The volatility clock is ticking in the world of investors, courtesy of the US debt ceiling impasse. New York, the heart of financial activity, braces itself as negotiations between political heavyweights drag on. Currency fluctuations and potential equity losses are on the horizon, with the US government struggling to secure a debt-limit deal.

Biding Time Amid Uncertainty

Speaker of the House Kevin McCarthy is expected to meet with President Joe Biden this Monday. Amid the crucial debt discussions that will continue later on Sunday, McCarthy expresses the urgency of the situation. The conversations are crucial, with Biden fresh off the G-7 summit in Japan, and McCarthy emphasizing that “time is of the essence”.

Treasury Secretary Janet Yellen rings a cautionary bell, hinting at the likelihood that the US may not meet its mid-June deadline to pay its bills. Currency trading is scheduled to start at 5 a.m. in Sydney, and futures contracts for Treasuries and US stocks commence three hours later, adding another layer of anticipation to the mix.

Stock Market

Related Posts

Best Crypto Exchange

Tricky Terrain for Traders

The debt-ceiling dilemma is an unwelcome distraction for traders who are also grappling with the uncertainty of the Federal Reserve’s impending policy decision in June. Financial strategists from industry titans JPMorgan Chase & Co. and Morgan Stanley forewarn of an adverse equity market outlook due to this standoff. As a response, traders are diving into swaps and options for significant currencies to buffer their portfolios.

Christine Lagarde, President of the European Central Bank, urges the US political leadership to resolve this issue during a recent television interview, stressing the global implications of the debate.

Best United States Crypto Card

Awaiting Resolution Amid Market Volatility

Carol Kong, a strategist at the Commonwealth Bank of Australia, predicts heightened market volatility as lawmakers potentially prolong the decision-making process. According to her, the shift in focus back to economic data and the FOMC will likely bring modest gains to the dollar once an agreement is reached.

The nation’s top three lenders are preparing for potential fallout, with executives in trading, corporate, and consumer banking trying to forecast the repercussions of the government’s failure to service its debts. The 2011 debacle is a haunting reminder of the substantial price fluctuations across asset classes, adding to the prevalent anxiety.

Uncharted Waters and Investor Preparedness

A significant portion of investors may not be adequately braced for the potential financial storm. Approximately 71% of respondents in a recent Bank of America survey anticipate a resolution before the government exhausts its funding options, however, not necessarily evading a default.

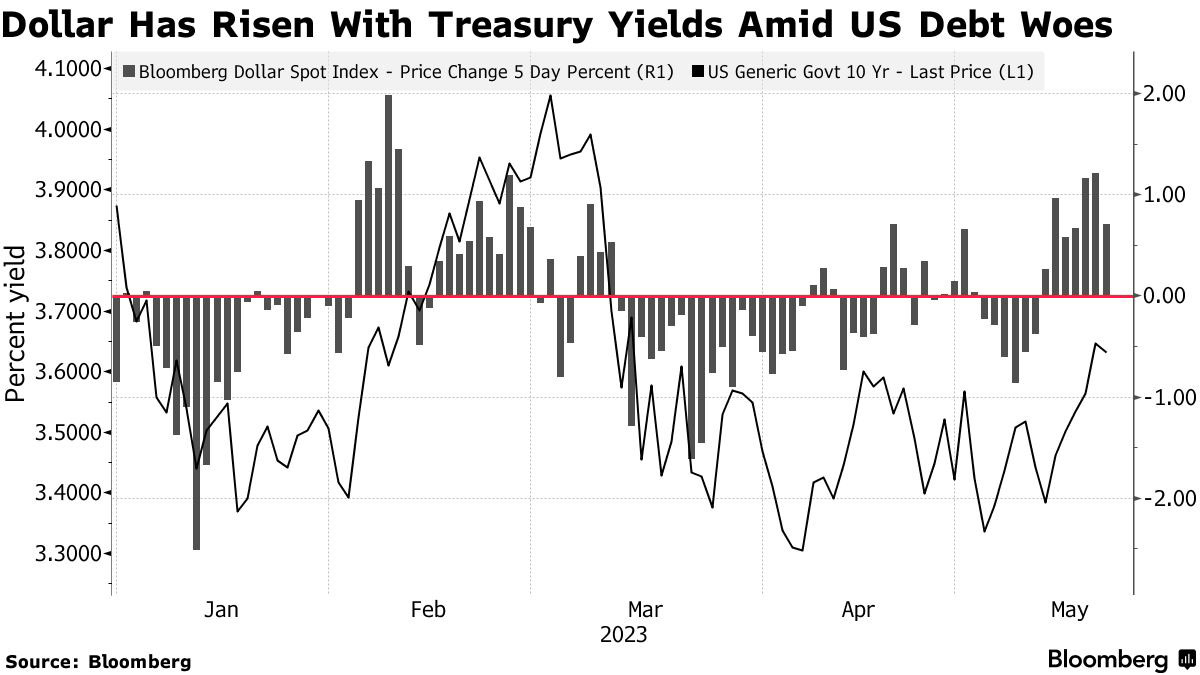

The S&P 500 Index witnessed a positive trend last week, reflecting hopes for a nearing resolution. Conversely, the dollar’s strength hit a two-month high, fueled by a safe-haven demand and reinforced expectations for Federal Reserve rate hikes.

Global Effects and Potential Fallout

Goldman Sachs Group Inc. sees the looming US debt ceiling as a credible catalyst for blows to economic growth and the stock markets. They caution that large export markets, like Korea, Mexico, and Taiwan, are likely to take the most substantial hit.

This debt-limit impasse illustrates how a domestic issue in the US can have worldwide implications, underlining the interconnectedness of global financial markets. As New York and the rest of the world watch, the US government’s ability to navigate this tricky situation will be under intense scrutiny in the days to come.

If you are able, we kindly ask for your support of Logll Tech News today. We appreciate it.

Sergio Richi

Editor, Logll Tech News

Conclusion

In conclusion, the ongoing US debt-limit impasse poses a substantial risk to both the domestic and international financial markets. This uncertainty is inducing apprehension among investors, causing potential spikes in currency volatility and potentially impacting equity. As discussions among key political figures continue, the world is attentively waiting for a resolution. The ultimate decisions made in this situation will have profound implications for financial markets, investors, and potentially the broader global economy.