The head of the Federal Reserve, Jerome Powell, has maintained a strong stance on fighting inflation by increasing the interest rate and holding it at a higher level for some time. Heeding the lessons from the 1970s, Powell is cautious of the risk of repeating history, when an early interest rate cut led to another inflation surge. However, recent events may force the FED to reconsider its approach.

Recent Bankruptcies and the Credit Suisse Saga

In the last couple of weeks, the financial landscape has shifted significantly. Regional American banks started to go bankrupt, prompting the FED to inject hundreds of billions of dollars to prevent panic and a liquidity crisis.

Additionally, the long-standing Credit Suisse issue found its resolution, leading to a sharp drop in Treasury yields. These events have spurred market participants to anticipate a potential interest rate cut by the FED beginning this summer.

The FED’s Dilemma: Maintaining Credibility or Adapting to New Realities

The FED now faces a serious dilemma. If it maintains its aggressive stance, the stock market, along with the bond, commodity, and other markets, may face severe selling pressure, potentially leading to more bankruptcies. Alternatively, the FED can acknowledge the changed macroeconomic landscape, putting an end to interest rate hikes and opening the door for future rate cuts. This move, however, would contradict previous rhetoric and risk repeating the mistakes of the 1970s.

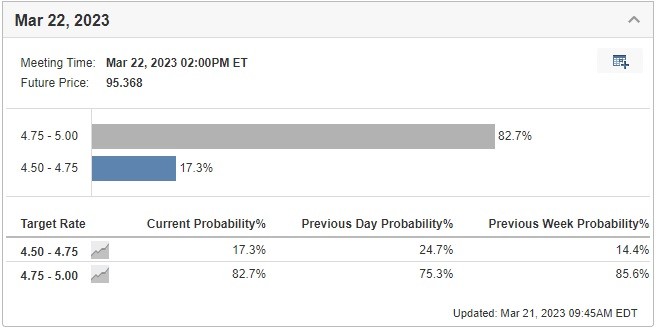

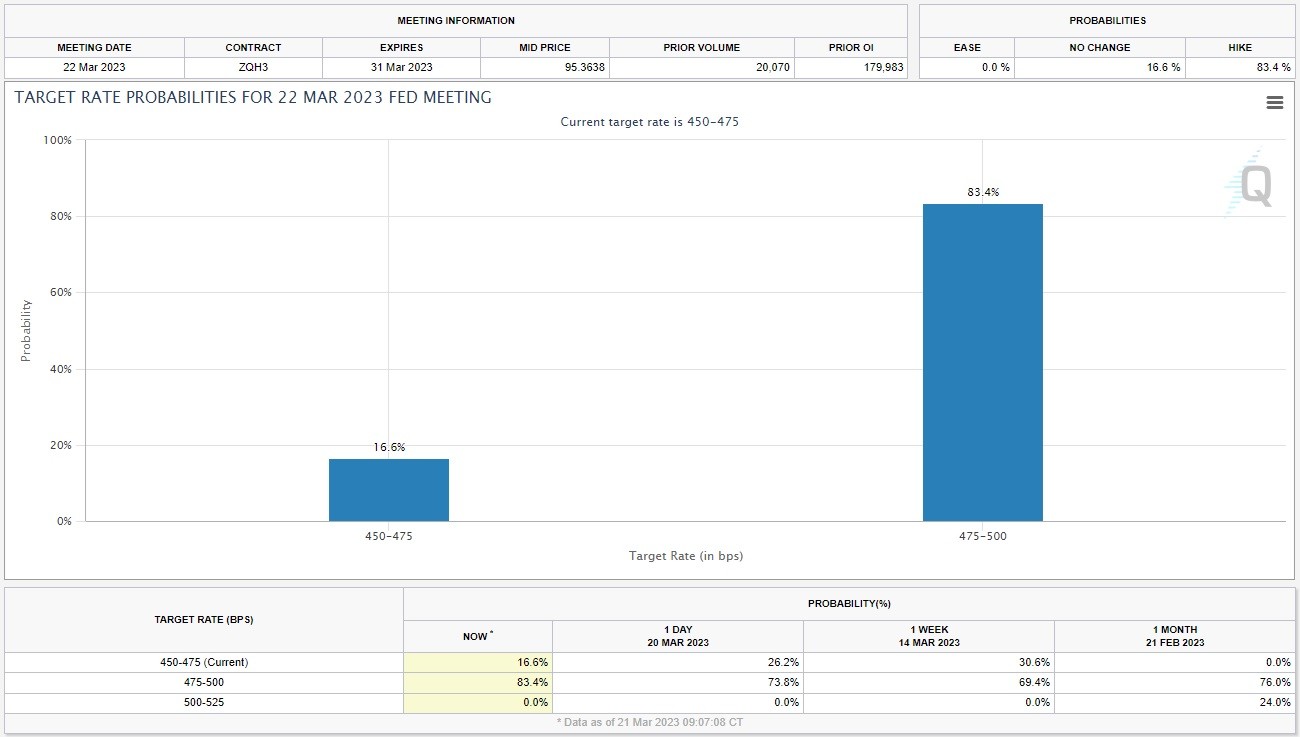

Potential Interest Rate Increase on March 22, 2023

Despite the challenges, the probability of the FED raising the interest rate by 25 basis points on March 22, 2023, stands at 83%. The market largely agrees with this move, and Powell is unlikely to defy expectations. The rate will likely be raised to 4.75-5%, as failing to do so may cause panic in the markets.

Market Bets on Interest Rate Cut in July

Interestingly, market participants are already anticipating an interest rate cut at the FED meeting in July. What could cause such a drastic shift in the upcoming months? A significant deterioration in the US economy may force Powell to lower the interest rate sooner than anticipated.

If you are able, we kindly ask for your support of Logll Tech News today. We appreciate it.

Sergio Richi

Editor, Logll Tech News

⭐️⭐️⭐️⭐️⭐️ Hardware Wallet

Trezor Model One - Crypto Hardware Wallet - The Most Trusted Cold Storage for Bitcoin, Ethereum, ERC20 and Many More (Black)

$59.00

Trezor Model T - Next Generation Crypto Hardware Wallet with LCD Color Touchscreen and USB-C, Store your Bitcoin, Ethereum, ERC20 and more with Total Security

$179.00

Ledger Nano X Crypto Hardware Wallet (Blazing-Orange) - Bluetooth - The Best Way to securely Buy, Manage and Grow All Your Digital Assets

$104.00

Recommended reading: Bitcoin million dollars prediction

Conclusion

In conclusion, the Federal Reserve faces a complex challenge in its fight against inflation, while ensuring economic growth and addressing the recent bankruptcies. As the FED balances between maintaining credibility and adapting to new realities, it must carefully navigate the road ahead to avoid the mistakes of the past.