Mounting market, legal, and regulatory challenges in the US cloud the firm’s future as it seeks an overseas reset. Since going all-in on Bitcoin over a decade ago, Tyler and Cameron Winklevoss have had their share of ups and downs. But these days, issues around the billionaire twins’ Gemini crypto exchange just seem to keep piling up.

The Winklevoss twins, Tyler and Cameron, who famously accused Mark Zuckerberg of stealing their idea for Facebook, have made a fortune in the cryptocurrency market. However, their crypto exchange, Gemini, has been facing significant challenges in recent times. This article examines the issues affecting Gemini and the twins’ attempts to pivot and stay relevant in the industry.

2. Challenges Faced by Gemini

Legal and regulatory challenges

Gemini has been facing legal and regulatory challenges as regulators crack down on the crypto industry. The Securities and Exchange Commission (SEC) has sued Gemini and its lending partner, Genesis, for allegedly selling unregistered securities through their Earn product. The SEC seeks remedies that could result in substantial financial penalties and a requirement to refund customers’ money.

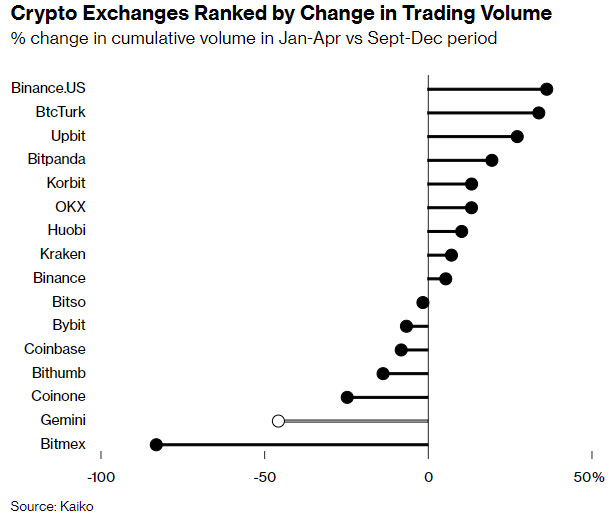

Shrinking market share

Despite the rebound in crypto prices, Gemini’s market share has been shrinking compared to its rivals. The exchange has experienced a decline in trading activity, which is a significant revenue source for platforms like Gemini. In contrast, competitors like Coinbase and Kraken have seen their market share increase.

Banking partner issues

Gemini faced a setback when its banking partner, JPMorgan Chase & Co., asked them to find another bank partner. This decision was reportedly due to the unprofitability of supporting Gemini. Gemini’s relationship with JPMorgan remains intact, according to the twins’ lawyer, but finding a new banking partner could be challenging.

Loan repayment concerns

Gemini has been dealing with a crucial due date on a loan from its bankrupt lending partner’s parent company. The resolution of this loan could help hundreds of thousands of Gemini customers recoup some of the $900 million worth of crypto deposits trapped in its defunct Earn product. However, negotiations on a resolution have been dragging on, and the situation remains uncertain.

Competition in crypto derivatives trading

Gemini’s attempt to enter the lucrative business of crypto derivatives trading outside the US faces competition from established players like Binance. The twins’ ambitious push into this market comes with its.

own set of challenges. Binance, one of the largest cryptocurrency exchanges in the world, has a strong foothold in the derivatives trading space and a significant user base. Gemini will need to compete aggressively to gain traction and establish itself as a credible player in this competitive market.

And that's a wrap! What an amazing week in Miami for Bitcoin 2023. In the days leading up to the conference, we held a @Gemini offsite of our senior leaders. We had a lot of meaningful discussions and made a lot of meaningful decisions mapping out the future for Gemini. Excited… pic.twitter.com/cS4OqaIBJm

— Cameron Winklevoss (@cameron) May 21, 2023

Related Posts

Best Crypto Exchange

3. Gemini’s Business Model and Ambitions

Gemini has positioned itself as a trusted and regulated cryptocurrency exchange. It has prioritized security and compliance, which has appealed to institutional investors and individuals looking for a reliable platform to trade digital assets. Gemini has obtained various licenses and adheres to strict regulatory requirements to ensure a safe trading environment.

In an effort to overcome the challenges faced in the US market, Gemini has been exploring opportunities abroad. The twins have attended international conferences and meetings with global leaders to expand their network and explore potential partnerships. They have expressed plans to establish a second headquarters in the United Kingdom and set up a base in Dublin, Ireland.

However, Gemini’s ambitions to pivot abroad have not been without setbacks. The twins have faced skepticism and resistance from industry insiders who question their ability to compete in foreign markets. Establishing a presence in new jurisdictions requires navigating complex regulatory landscapes and building trust with local investors and regulators.

4. The Winklevoss Twins’ Commitment and Optimism

Despite the challenges, Tyler and Cameron Winklevoss remain committed to Gemini’s success. They have been actively involved in promoting the exchange and advocating for the wider adoption of cryptocurrencies. The twins have attended industry conferences, spoken at events, and engaged with thought leaders to raise awareness and drive interest in Gemini.

The Winklevoss twins’ optimism is evident in their plans for expansion. They see the United Kingdom as a key market for their international growth strategy, given its status as a financial hub and its supportive regulatory environment. They believe that establishing a second headquarters in the UK will provide them with a solid foundation to further penetrate the European market.

Additionally, setting up a base in Dublin is seen as a strategic move to access the European Union market, leveraging Ireland’s position as a gateway to the EU. The twins are actively exploring opportunities to collaborate with local financial institutions and regulators to facilitate Gemini’s expansion efforts.

5. The Reassessment of Crypto and Gemini’s Future

The recent volatility and regulatory scrutiny in the cryptocurrency industry have prompted a reassessment of the value and future prospects of cryptocurrencies. Some investors and industry observers have expressed concerns about the sustainability of the market and the potential risks associated with digital assets.

Gemini has embraced the call for increased regulation in the crypto industry. The exchange has actively worked with regulators to establish a framework that promotes transparency, consumer protection, and market integrity. By positioning itself as a compliant and regulated platform, Gemini aims to instill confidence in investors and differentiate itself from less regulated competitors.

To mitigate the challenges faced in the US market, Gemini is considering staking its future overseas. The twins believe that expanding internationally will provide them with new opportunities, diversify their user base, and reduce reliance on the US market. However, the success of this international pivot will depend on Gemini’s ability to navigate regulatory hurdles, build trust with users, and effectively compete with established players in foreign markets.

6. Gemini’s Market Share and Financial Challenges

Gemini’s market share has been under pressure, with declining trading volumes compared to its competitors. While the crypto market as a whole has experienced growth, Gemini has struggled to maintain its share in the highly competitive exchange landscape. Platforms like Coinbase and Kraken have seen their user bases expand, putting pressure on Gemini to regain momentum.

Financially, Gemini has faced losses and the need for additional funding. The decline in trading volume and regulatory challenges have impacted the exchange’s revenue. Gemini has been exploring options to raise capital, including seeking additional investment and potentially considering a public listing to secure the necessary funds for its expansion plans.

In conclusion, Gemini, led by the Winklevoss twins, continues to face significant challenges and opportunities in the evolving cryptocurrency industry. While the twins’ commitment and optimism drive their efforts, the success of Gemini will depend on its ability to navigate regulatory complexities, establish a strong international presence, and regain market share in a highly competitive landscape. Only time will tell how Gemini’s story unfolds and whether it can achieve its ambitions in the dynamic world of cryptocurrencies.

4/ We look forward to defending ourselves against this manufactured parking ticket. And we will make sure this doesn’t distract us from the important recovery work we are doing.

— Tyler Winklevoss (@tyler) January 12, 2023

Best United States Crypto Card

7. Gemini’s Focus on Innovation and Product Development

To regain momentum and differentiate itself from competitors, Gemini has been focusing on innovation and product development. The exchange has introduced new features and services to enhance the trading experience for its users. Gemini’s Gemini Pay, for instance, allows users to make purchases with cryptocurrencies at participating merchants, aiming to promote mainstream adoption of digital assets.

Gemini has also ventured into the realm of decentralized finance (DeFi) by launching its own decentralized exchange called Gemini DEX. This move aligns with the growing popularity of DeFi protocols and allows Gemini to tap into this emerging market segment. By expanding its product offerings and embracing new technologies, Gemini aims to attract a wider range of users and stay at the forefront of industry trends.

8. Gemini’s Commitment to Security and Compliance

Gemini’s commitment to security and compliance remains a key pillar of its business strategy. The exchange has invested heavily in robust security measures to safeguard user funds and protect against cyber threats. Gemini follows industry best practices and holds a significant portion of its digital assets in offline cold storage, minimizing the risk of hacking incidents.

In terms of compliance, Gemini has obtained licenses in various jurisdictions, including the United States, the United Kingdom, and Singapore. These licenses ensure that Gemini operates within the legal framework of each jurisdiction, reinforcing its reputation as a trusted and regulated platform. By prioritizing security and compliance, Gemini aims to instill confidence in its users and attract institutional investors seeking a compliant trading environment.

9. Gemini’s Role in the Evolution of Cryptocurrencies

Gemini, under the leadership of the Winklevoss twins, has played a significant role in the evolution of cryptocurrencies. Their early involvement in Bitcoin and their efforts to establish a regulated exchange have contributed to the mainstream acceptance and legitimacy of digital assets. Gemini’s emphasis on compliance and investor protection has helped shape the regulatory discussions surrounding cryptocurrencies and has influenced the development of industry standards.

The twins’ advocacy for clear regulations and investor safeguards has garnered attention from policymakers and regulators. They have actively engaged with government agencies and industry organizations to shape the regulatory landscape and promote responsible innovation in the crypto space. Gemini’s commitment to compliance and its proactive approach to regulation positions it as a key player in the ongoing dialogue between the cryptocurrency industry and regulators.

10. The Future Outlook for Gemini

As the cryptocurrency industry continues to evolve, the future outlook for Gemini is both challenging and promising. The exchange faces intense competition, regulatory complexities, and the need to regain market share. However, Gemini’s commitment to security, compliance, innovation, and its expansion plans overseas provide a foundation for its growth and success.

Gemini’s success will depend on its ability to adapt to changing market dynamics, navigate regulatory landscapes effectively, and provide value-added services that resonate with users. The Winklevoss twins’ vision and determination to drive mainstream adoption of cryptocurrencies will continue to shape Gemini’s trajectory.

If you are able, we kindly ask for your support of Logll Tech News today. We appreciate it.

Sergio Richi

Editor, Logll Tech News

Conclusion

Overall, Gemini’s story is still unfolding, and it remains an intriguing player in the cryptocurrency exchange landscape. With its focus on security, compliance, innovation, and international expansion, Gemini is positioning itself to be a prominent force in the industry, shaping the future of digital asset trading and influencing the broader adoption of cryptocurrencies worldwide.