As the US banking system grapples with significant challenges, investment firm Bernstein’s analysts predict a ripe environment for the cryptocurrency market to flourish. They contend that the present circumstances offer the perfect opportunity for decentralized financial systems to step into the limelight as viable alternatives to conventional banks.

A Silver Lining in Banking Collapses: Decentralized Finance on the Rise

With a string of banking collapses in early March, Bernstein identifies a unique set of conditions for decentralized financial systems to solidify their position as alternatives and fuel the growth of cryptocurrency markets.

The Crux: Cryptocurrency’s Role in Bank Failures

The initial cause behind the collapses of Silvergate Bank, Silicon Valley Bank (SVB), and Signature Bank was their associations with cryptocurrency companies. Analysts assert that these banks’ troubles were confined to their internal operations.

First Republic Bank Shares Tumble Amid SVB Debacle

As SVB’s collapse unfolded on March 11th, First Republic Bank (FRC) faced its own tribulations: its shares nosedived by 65%. The following day, FRC announced it had secured an additional $70 billion in liquidity from the Federal Reserve and major US banks, including JPMorgan Chase and Bank of America.

Rescue Measures Expose a “Common Banking Problem”

According to Bernstein’s report, the rescue measures implemented for First Republic Bank’s deposits expose a broader banking issue, absolving cryptocurrencies of responsibility.

A Golden Opportunity for Bitcoin, Ethereum, and Decentralized Financial Systems

“This is the perfect situation for Bitcoin, Ethereum, and other decentralized financial systems to emerge as an alternative system, distinct from the traditional centralized banking system,” experts proclaim.

Crypto Access May Falter in the US but Remain Steady Globally

While analysts foresee potential weakening of crypto access through the US banking system, they maintain that stability will persist internationally, including in over-the-counter centers across Asia and Europe. These centers also seem to function without interruption in the US.

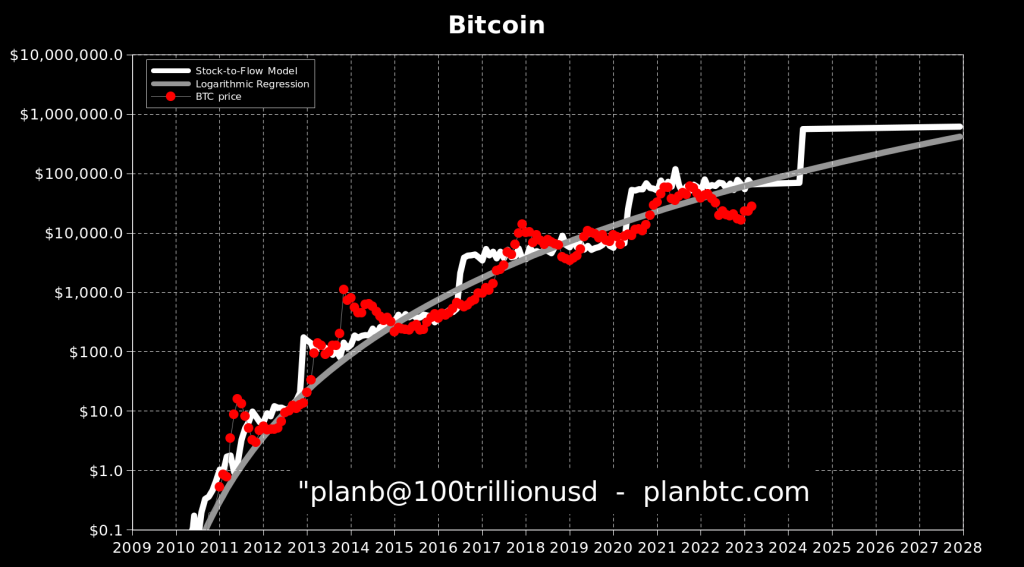

Crypto Oracle Davincij15 Foresees Bitcoin at $1 Million Within 3-6 Months

Renowned crypto forecaster Davincij15, known for his uncanny accuracy in predicting Bitcoin prices, passionately explains why Bitcoin will be worth a million dollars per coin in just 3-6 months. His rationale resonates with Balaji Srinivasan, former CTO of Coinbase, who is prepared to wager a million dollars against anyone doubting Bitcoin’s million-dollar valuation within the next 90 days.

Analyst Support for Bold Predictions Grows Daily

Backing for this audacious forecast is steadily increasing, with a growing number of economic media outlets substantiating and defending its plausibility. Notably, they all express Bitcoin’s future price in the world’s most stable fiat currency: the US dollar.

What Must Happen to the US Dollar for Bitcoin’s Meteoric Rise?

It’s unclear what must occur for the US dollar to facilitate Bitcoin’s skyrocketing ascent in just three months. One possibility is the dollar’s purchasing power taking a sharp downturn—by precisely 40 times!

A Million-Dollar Bitcoin: Challenging the Dollar’s Global Functions

Such a development would see the US dollar losing its function as both a store of value and its primary global function as a unit of account. All commodities, from precious metals to oil and other raw materials, would start being valued in Bitcoin.

One World, One Leader: The Struggle Between Digital and Traditional Currencies

If Bitcoin achieves a million-dollar valuation, the world may be forced to reevaluate its financial landscape. The battle between digital and traditional currencies will continue to transform the world of finance, and it’s essential to consider the potential implications for the US dollar’s global role. With Bitcoin’s rise possibly destabilizing the dollar’s value, we may see a shift in how goods and services are valued, leading to a change in the global financial landscape.

Though the precise course of these events remains uncertain, one fact is indisputable: the financial world is on the cusp of a transformative era as digital currencies vie for supremacy against their traditional counterparts. As Bitcoin inches closer to the million-dollar milestone, the ensuing struggle between old and new financial systems will undoubtedly redefine the future of currency and global economic power.

⭐️⭐️⭐️⭐️⭐️ Hardware Wallet

Trezor Model One - Crypto Hardware Wallet - The Most Trusted Cold Storage for Bitcoin, Ethereum, ERC20 and Many More (Black)

$59.00

Trezor Model T - Next Generation Crypto Hardware Wallet with LCD Color Touchscreen and USB-C, Store your Bitcoin, Ethereum, ERC20 and more with Total Security

$179.00

Ledger Nano X Crypto Hardware Wallet (Blazing-Orange) - Bluetooth - The Best Way to securely Buy, Manage and Grow All Your Digital Assets

Recommended reading: Hardware Wallet

Conclusion

In conclusion, the cryptocurrency market, led by Bitcoin, is set to challenge the traditional financial systems and the US dollar’s global dominance. As the potential of decentralized finance is recognized, a shift in the global financial landscape seems inevitable. While the outcome remains uncertain, it’s clear that we are witnessing a transformative period in the world of finance, with digital currencies emerging as powerful contenders. The race between traditional and digital currencies will undeniably shape the future of global economic power, potentially altering the way we perceive and use money forever.

https://youtu.be/XIJgHXLL5so