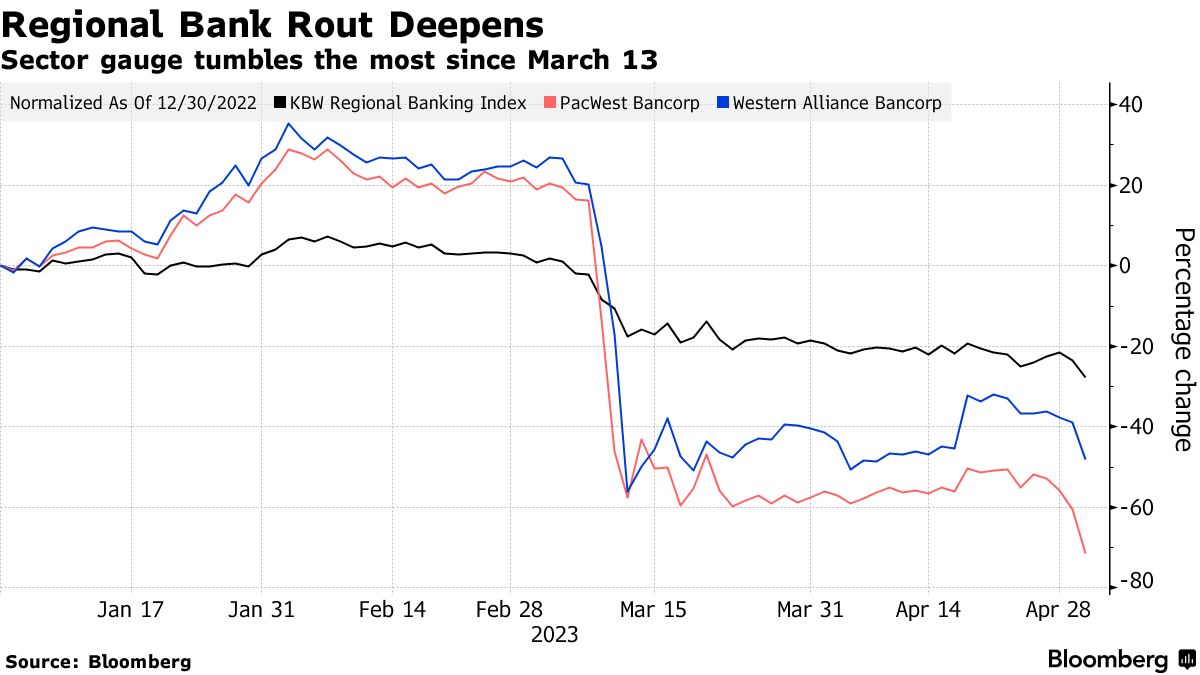

Just a day after Wall Street exhaled in relief following the rescue of First Republic Bank, a sharp selloff in US regional lenders ignited fresh worries about financial stability. This development sent stocks plummeting across the board and pushed investors towards the safest market assets.

Many traders found the timing particularly troubling. On the cusp of the Federal Reserve’s decision, trading was halted in both PacWest Bancorp and Western Alliance Bancorp due to significant volatility. Both shares tumbled at least 15% during Tuesday’s trading session. Consequently, the financial sector dragged the S&P 500 Index down nearly 2% before it managed to recover some losses.

Hedge-Fund Traders Fuel Selling Frenzy

Bearish hedge-fund traders contributed to the selling frenzy that erupted on Tuesday, ultimately provoking long-only investors to follow suit, according to a note from John Flood, a partner at Goldman Sachs Group Inc. “Wall Street is swiftly pressing the sell button as the banking crisis shows no signs of abating,” observed Ed Moya, senior market analyst at Oanda. “Traders’ risk appetite faltered as they grappled with lingering concerns over regional banks, escalating recession probabilities, and the increasing likelihood of a US debt default next month.”

These factors, combined, intensified investors’ unease about the Fed’s dilemma. Officials are grappling with both persistent inflation and indicators of an economic downturn, such as the recent JOLTS record of job openings, which has reached its lowest level in nearly two years.

Related Posts

Debt Ceiling Woes Compound Problems

Further complicating matters is the growing anxiety surrounding the US debt ceiling, which adds another layer to the debate on whether the Fed should pause after its May rate hike to avert a more severe economic recession. Although swaps continue to price in a quarter-point Fed rate increase this week, traders have reduced their bets on a subsequent hike, opting instead to increase wagers on rate cuts before year-end.

Given the numerous factors at play, it is unsurprising that bonds were in high demand on Tuesday, particularly after the previous session’s selloff. Two-year rates, which are more responsive to upcoming Fed moves, dropped by as much as 21 basis points to below 4%.

In the meantime, Treasury bill yields for June exceeded 5% following a warning from Janet Yellen that the US government could face debt-ceiling restrictions as early as next month. This recent upheaval in the banking sector has rattled Wall Street, and as investors grapple with the potential consequences, the market’s stability hangs in the balance.

Best Virtual Payment Card

If you are able, we kindly ask for your support of Logll Tech News today. We appreciate it.

Sergio Richi

Editor, Logll Tech News

Best Offer Today

Conclusion

In conclusion, the recent selloff in US regional lenders has sent shockwaves through Wall Street, exacerbating concerns about financial stability and economic downturn. Investors now face a challenging landscape marked by potential recession, stubborn inflation, and the looming threat of a US debt default. As the Federal Reserve grapples with these complex issues, market participants remain on edge, seeking safety in bonds while anxiously awaiting the central bank’s next move. The convergence of these factors underscores the importance of careful decision-making by policymakers and investors alike, as they navigate the turbulent waters of an uncertain financial future.