founders doing it? https://t.co/pw8ukMiR8v

If you are able, we kindly ask for your support of Logll Tech News today. We appreciate it.

Sergio Richi

Editor, Logll Tech News

Conclusion

In summary, the cryptocurrency market is primarily taking cues from the ongoing U.S. banking crisis and its potential impact on the Federal Reserve’s decisions regarding interest rate hikes and cuts. This means that the Ethereum Foundation’s sales of Ether may not be the primary factor affecting the price trend of the cryptocurrency. Instead, macroeconomic factors and the overall market sentiment play a more significant role in shaping Ethereum’s price trajectory.

Investment Risks and Market Outlook

It is essential to recognize that this article does not offer investment advice or recommendations. Every investment and trading decision carries risks, and readers should conduct thorough research and consider their own risk tolerance before making any decisions. While the Ethereum Foundation’s sale of $30 million in Ether has caused concern among some market participants, it is crucial to examine the broader market context and factors influencing the cryptocurrency’s price.

As the cryptocurrency market continues to navigate the uncertainties brought on by the U.S. banking crisis and the Federal Reserve’s actions, it remains to be seen how Ether’s price will react in the short and long term. For now, traders and investors should closely monitor market developments and make informed decisions based on comprehensive research and analysis.