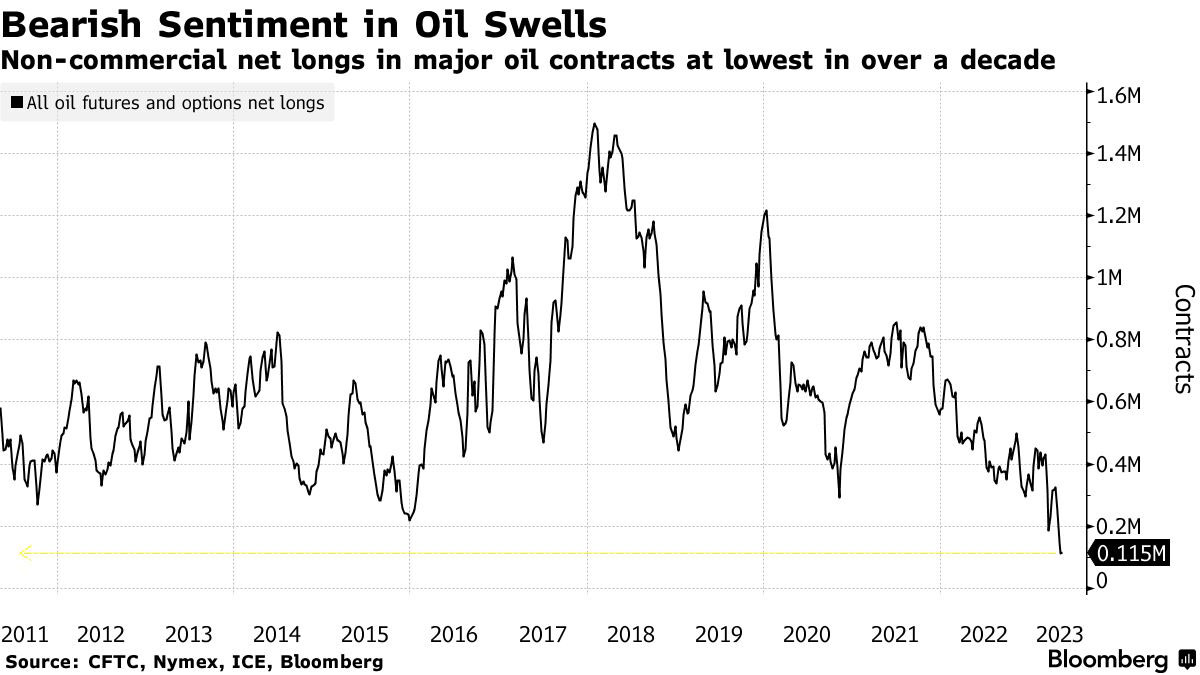

Money managers dealing in oil-linked derivatives are displaying the highest levels of bearish sentiment seen in over a decade. The overarching market consensus appears to be anticipating a recession that could push contracts from crude to jet fuel to plummet again. This is largely due to bearish stances of non-commercial players, such as hedge funds, which have escalated to levels unseen since 2011 across most major oil contracts.

Signs of an Anticipated Recession

Speculators have been closely watching the markets, particularly diesel and gasoil – economic barometers. Their combined outlooks mirror the highest levels of pessimism seen since the early days of the Covid-19 pandemic. This sour sentiment originates from several fronts, including fears of a recession induced by the Federal Reserve’s planned rate hikes, and China’s disappointing post-Covid recovery. Additional factors include a potential US default, should politicians not raise the debt ceiling, and concerns that OPEC+ may fall short of its output cut commitments.

Diverging Market Perspectives

Pacific Investment Management Co.’s energy and commodities portfolio manager, Greg Sharenow, finds this negative positioning to be noteworthy. However, it’s important to mention that non-commercial traders represent a broad spectrum of approaches and predictions. These include everything from macro strategy-focused hedge funds to algorithm-driven momentum and trend traders. Furthermore, while some commercial traders are anticipating a price drop, others are less bearish and have even begun reducing their hedging against such an event.

Related Posts

Potential Market Turbulence Ahead

The pessimism of financial traders could potentially ignite market volatility if OPEC+ decides to implement further production cuts. Such a situation might result in an oil price surge, intensifying inflation. Goldman Sachs Group Inc. suggests that significant rises in oil prices could spur as much as $40 billion worth of US crude and Brent purchases from trend-following commodity trading advisors. Conversely, substantial price drops are predicted to have less effect on market positions.

Consistent Recession Forecasts Despite Robust Labor Market

Recession predictions from oil traders aren’t unfounded. In a recent Bloomberg survey of 27 forecasters, 22 anticipate the US economy to contract within the next year. This projection keeps being postponed, however, as the strong labor market continues to push wage growth and pandemic savings support American consumer spending.

Motor Oil

Physical Markets Remain Resilient

Despite the bleak outlook from traders, physical markets remain robust. Refineries are processing record amounts of crude for this time of the year since the pandemic started. Air travel and US gasoline demand are both on the rise, while fuel inventories remain below seasonal averages in the US due to OPEC+ cuts and wildfires in Canada.

If you are able, we kindly ask for your support of Logll Tech News today. We appreciate it.

Sergio Richi

Editor, Logll Tech News

Conclusion

In conclusion, while the financial market shows significant pessimism towards the oil sector, physical markets seem resilient. Traders continue to monitor the situation closely, factoring in multiple variables including China’s recovery and the US debt-ceiling deadlock.